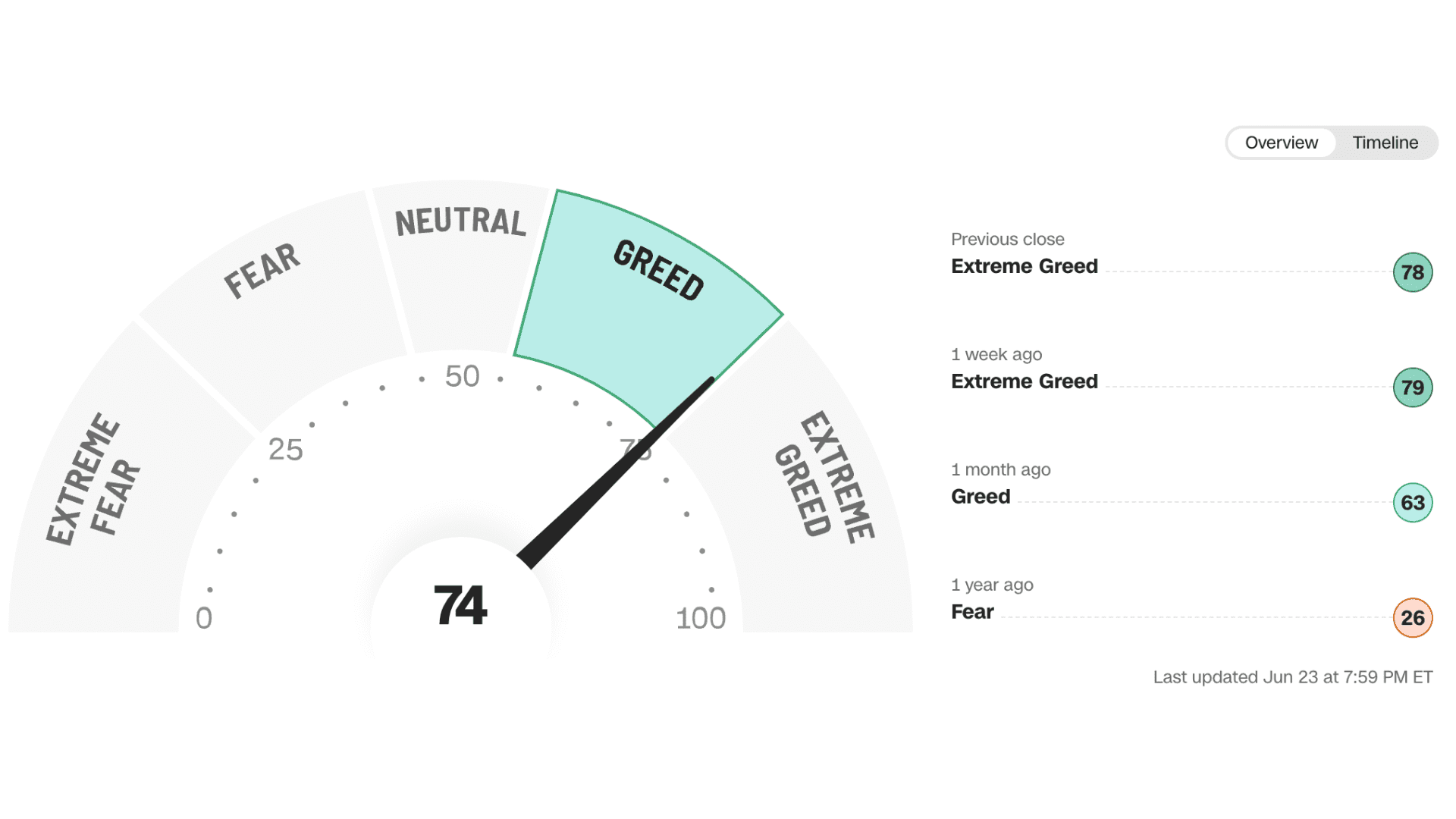

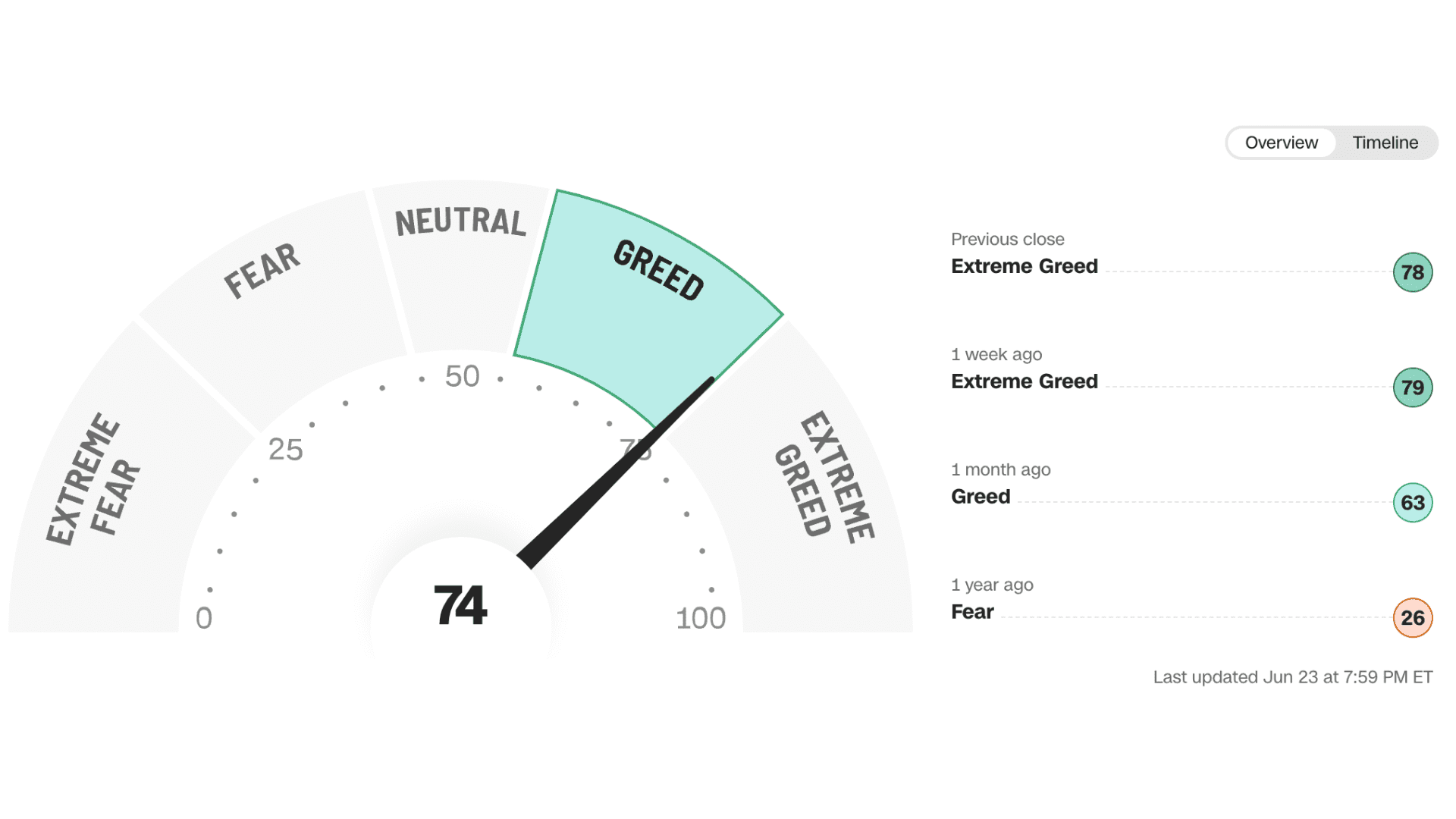

Financial markets are driven not only by economic fundamentals but also by human emotions and behavior. The CNN Business Fear & Greed Index is a tool designed to assess stock market movements and determine if stocks are priced fairly. It operates on the principle that excessive fear tends to drive down stock prices, while heightened greed can have the opposite effect.

The Index derives its calculation from seven different indicators that measure various aspects of stock market behavior. These indicators include market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. The index tracks the deviation of these indicators from their averages and compares them to their typical divergences. Each indicator is given equal weighting in the calculation, resulting in a score ranging from 0 to 100. A score of 100 indicates maximum greediness, while a score of 0 signifies maximum fear.

The Fear & Greed Index has emerged as a valuable tool in capturing and quantifying investor sentiment, providing insights into market dynamics. We will delve into the significance of the Fear & Greed Index, its components, and its implications for investors and the broader financial landscape.

Understanding the Fear & Greed Index

The Fear & Greed Index serves as a barometer of market sentiment, reflecting the prevailing emotions of fear and greed among investors. Developed to measure the psychological aspects of investing, it offers a composite view of various indicators and factors to provide a single numeric or visual representation of sentiment. By analyzing this index, investors can gain a deeper understanding of the prevailing market sentiment and potential investment opportunities.

Components of the Fear & Greed Index

The Fear & Greed Index incorporates a diverse range of indicators and factors to capture the overall sentiment. Some common components include:

Stock Price Momentum

This component evaluates the performance of the stock market over a specific period, analyzing factors such as price trends, market breadth, and volatility. Strong positive momentum indicates investor optimism and greed, while negative momentum suggests fear and caution.

Put/Call Ratio

This ratio assesses the relative trading volume of put options (bearish bets) to call options (bullish bets). Higher put/call ratios indicate increased investor fear and a preference for downside protection, while lower ratios indicate greater optimism and risk appetite.

Volatility Index (VIX)

The VIX, often referred to as the “fear gauge,” measures expected volatility in the market. Higher VIX levels imply heightened investor anxiety and fear, while lower levels indicate complacency and confidence.

Safe Haven Demand

This component considers the demand for safe-haven assets such as gold, Treasury bonds, or the Swiss franc. Increased demand for these assets suggests higher fear levels, while decreased demand indicates greater risk appetite and confidence in riskier investments.

Junk Bond Demand

Junk bonds, also known as high-yield bonds, are considered riskier investments. The demand for junk bonds can provide insights into investor appetite for risk. Higher demand signifies lower fear levels and increased risk appetite, while lower demand reflects heightened fear and a flight to quality.

Implications for Investors

The Fear & Greed Index serves as a valuable tool for investors, providing insights into market sentiment and potential market turning points. Understanding the index can help investors make informed decisions regarding asset allocation, risk management, and market timing.

For instance, when the index indicates high levels of fear, it may present buying opportunities for contrarian investors looking to capitalize on market downturns. Conversely, when the index reaches extreme greed levels, it could signal an overheated market and a potential time to exercise caution or consider profit-taking.

Moreover, monitoring the Fear & Greed Index alongside other fundamental and technical analysis tools can help investors develop a comprehensive investment strategy, considering both market sentiment and underlying economic factors.

The Fear & Greed Index serves as a tool to gauge the market’s sentiment. It recognizes that many investors are driven by emotions and tend to react impulsively. By using fear and greed sentiment indicators, investors can become more aware of their own emotions and biases, which can influence their decision-making process. When combined with fundamental analysis and other analytical tools, the Fear & Greed Index can provide valuable insights into market sentiment, aiding investors in assessing potential risks and opportunities.

The index offers a unique perspective on investor sentiment, capturing the psychological aspects that drive financial markets. By incorporating various indicators, it provides a snapshot of fear and greed levels, assisting investors in making informed decisions. While not a foolproof indicator, understanding the Fear & Greed Index can help investors navigate the complexities of the market and identify potential opportunities or risks. Ultimately, a balanced approach that considers both sentiment and fundamentals can lead to more successful investment outcomes.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.