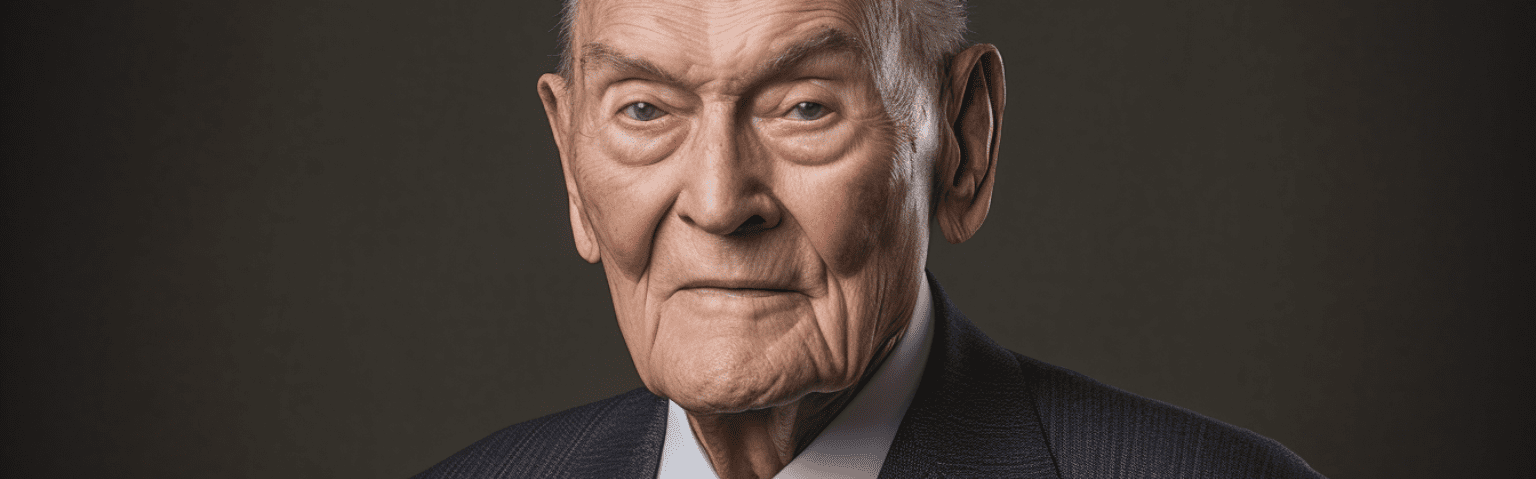

John Bogle, the influential founder of The Vanguard Group, revolutionized the investment world with his advocacy for low-cost index investing and dedication to individual investors. Graduating from Princeton University in 1951, he embarked on a career in finance, culminating in the founding of Vanguard in 1974.

His creation of the Vanguard 500 Index Fund in 1976 marked a watershed moment, offering investors a low-cost vehicle to track the S&P 500. Throughout his career, Bogle championed investor rights and authored influential books like “Common Sense on Mutual Funds.” His legacy of integrity and commitment to investors continues to shape the investment landscape, inspiring generations to pursue prudent, long-term investment strategies and advocated a steadfast commitment to a few fundamental principles when it comes to investing:

Stay the Course

First and foremost, Bogle emphasized the significance of adopting a long-term perspective. He believed that successful investing isn’t about trying to outsmart the market in the short term but rather staying the course over the long haul. Market fluctuations and economic downturns are inevitable, but Bogle asserted that sticking to a well-thought-out investment plan, even during turbulent times, is key to achieving financial goals.

Focus on Asset Allocation

Central to Bogle’s investment philosophy was the concept of asset allocation and diversification. He stressed the importance of spreading investments across various asset classes such as stocks, bonds, and cash equivalents to mitigate risk. By diversifying, investors can reduce the impact of volatility in any single investment and improve the consistency of returns over time.

Keep Costs Low

Another cornerstone of Bogle’s approach was the emphasis on keeping investment costs low. He famously championed index investing, which involves buying and holding a diversified portfolio of securities that mirror a broad market index, such as the S&P 500. By eschewing actively managed funds with higher fees and instead opting for low-cost index funds or exchange-traded funds (ETFs), investors can maximize their returns over the long term.

Don’t Try to Time the Market

In line with his belief in the futility of trying to time the market, Bogle advised against making investment decisions based on short-term market movements or attempting to predict future price movements. He argued that market timing is inherently risky and that even seasoned professionals struggle to consistently outperform the market through timing strategies. Instead, Bogle advocated for a disciplined buy-and-hold approach, where investors maintain a diversified portfolio aligned with their long-term financial objectives.

Ignore Market Noise

Bogle also cautioned against succumbing to the noise and hype of the financial markets. In an era of 24-hour news cycles and constant information overload, he encouraged investors to focus on the fundamentals and block out the distractions of sensational headlines and short-term market fluctuations. By staying informed but not swayed by market sentiment, investors can make more rational and informed decisions.

Invest Regularly

Consistency and discipline were recurring themes in Bogle’s investment advice. He emphasized the importance of adhering to a consistent investment strategy and resisting the urge to make impulsive decisions driven by fear or greed. Whether it’s sticking to a regular investment plan, rebalancing portfolios periodically, or ignoring the latest investment fads, Bogle believed that disciplined investors are more likely to achieve long-term success.

Avoid Speculation & Stay Disciplined

Furthermore, Bogle cautioned against speculative behavior and chasing after hot stocks or market trends. He advocated for a conservative, principles-based approach to investing, where investors focus on the underlying fundamentals of companies and maintain a diversified portfolio tailored to their risk tolerance and investment objectives.

Reinvest Dividends

Bogle also recognized the power of compounding returns over time. He advised investors to reinvest dividends and other income generated from their investments to harness the benefits of compounding. By reinvesting dividends, investors can accelerate the growth of their portfolios and achieve greater wealth accumulation over the long term.

John Bogle’s principles of investing boil down to a few fundamental truths: stay the course, diversify, keep costs low, avoid speculation, and remain disciplined. By adhering to these timeless principles and maintaining a long-term perspective, investors can increase their chances of achieving their financial goals and building wealth over time. His strategy emphasized low-cost index funds, which track the performance of a specific market index, such as the S&P 500.

Bogle’s philosophy revolved around the idea that, by investing in a diversified portfolio of low-cost index funds and holding them for the long term, investors could capture the market’s returns while minimizing fees and taxes.

This approach, known as passive investing or the Bogleheads philosophy, has gained widespread popularity for its simplicity, transparency, and ability to deliver solid returns over time. Bogle’s legacy continues to influence countless investors seeking to build wealth through sound asset allocation principles.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.