The financial advisory profession has never been more dynamic or essential, especially in Singapore. As a thriving global hub for innovation and wealth management, Singapore’s financial industry is evolving rapidly.

The growing use of digital channels, adoption of robo-advisory services, and increasing comfort with AI-guided wealth management are reshaping the landscape. For individuals seeking a career that combines professional growth with meaningful impact, becoming a financial advisor offers unparalleled opportunities.

Financial Services Industry Outlook in 2025

Singapore’s wealth management sector is undergoing significant transformation. Surveys reveal that 91% of Singaporeans under 35 have significantly increased their use of digital channels for managing wealth over the past two years. While the appetite for technology-driven solutions is clear, the human element remains crucial. With 31% of respondents still relying on financial advisors, the demand for expert guidance remains steady. This dual reliance on technology and human advice creates a unique niche for financial advisors to excel as hybrid professionals who bridge the gap between digital tools and personalized service.

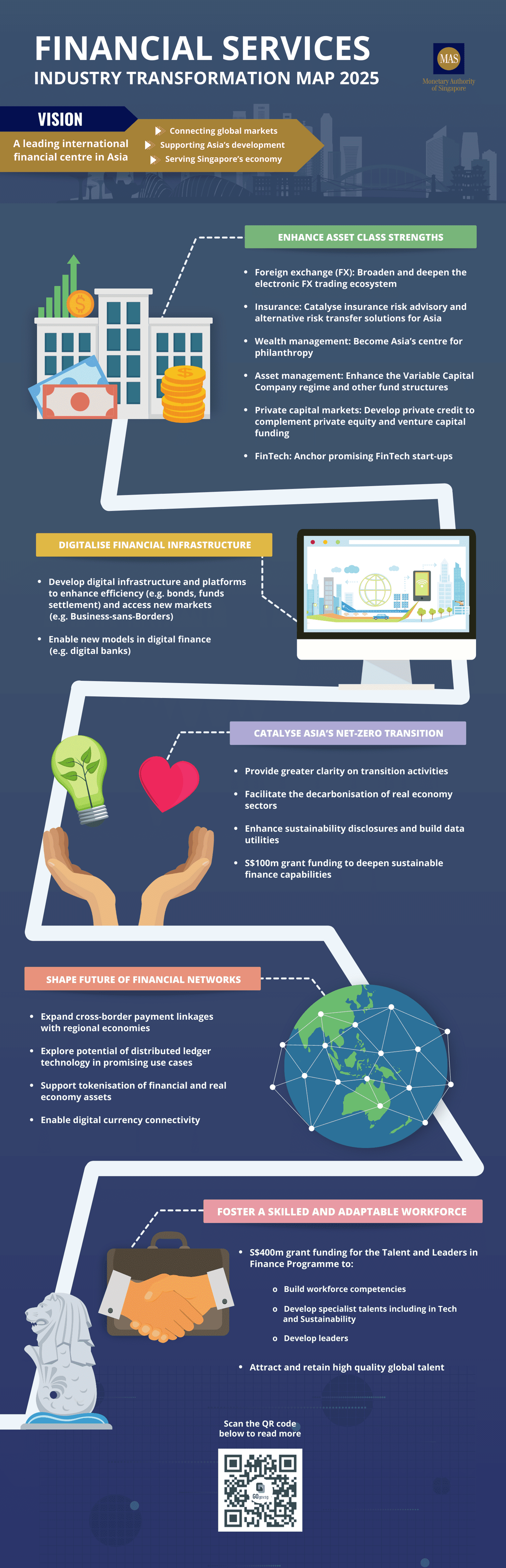

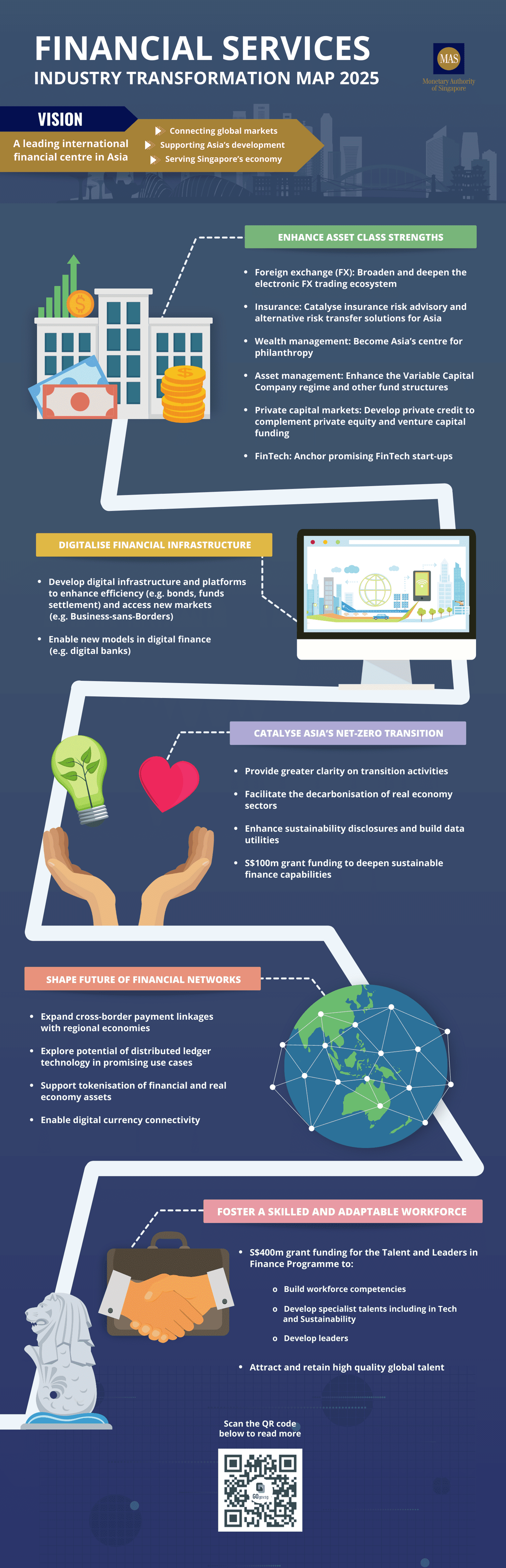

The updated Financial Services Industry Transformation Map (ITM) 2025 outlines growth strategies by the Monetary Authority of Singapore (MAS) to further solidify the nation’s position as a global financial hub. Key strategies include:

- Enhancing Asset Class Strengths: Deepening capabilities in critical asset sectors to improve Singapore’s value proposition in Asia.

- Digitalizing Financial Infrastructure: Leveraging technology to foster new business models, increase efficiency, and improve financial inclusion.

- Catalyzing Asia’s Net-Zero Transition: Channeling investments towards sustainable initiatives for a greener future.

- Building a Responsible Digital Asset Ecosystem: Shaping the future of financial networks through innovation.

- Fostering a Skilled Workforce: Developing local talent while attracting high-quality global professionals to strengthen the industry.

The financial sector aims for annual value-added growth of 4-5%, with the creation of 3,000 to 4,000 new jobs each year. This expansion ensures a dynamic and adaptive workforce to meet the growing demands of the industry.

The Rewards of Being a Financial Advisor

Starting your career as a financial advisor comes with a solid foundation of support to ensure your success. During your first one or two years, you will receive monthly allowances designed to provide financial stability as you establish yourself in the industry. This initial support allows you to focus on building your expertise, gaining confidence, and laying the groundwork for a thriving career. Beyond these allowances, you will benefit from attractive compensation packages, including first-year commissions and bonuses, which recognize and reward your dedication and performance.

A career in financial advisory offers a range of unique benefits, making it an appealing choice for those seeking flexibility, growth, and purpose. Advisors enjoy the autonomy to set their schedules, giving them the ability to balance their professional and personal lives effectively. This flexibility is especially valuable for individuals looking for a dynamic work environment that isn’t bound by traditional office hours.

The role also emphasizes continuous learning and development, providing opportunities to enhance skills in financial planning, client relationship management, and communication. Advisors are consistently challenged to adapt to market trends and evolving client needs, ensuring they remain trusted and knowledgeable professionals in their field. This commitment to growth fosters a rewarding journey of self-improvement and professional mastery.

Career progression in financial advisory is both diverse and rewarding. In Singapore, many advisors begin their journey with rigorous training programs and a focus on building a client base. Over time, they can choose to specialize in specific areas, assume leadership positions, or even establish their own independent practices. Each stage of progression brings greater responsibilities, higher earning potential, and the opportunity to make a more significant impact.

The essence of financial advisory lies in the ability to create a meaningful difference in people’s lives. By helping clients achieve financial independence and security—whether through investment management, insurance planning, or retirement preparation—advisors play a pivotal role in shaping brighter futures. This sense of purpose adds profound fulfillment to the career, making it especially rewarding for those passionate about empowering others.

Financial advisory is also a career with exceptional earning potential. In Singapore, advisors often earn a competitive base salary, averaging 3,000 SGD per month. However, commissions, which form the bulk of their income, allow top performers to earn significantly more—some achieving upwards of 77,000 SGD annually. Leading firms like AIA Singapore offer schemes that provide monthly pay ranging from 2,700 to 8,000 SGD, further incentivizing advisors. This performance-driven structure not only rewards hard work but also enables ambitious individuals to control their income and achieve financial success.

The long-term rewards of a financial advisory career extend beyond immediate earnings. Renewal year commissions and sustained compensations create a stable income stream, offering financial security as you grow your career. Additionally, the role provides intangible benefits: the satisfaction of leading and mentoring others, the joy of helping clients achieve their goals, and the freedom to shape your professional future. Together, these rewards make financial advisory a fulfilling and empowering career path.

Leading Your Own Team

This role presents a dynamic and empowering opportunity to carve out your own path to success while taking on the challenge of building and leading a high-performing team. It allows you to harness your entrepreneurial spirit and leadership potential, giving you the freedom to shape your career in alignment with your vision and ambitions. As you focus on achieving sales excellence and honing your personal and professional skills, you’ll simultaneously guide and inspire others to unlock their potential and reach their goals.

Through your leadership, you and your team will embark on a shared journey of growth and transformation. This collective effort is about more than just achieving targets—it’s about creating meaningful impact, fostering a culture of collaboration, and driving success that resonates beyond individual achievements. Together, you’ll build a legacy of progress and inspiration, leaving a lasting mark in your field and within the lives of those you lead.

Incentive Trips & Conventions

Trips and conventions greatly enhance financial advisors’ job satisfaction by offering valuable learning opportunities, recognition, and connection. These events promote professional development through exposure to industry trends and best practices, boosting confidence and competence.

Networking at such gatherings fosters relationships with peers and leaders, reducing isolation and opening doors to referrals. Incentive trips reward and motivate advisors, while providing breaks from routine improves mental health and prevents burnout.

Additionally, team-building activities during these events strengthen workplace camaraderie, creating a supportive environment. Overall, these perks drive both individual growth and a more engaged workforce.

Challenges and Opportunities in Financial Advisory

The emergence of robo-advisors and artificial intelligence (AI) has significantly changed the landscape of wealth management. Forty percent of individuals under 35 already use robo-advisory services, with many others expected to follow suit in the near future. Despite this shift, these digital tools are meant to complement, not replace, human advisors. Financial advisors continue to play a crucial role in interpreting data generated by technology, offering the personalized attention and expertise that even the most advanced algorithms cannot match.

While 76% of younger clients are comfortable using AI for wealth management, the preference for in-person interactions remains strong, especially among older generations. This blend of digital and personal preferences highlights the need for an omnichannel approach that seamlessly integrates both self-service technology and human engagement. Financial advisors are uniquely positioned to provide tailored experiences, ensuring clients feel valued and understood, regardless of their communication preferences.

The financial advisory profession presents both challenges and opportunities. One significant challenge is overcoming the stigma of being perceived as pushy salespeople, a stereotype that can hinder trust-building. To overcome this, advisors must focus on ethical practices and prioritize their clients’ needs to foster trust and credibility.

Another key challenge is client acquisition, particularly for newcomers without established networks. Success in this field relies heavily on strong networking and relationship-building skills. However, there is a substantial opportunity among younger investors in Singapore, where 57% of individuals under 35 are open to switching providers within a year. Advisors can capitalize on this by positioning themselves as trusted guides for this tech-savvy and affluent demographic.

Lastly, the absence of traditional employee benefits, such as CPF contributions and medical coverage, adds complexity to personal financial planning for advisors. While the potential for high earnings can offset this, it’s an important consideration for those entering the profession.

Is Being a Financial Advisor Worth it in Singapore?

Being a financial advisor is more than a career—it’s a calling to empower others. It combines the analytical challenge of navigating markets with the human satisfaction of helping clients achieve their financial dreams. The sector’s expansion, driven by Singapore’s Financial Services Industry Transformation Map (ITM) 2025, ensures continued demand for skilled professionals.

Becoming a financial advisor in Singapore offers a rewarding career with significant opportunities for growth and impact. Successful Advisors enjoy flexibility, high earning potential through commissions, and continuous learning. The role provides a sense of purpose, making it a fulfilling career for those who navigate its complexities well.

Your Journey Starts Now

If you’re seeking a career that combines great earning potential, continuous learning, and the opportunity to make a meaningful impact, becoming a financial advisor in Singapore could be the perfect fit for you. This path offers high rewards for high performers, ensuring your efforts and dedication are directly reflected in your earnings. Moreover, the role allows you to develop valuable skills in financial planning, communication, and leadership, all while helping others achieve their financial goals.

However, it’s essential to consider that this career may not suit everyone. Financial advisory often comes with a steep learning curve, requiring patience and persistence, particularly in the early stages. Income can also be unpredictable at the start, as it largely depends on your ability to build a client base and deliver results. For those who are determined, adaptable, and ready to embrace challenges, these initial hurdles can lead to significant long-term rewards.

If you’re unsure whether financial advisory is the right career for you, or if you’ve already decided but have lingering questions, we’re here to help. We can connect you with top-performing directors in the industry who are eager to share their personal experiences, success stories, and practical advice. These conversations are purely informational—no sales pitches, no commitments.

Take the first step in exploring this exciting career path by sending us a message today. Whether you’re seeking clarity or inspiration, we’re here to support your journey toward a fulfilling and successful career in financial advisory.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.