Ikigai, a Japanese term meaning “reason for being,” has captured global interest for its promise of fulfillment and purpose. While deeply ingrained in Japanese culture as a multifaceted and evolving concept, the Westernised version of ikigai has taken on a different form.

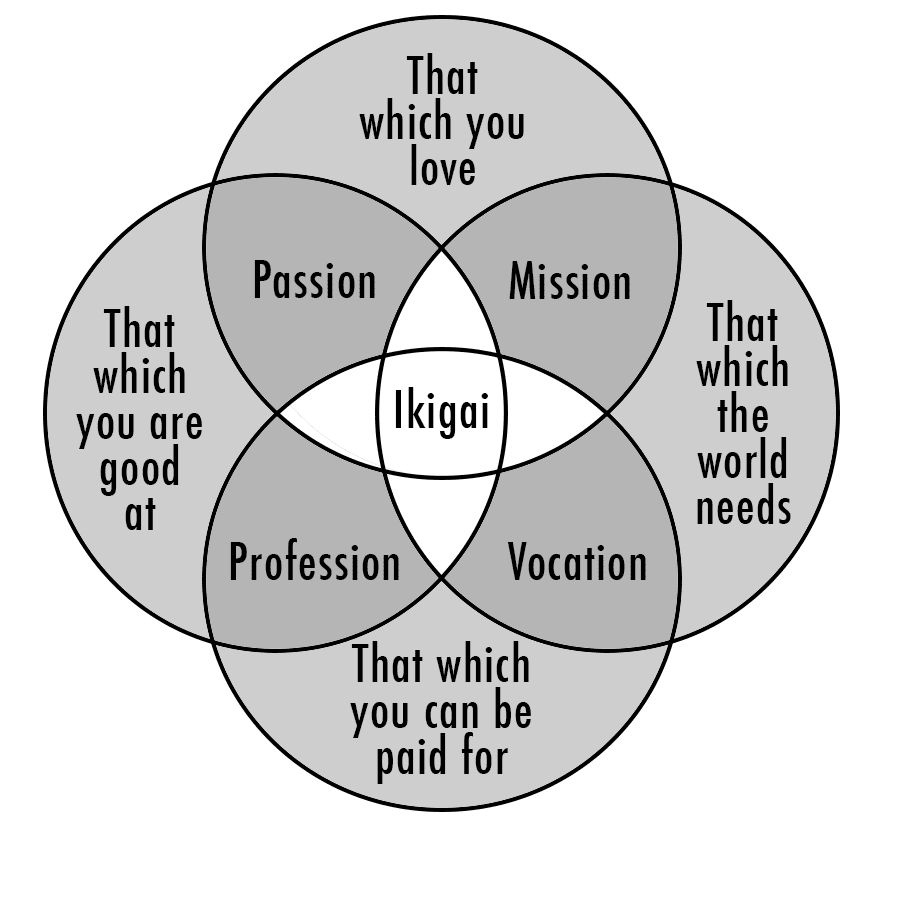

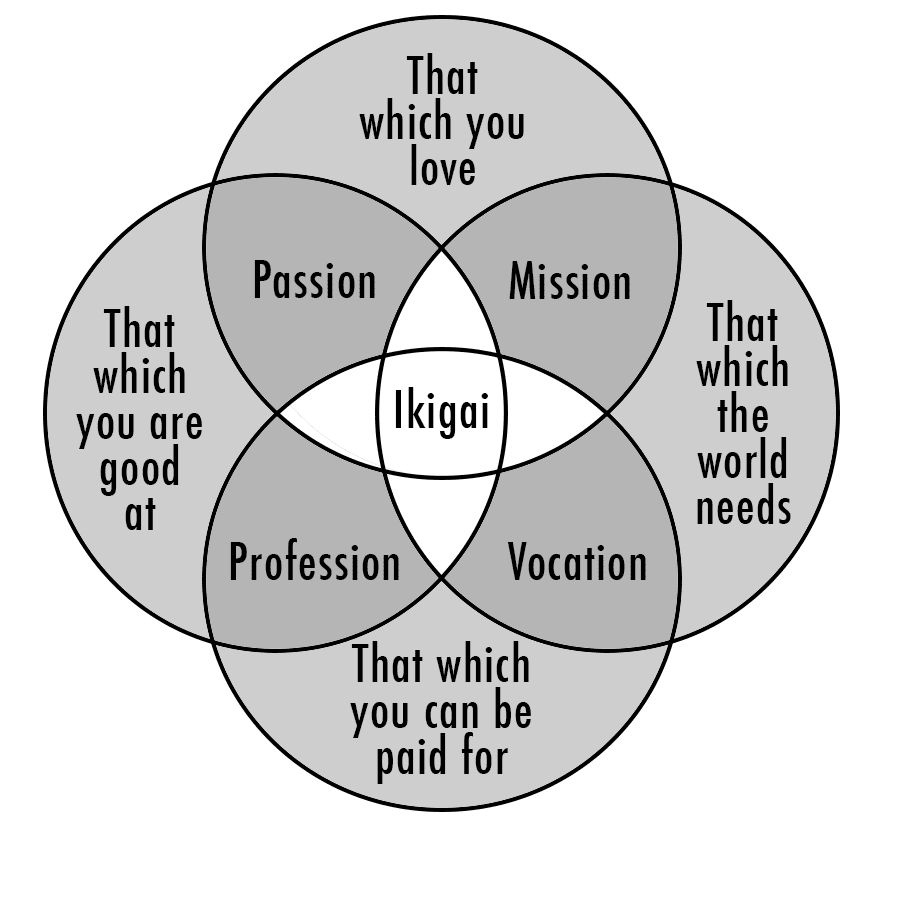

The Western interpretation simplifies ikigai into a structured framework, represented by a Venn diagram with four intersecting circles. These circles pose four key questions:

- Are you doing something you love?

- Are you doing something the world needs?

- Are you doing something you are good at?

- Are you doing something you can be paid for?

The idea is that true ikigai lies at the intersection of these components. While this approach has gained popularity among life coaches, HR professionals, and entrepreneurs, it is, in fact, a misrepresentation of the original Japanese concept.

Misconceptions About Ikigai

One of the main misconceptions of this framework is that it suggests one must meet all four conditions to achieve ikigai. For instance, if you are engaged in an activity you love but it doesn’t generate income, the framework implies you have not found your ikigai. This rigid interpretation contradicts the traditional Japanese understanding.

For the Japanese, ikigai is not confined to such structured criteria. It is an evolving aspect of life that becomes clearer as one grows older and gains more life experience. It is neither grandiose nor tied to the necessity of income, skill, or societal impact. In fact:

- Ikigai doesn’t have to generate income.

- It doesn’t have to align with what the world needs.

- It doesn’t have to involve mastery or proficiency.

- It doesn’t even have to be something you deeply love.

In Japan, the word “ikigai” is often used casually to describe simple pleasures, such as enjoying a morning cup of coffee, spending time with loved ones, or savoring small rituals in daily life. Japanese psychologist Ken Mogi explains that Japanese people don’t rely on motivational frameworks to find their ikigai; rather, they draw from the joy of everyday routines.

Ikigai for Financial Advisors in Singapore

For financial advisors in Singapore, the idea of ikigai can offer a meaningful lens through which to approach both professional and personal fulfillment. While the structured Westernised framework of ikigai might seem appealing, financial advisors should recognize that their “reason for being” doesn’t need to perfectly align with earning a high income, following a passion, or addressing a grand societal need.

Missteps in Applying the Westernised Framework

Singapore’s fast-paced and competitive financial advisory landscape often focuses on meeting income targets, developing sales skills, and keeping up with regulatory requirements. Many advisors might feel pressured to meet all four conditions of the Westernised ikigai framework, especially the notion that one must be paid for what they love.

However, as ikigai teaches, a financial advisor’s purpose doesn’t need to be tied solely to monetary goals or societal validation. Your ikigai might simply lie in small, personal aspects of your role:

- Building strong relationships with clients. Helping families achieve their financial goals can bring immense personal satisfaction.

- Learning and growing. The process of mastering financial products or understanding market trends can itself be fulfilling.

- Appreciating small victories. Moments like seeing a client’s relief after planning for retirement or securing insurance coverage can be deeply rewarding.

Aligning Ikigai with a Financial Advisor’s Role

What You Love

Financial advisors often find joy in empowering others. Whether it’s educating clients about investment options or offering reassurance during volatile markets, this love for helping others can form the foundation of your ikigai.

What the World Needs

Singapore has a growing demand for financial literacy and long-term planning. Financial advisors play a crucial role in bridging this gap, helping individuals and families secure their futures.

What You Are Good At

With continuous training and professional development, financial advisors excel in providing tailored advice, interpreting market trends, and crafting solutions for clients. Skills like active listening, empathy, and strategic thinking are essential strengths that align with the profession.

What You Can Be Paid For

In Singapore, financial advisors often operate in a performance-driven environment with potential for significant earnings through commissions, fees, and incentives. However, this doesn’t mean one’s purpose must solely revolve around financial gain.

Embracing the True Spirit of Ikigai

Financial advisors in Singapore can find their ikigai in the small yet impactful moments that define their daily routines. Whether it’s the satisfaction of simplifying a complex investment plan for a client or the pride of achieving a professional milestone, ikigai doesn’t have to follow a rigid structure.

Ultimately, your ikigai is personal and unique. It can range from the joy of connecting with clients, celebrating small wins, or even balancing work with family and personal passions. By appreciating the journey and focusing on the moments that matter, financial advisors can embrace the true essence of ikigai—finding purpose and contentment in their everyday lives.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.