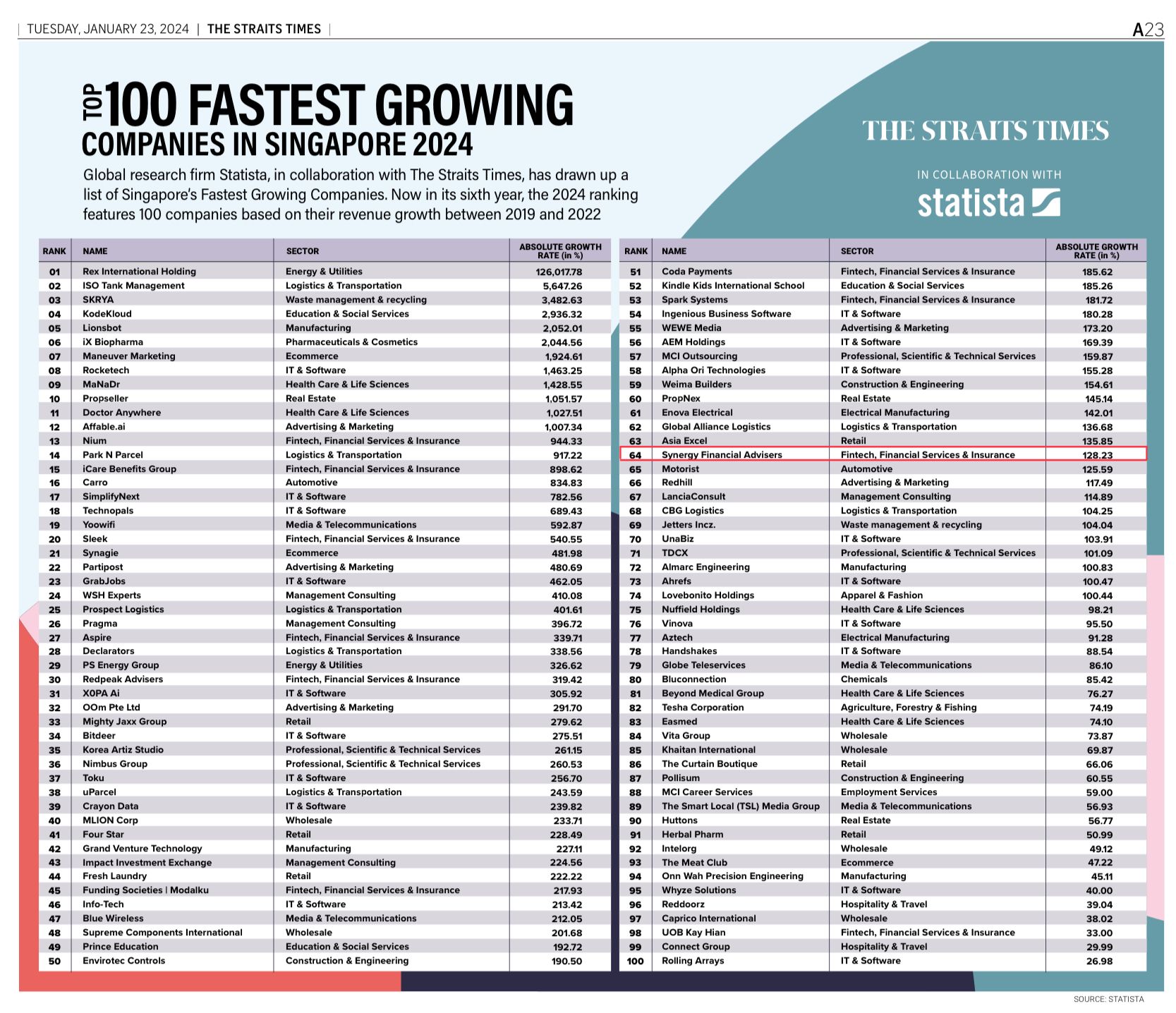

Statista, a renowned global research firm known for its comprehensive data and insights, has collaborated with The Straits Times to compile a meticulously curated list showcasing Singapore’s Growing Companies for the year 2024. This exclusive ranking highlights 100 companies that have demonstrated exceptional revenue growth.

Among these distinguished companies, a notable selection hails from the dynamic sectors of Fintech, Financial Services, and Insurance. These companies have been recognized for their outstanding performance and significant contributions to Singapore’s thriving economy. Below, we present a detailed overview of the companies within this sector that have secured positions on the prestigious list, reflecting their remarkable achievements and growth trajectory.

13. Nium

Nium, headquartered in Singapore, is a leading global fintech company specializing in cross-border payments. Formerly known as InstaReM, Nium was established in 2015 and has since become a prominent player in the financial technology industry. The company offers a comprehensive platform that enables businesses and individuals to send and receive money across borders efficiently and securely. Leveraging advanced technology and a vast network of partnerships, Nium has facilitated seamless international transactions in over 100 countries and multiple currencies. Nium’s innovative solutions, commitment to customer satisfaction, and regulatory compliance have positioned it as a trusted leader in the rapidly evolving landscape of cross-border payments.

15. iCare Benefits Group

iCare Benefits Group is a Singapore-based financial technology company that focuses on providing employee benefits and financial services to underserved communities globally. Founded in 2012, iCare Benefits Group offers a range of products including salary-deductible loans, healthcare benefits, and insurance coverage to employees of corporate clients. The company partners with employers to offer these benefits as part of employee compensation packages, aiming to improve financial inclusion and well-being among low to middle-income workers. With operations in several countries across Asia and Africa, iCare Benefits Group utilizes technology to streamline the delivery of its services, making financial solutions more accessible and affordable for its target demographic.

20. Sleek

Sleek is a Singapore-based corporate services provider that offers online company incorporation, corporate secretarial services, accounting, and tax compliance solutions for entrepreneurs and small businesses. Founded in 2017, Sleek aims to simplify the process of setting up and managing companies in Singapore and Hong Kong through its user-friendly online platform. The company provides tailored solutions to meet the needs of startups, SMEs, and multinational corporations, offering transparent pricing and efficient service delivery. With a focus on technology-driven solutions and regulatory compliance, Sleek has emerged as a trusted partner for businesses seeking to establish and grow their presence in Asia.

27. Aspire

Aspire is a Singapore-based financial technology company that offers banking solutions tailored to the needs of small and medium-sized enterprises (SMEs). Founded in 2018, Aspire provides business accounts, corporate cards, and expense management tools designed to streamline financial operations and facilitate growth for SMEs. The company leverages technology to offer fast and convenient onboarding processes, real-time transaction monitoring, and customizable financial reporting. With a focus on empowering entrepreneurs and businesses, Aspire aims to bridge the gap in access to financial services and support the growth aspirations of SMEs in Singapore and Southeast Asia.

30. Redpeak Advisers

Redpeak Advisers is a boutique consultancy firm headquartered in Singapore, specializing in corporate finance, mergers and acquisitions (M&A), and strategic advisory services. Redpeak serves clients across various industries, including technology, healthcare, consumer goods, and financial services. The company provides personalized and comprehensive solutions to help clients navigate complex transactions, optimize capital structures, and achieve their strategic objectives. With a team of experienced professionals and a track record of successful deals, Redpeak Advisers has earned a reputation for delivering value-added advisory services to corporate clients, private equity firms, and entrepreneurs in Singapore and the Asia-Pacific region.

45. Funding Societies, Modalku

Funding Societies, Modalku is a leading peer-to-peer (P2P) lending platform operating in Southeast Asia, with headquarters in Singapore. Established in 2015, the company provides a digital marketplace that connects SMEs in need of financing with investors seeking attractive returns on their investments. Funding Societies | Modalku offers various financing solutions, including business term loans, invoice financing, and working capital loans, to support the growth and expansion of SMEs across the region. Leveraging technology and data analytics, the platform provides fast and convenient access to funding for businesses, while offering investors diversified investment opportunities with transparent risk profiles. With a commitment to financial inclusion and innovation, Funding Societies | Modalku has facilitated millions of dollars in loans to SMEs and continues to play a significant role in driving economic growth and development in Southeast

51. Coda Payments

Coda Payments is a fintech company headquartered in Singapore, specializing in providing alternative payment solutions for digital content providers, game developers, and publishers across Southeast Asia. Established in 2011, Coda Payments offers a range of services including payment aggregation, mobile payments, and carrier billing, enabling users to make purchases conveniently through various channels such as web, mobile apps, and offline stores. The company partners with leading digital platforms and telecommunications operators to offer seamless payment experiences and expand the reach of digital content in emerging markets. With a focus on innovation and customer satisfaction, Coda Payments has become a trusted partner for businesses looking to monetize their digital offerings and reach a wider audience in the region.

53. Spark Systems

Spark Systems is a financial technology company based in Singapore, specializing in providing electronic foreign exchange (FX) trading solutions. Founded in 2016, Spark Systems offers a cutting-edge trading platform that enables banks, financial institutions, and institutional traders to execute FX trades efficiently and cost-effectively. The platform leverages innovative technology, including low-latency trading infrastructure and intelligent algorithms, to provide fast and reliable execution for FX transactions. Spark Systems aims to enhance liquidity, transparency, and efficiency in the FX market, catering to the evolving needs of institutional clients in Asia and beyond. With a focus on innovation and reliability, Spark Systems has positioned itself as a key player in the electronic FX trading space, serving clients with advanced trading solutions and superior customer service.

64. Synergy Financial Advisers

Synergy Financial Advisers is a leading financial advisory firm based in Singapore, offering comprehensive financial planning and wealth management services to individuals, families, and businesses. Synergy Financial Advisers operates with a team of experienced financial consultants who provide personalized advice tailored to clients’ unique financial goals and circumstances. The company offers a wide range of services including retirement planning, investment management, insurance planning, and estate planning. With a client-centric approach and a commitment to professionalism and integrity, Synergy Financial Advisers has earned a reputation for delivering trusted financial advice and helping clients achieve long-term financial success.

98. UOB Kay Hian

UOB Kay Hian is a prominent financial services company headquartered in Singapore, with a strong presence throughout Asia. Established in 1970, it is a subsidiary of United Overseas Bank (UOB), one of the largest banks in Southeast Asia. UOB Kay Hian offers a comprehensive suite of financial services, including stockbroking, wealth management, investment banking, and research analysis. With a focus on providing innovative solutions and personalized advice to individual and institutional clients, UOB Kay Hian has established itself as a trusted partner in the financial markets. The company’s extensive network and deep expertise in Asian markets make it a preferred choice for investors seeking quality financial services and investment opportunities in the region.

The collaboration between Statista and The Straits Times has shed light on Singapore’s vibrant business landscape, particularly within the Fintech, Financial Services, and Insurance sectors. The recognition of these companies on the 2024 Growing Companies list underscores their resilience, innovation, and unwavering commitment to growth. As Singapore continues to position itself as a global hub for finance and technology, these companies play a pivotal role in driving economic prosperity and fostering a culture of entrepreneurship. With their remarkable achievements and promising growth trajectories, these companies are poised to further contribute to Singapore’s dynamic and thriving economy in the years to come.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.