Keeping up with changes in brokerage services is vital for investors looking to improve their trading experience.

Recent months have seen significant developments like fee cuts, new pricing models, and the arrival of fresh contenders in the market. It’s crucial to compare these changes to find the right brokerage platform. In this updated 2024 comparison, we delve into the nuances of various low-cost brokers in Singapore, covering crucial aspects such as trading fees, currency exchange rates, features, and more.

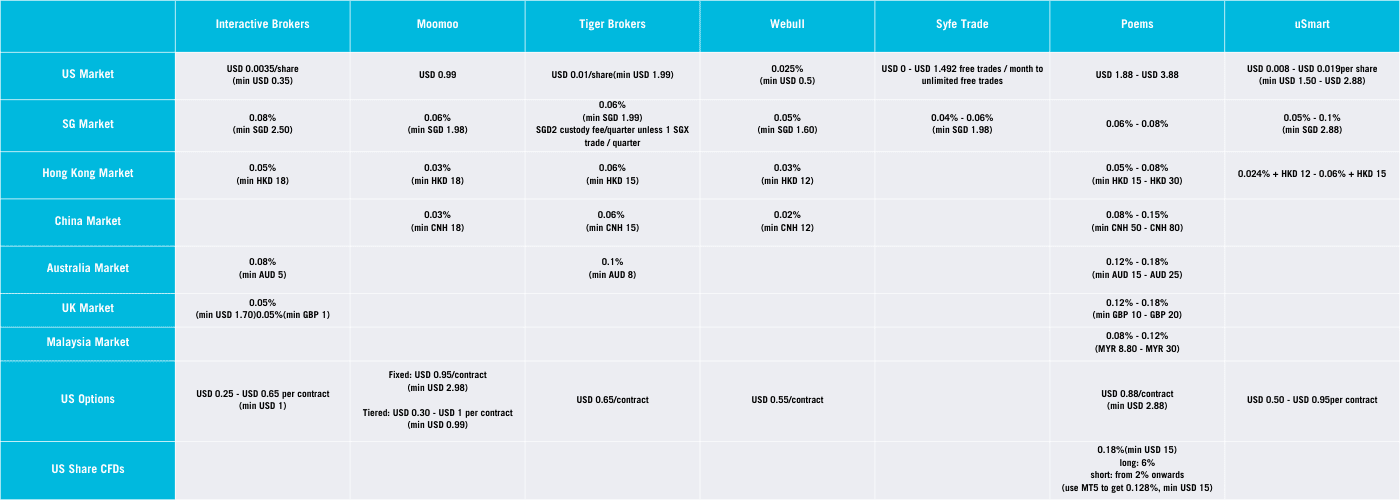

Fee Analysis

In our analysis of trading fees, we first concentrate on different markets to pinpoint the most cost-effective options available. Interactive Brokers stands out as a leading contender in the US market, thanks to its remarkably low commission per share at USD 0.0035/share. Following closely behind is Moomoo SG, which offers a flat fee structure at USD 0.99 irrespective of the volume of shares traded. Notable mentions include Syfe Trade and CMC Invest, both of which offer free trades for passive investors, adding an attractive dimension to their offerings.

Currency Conversion

In our examination of currency conversion rates, we recognize the significant impact they have on overall costs and conduct a thorough assessment of each broker’s rates. Interactive Brokers consistently demonstrates an advantageous position in this aspect, maintaining favorable conversion rates. POEMS also exhibit competitive rates, positioning them as viable options for traders concerned about currency conversion costs. By integrating both trading commissions and forex conversion rates into our analysis, we ensure a comprehensive evaluation to identify the most economically advantageous options available to investors.

Market-specific Insights

Let’s take a closer look at different markets: Singapore, Hong Kong, China, Australia, the UK, and Malaysia. We’ll give you tailored details about trading fees and currency conversions.

Each market has its quirks, influenced by things like rules, how much trading is happening, and what investors like. Certain brokers stand out in each market, leveraging their fee structures and exchange rates to offer distinct advantages to traders. By providing tailored assessments, we empower investors to make informed decisions based on their specific market preferences and trading objectives.

Options Trading and Recurring Fees

When it comes to options trading, many investors lean towards Interactive Brokers. Why? Well, they offer pretty good deals. Their pricing for options contracts is quite competitive, making them a top pick for those interested in trading derivatives. Additionally, Moomoo SG’s innovative tiered pricing plan introduces a dynamic element to commission fees, providing flexibility for traders based on their trading volume and frequency. Moreover, recurring fees, often overlooked but crucial for long-term investors, are meticulously examined. Insightful analysis is provided on waiver conditions and the implications of these fees on overall investment costs, ensuring investors have a comprehensive understanding of the financial implications associated with their chosen brokerage platform.

Feature Comparison

In our comprehensive comparison, we extend our analysis beyond fees to explore the diverse range of features offered by each brokerage platform. These features encompass various aspects such as fractional shares, odd lot orders, option strategies, recurring buy options, idle cash returns, reward systems, and support for CPF and SRS investments. By evaluating these features, investors can align their preferences with the brokerage platform that best caters to their specific requirements and investment strategies. Whether investors prioritize accessibility to fractional shares, the ability to execute complex option strategies, or the convenience of recurring buy options, our comparison equips them with the insights needed to make informed decisions tailored to their individual needs and preferences.

Pros and Cons Consideration

As we wrap up our comparison, it’s important to highlight that there isn’t one perfect solution for everyone. Every brokerage platform has its perks and drawbacks, designed for various kinds of investors and trading methods. By weighing the pros and cons we’ve outlined, investors can make smart choices that match their priorities, how much risk they’re willing to take, and their investment goals. Investors are urged to thoroughly assess their options. Whether they value low trading fees, advanced features or excellent customer support, they can choose the brokerage platform that perfectly fits their individual needs and preferences. Making an informed decision sets the stage for a rewarding and prosperous journey in the ever-changing landscape of financial markets.

In today’s dynamic market environment, characterized by rapid innovations and evolving investor needs, staying informed and discerning is paramount to making sound investment decisions. With a multitude of brokerage options available in Singapore, investors face the challenge of selecting the most suitable platform to meet their investment objectives. With a wealth of information in this detailed comparison investors can confidently navigate the intricate world of brokerage services. They are equipped with a better grasp of elements like trading fees and currency exchange rates, features and the pros and cons of each platform become clearer. Investors can make educated decisions that align with their financial objectives and risk tolerance. This knowledge enables investors to enhance their trading journey. It also helps unlock investment opportunities in the current dynamic market environment.

Through this comprehensive comparison updated for 2024, investors are equipped with the knowledge and insights necessary to navigate the intricate landscape of low-cost brokers in Singapore. By gaining a deeper understanding of each broker’s offerings, including trading fees, currency conversion rates, features, and market-specific advantages, investors can make informed decisions tailored to their individual needs and preferences. Armed with this knowledge, investors can enhance their trading experience, minimize costs, and ultimately maximize their investment potential. By making well-informed choices, investors can position themselves for success in the dynamic and competitive world of financial markets.