Financial advisors in Singapore should invest in stocks to better serve their clients, diversify portfolios, and maintain a competitive edge in a dynamic market. Understanding stocks allows advisors to offer tailored, informed advice that aligns with client goals while also helping to build their own wealth and credibility.

This knowledge is especially crucial in Singapore’s unique market, where both local and international factors influence investment decisions.

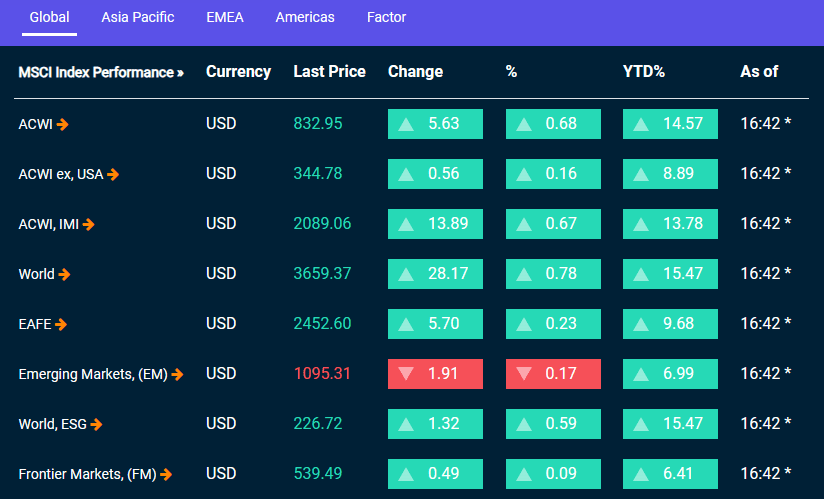

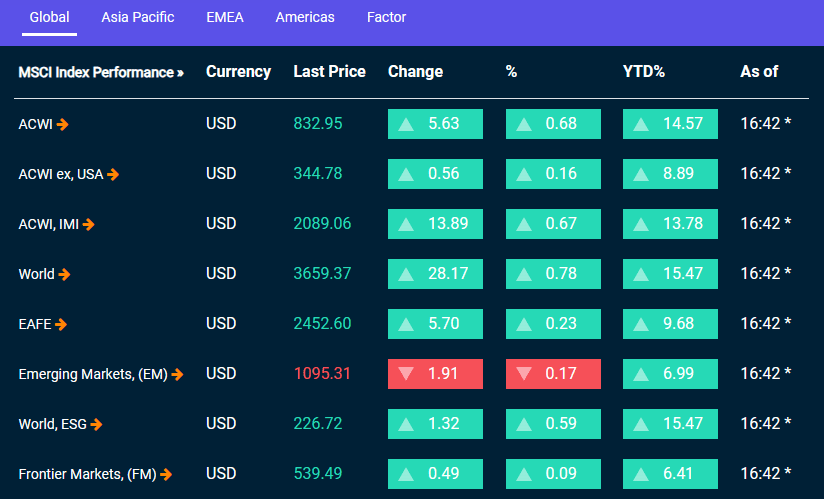

This enables them to provide strategic investment advice tailored to client needs. By grasping macroeconomic factors such as interest rates, advisors can guide clients on where to allocate their funds for optimal returns. Interest rates directly influence the stock market by affecting borrowing costs and investor behavior—higher rates often lead to lower stock prices, while lower rates can drive market growth.

Additionally, understanding market trends, economic indicators, and their interplay with financial markets allows advisors to anticipate risks and opportunities, helping clients achieve their financial goals more effectively. With increasing client expectations, mastering stock investing is not just beneficial —it’s essential for staying relevant and advancing in the field.

The Wisdom in Following Wealthy Investors

A valuable strategy for aspiring investors is to observe the habits of wealthy individuals. Those who have successfully accumulated wealth often increase their investments in stocks or business interests, signaling the importance of these assets in wealth-building. Paying attention to where wealthy people invest can offer key insights into smart investment choices.

How to Choose Stocks

Understanding why to invest in stocks is only the beginning. The next step is learning how to select the right ones. If you’re seeking specific stock tips, this isn’t the place. But if you want to develop the skills to find promising stocks yourself, the first rule is to choose companies whose business models you can easily explain. If you can’t break it down for a 12-year-old, you likely don’t understand it well enough, which could lead to risky, uninformed investing.

Financial advisors should have a deep understanding of the stock market because it enables them to provide strategic investment advice tailored to client needs. By grasping macroeconomic factors such as interest rates, advisors can guide clients on where to allocate their funds for optimal returns.

Interest rates directly influence the stock market by affecting borrowing costs and investor behavior—higher rates often lead to lower stock prices, while lower rates can drive market growth. Additionally, understanding market trends, economic indicators, and their interplay with financial markets allows advisors to anticipate risks and opportunities, helping clients achieve their financial goals more effectively.

The Essential Skill: Reading Financial Statements

To make informed stock picks, learning to read financial statements is crucial. These documents are often referred to as the language of business and investing. Without the ability to interpret them, investing successfully becomes a challenge. Focus on three key financial statements:

- Income Statement

- Balance Sheet

- Cash Flow Statement

Mastering these will give you the necessary foundation to understand a company’s financial health.

Operating Cash Flow: The Lifeblood of a Company

One of the most important figures in financial statements is Operating Cash Flow. This number shows whether a company is actually receiving cash for its sales, not just recording sales on paper. For example, selling a product for $5 with payment due in three months counts as a sale, but no money has been received yet. This concept, known as accrual accounting, highlights why a company can report profits without actual cash flow—something investors must understand to avoid pitfalls.

Net Cash: A Safety Net for Tough Times

Net Cash is another critical metric, indicating whether a company can comfortably cover its debts. While some companies appear profitable due to heavy borrowing, this can be risky. A general rule is that for every dollar of debt, there should be a corresponding dollar in cash. The simple formula is: (Cash + Cash Equivalents) – (Short + Long-term Debt). Companies with strong Net Cash positions are better equipped to weather financial challenges.

Net Profit: A Sign of a Healthy Business

Net Profit shows whether a company is actually making money, which is fundamental to its long-term viability. Companies with solid profits tend to see their stock prices rise and are more likely to pay dividends, making them attractive investments.

When to Buy a Stock

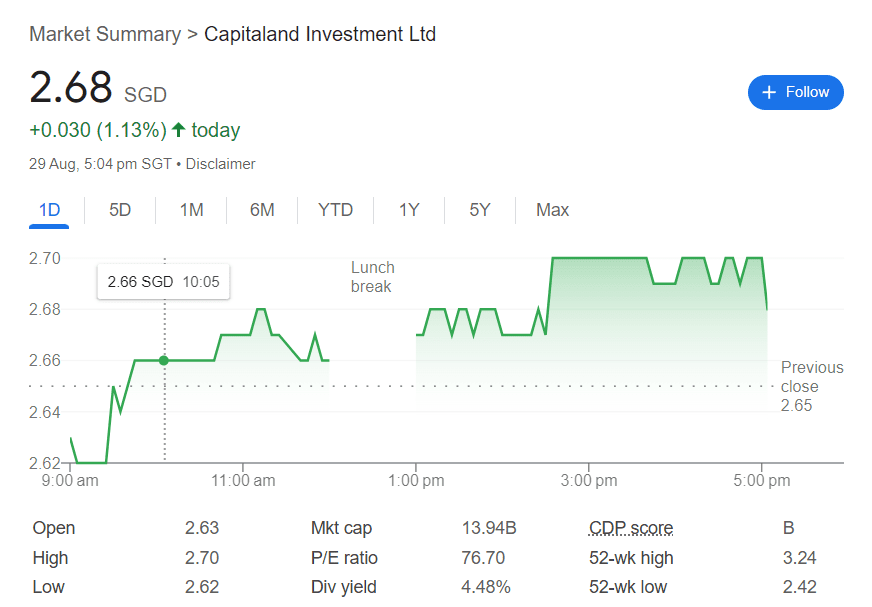

Timing is everything in stock investing, but it’s notoriously difficult to get right. One helpful tool is the Price-to-Earnings (P/E) Ratio, which indicates how quickly you can expect to recoup your investment. For instance, a P/E ratio of 10 suggests it will take 10 years to earn back your investment or yield a 10% annual return.

Patience Is a Virtue in Investing

Investors must remember that stock prices typically don’t increase overnight. Significant gains often require a holding period of 2-5 years. Patience is a key differentiator between successful and unsuccessful investors. Those with short-term mindsets might panic during downturns and sell at a loss, while long-term investors might seize opportunities to buy more at lower prices. The stock market rewards patience, as demonstrated by investors like Warren Buffett, who have consistently profited over decades.

The Power of a Good Stock Pick

Even if only three out of ten stock picks are successful, you can still achieve financial success. A single good stock can more than make up for several poor choices. Unlike a traditional job with capped earnings, the stock market offers opportunities where the potential upside far outweighs the downside, making it a relatively low-risk avenue for wealth creation.

Summary

For financial advisors in Singapore, learning to invest in stocks is not just a beneficial skill—it’s essential. It enhances their ability to serve clients effectively, build diversified portfolios, stay competitive in a growing market, and establish credibility. By understanding the intricacies of stock investing, advisors can provide better guidance, helping their clients achieve their financial goals while also advancing their own careers and personal wealth.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.