There’s a new broker in Singapore, and this time it’s Longbridge. Yes, that’s really the name — Longbridge. While upon first view they may seem just another promising broker offering low-commission trading on stocks, ETFs, and options, the question is: does Longbridge bring anything unique to the table?

Or are they just one of those types of brokers people join up with so they can get a couple of free gadgets and then forget about them?

Longbridge offers lifetime commission-free trading for U.S. and Hong Kong stocks, an attractive platform for visible investors who intend to cut trading costs. Users can also access real-time Level 1 quotes from the Hong Kong Exchange (HKEX) and the Singapore Exchange (SGX) for free, so that market information can be updated with the latest information in a timely manner. Opening a trading account is fast and easy; it takes only three minutes via MyInfo with Singpass. Furthermore, the platform is fully licensed and regulated by the Monetary Authority of Singapore (MAS), providing a secure trading environment.

Who is Longbridge?

Longbridge is a relatively fresh broker, founded in 2019 by a team of professionals with experience in major tech companies such as Alibaba and ByteDance. It is licensed to operate in Singapore, Hong Kong, China, the United States, and New Zealand. Longbridge will allow trading in stocks, ETFs, funds, options, warrants, CBBCs, and bonds across three major markets: Singapore, Hong Kong, and the U.S. Now that you know a bit about them, let’s go on to what the majority of people consider the most important piece-fees.

Longbridge Signup Bonus

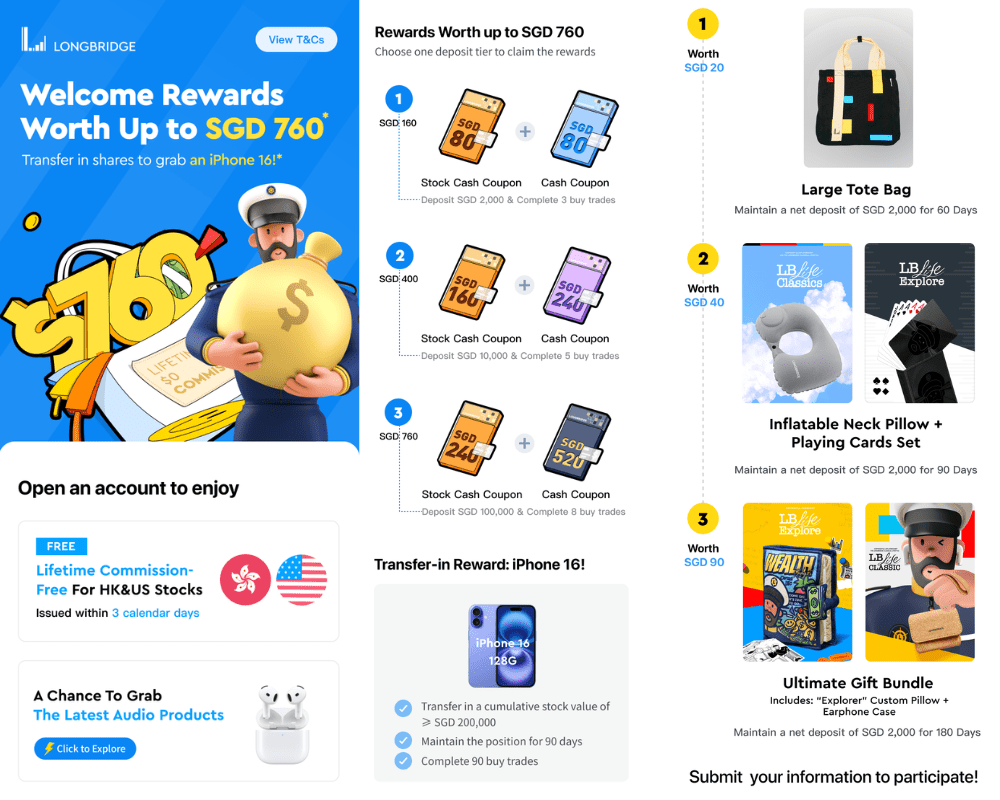

Longbridge currently offers a welcome promotion that can be combined with the exclusive bonuses mentioned earlier. By signing up with Longbridge Securities, you can claim up to S$760 in welcome rewards, receive the latest audio products, transfer in stocks and get an iPhone 16, and enjoy commission-free trades in the U.S. and Hong Kong markets.

By opening an account, investors can enjoy lifetime $0 commission trading on U.S. and Hong Kong stocks, making Longbridge the first brokerage in Singapore to offer this benefit. Clients also gain access to real-time market data for Singapore and Hong Kong, ensuring they stay updated on market trends.

As part of this offer, Longbridge provides stock rewards for new clients based on their deposit amounts and trading activity:

- Deposit SGD 2,000, maintain the balance for 30 days, and complete 3 trades to receive 1 NVIDIA (NVDA.US) share.

- Deposit SGD 10,000, maintain the balance for 90 days, and complete 5 trades to earn 1 Apple (AAPL.US) share.

Flexible Transfer Incentives and iPhone Giveaway

Beginning November 2024, Longbridge has rolled out a multi-tiered asset transfer rewards program tailored to clients’ capital and trading levels.

- Fee Reimbursement: Longbridge will cover transfer fees from other brokerages, up to SGD 200.

- Tiered Transfer Rewards:

- Transfer SGD 10,000, maintain the balance for 90 days, and complete 10 trades to receive SGD 100 in stock cash coupons.

- Transfer SGD 100,000, maintain the balance for 90 days, and complete 20 trades to receive Apple AirPods 4 and SGD 100 in stock cash coupons.

- Transfer SGD 200,000, maintain the balance for 90 days, and complete 90 trades to win the iPhone 16 Pro Max.

These incentives highlight Longbridge’s commitment to offering cost-effective trading and attractive rewards for its clients.

Longbridge Singapore Review

Access to Multiple Markets

Longbridge offers users the opportunity to trade across three major stock markets: Singapore, Hong Kong, and the U.S. This wide access enables traders to diversify their portfolios, spreading risk and taking advantage of different market conditions. Such access is particularly beneficial for investors looking to explore international markets without needing multiple accounts across different platforms.

Low-Cost Trading

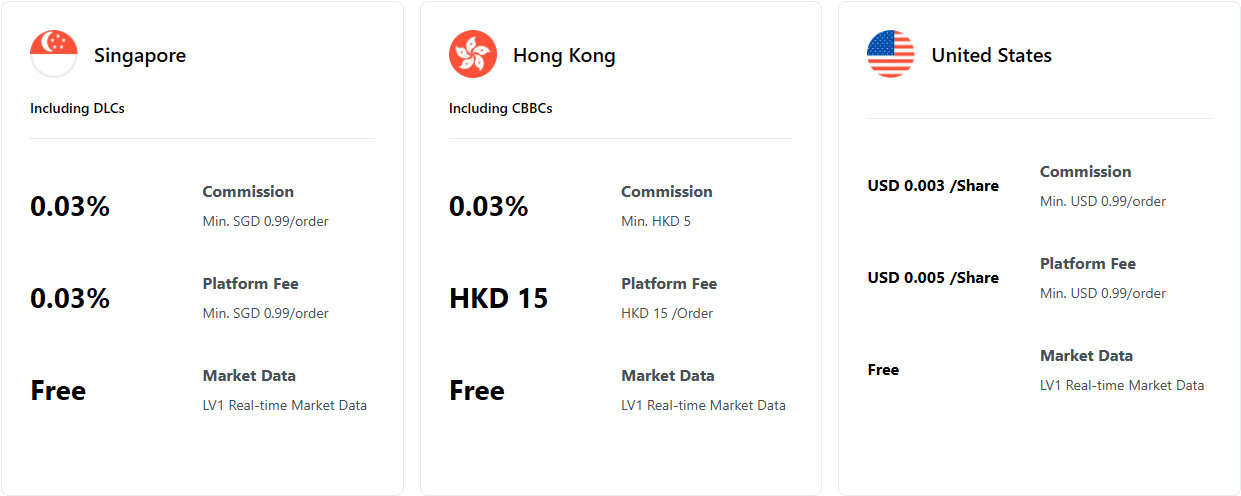

One of the key benefits of Longbridge is its commission-free trading for Singapore stocks. This feature makes the platform highly attractive to frequent traders who want to reduce transaction costs. By eliminating commissions, Longbridge enables users to maximize their returns, particularly those who trade in high volumes. For U.S. stocks and ETFs, there is no commission fee. However, a platform fee of USD 0.005 per share applies, with a minimum charge of USD 0.99 per order. Singapore stocks and ETFs come with a commission rate of 0.03%, with a minimum of SGD 0.99 per order, alongside a matching platform fee of 0.03%. For Hong Kong stocks and ETFs, while there is no commission fee, a platform fee of HKD 15 per order is charged. Notably, mutual funds incur no fees, making them a cost-effective option for diversifying portfolios.

Longbridge stands out by offering a range of services without additional fees. There are no carrying or holding costs, no manual order fees, no custody fees, and no inactivity fees, which is highly beneficial for users looking to avoid hidden costs.

Fees Comparison

Let’s compare Longbridge’s fees with other popular brokers in Singapore, such as Interactive Brokers, Moomoo SG, Tiger Brokers, Webull, and Syfe Trade. Starting with the U.S. market, Longbridge charges USD 0.008 per share, with a minimum fee of USD 1.98. Unfortunately, this makes Longbridge one of the more expensive brokers for small U.S. trades. Brokers like Interactive Brokers and Webull charge a lower minimum fee of USD 0.50 or less, making them more cost-effective for trading a small number of shares. Even for large trades, Longbridge still loses out to Interactive Brokers, which charges a lower fee per share, and Moomoo SG, which has a fixed fee of USD 0.99 per trade.

For the Singapore market, Longbridge charges 0.06%, with a minimum of SGD 1.98 per order. When you compare just the fees, ignoring free trade promotions, Longbridge stands among the cheapest brokers for SG stocks, alongside Moomoo SG, Tiger Brokers, and Syfe Trade. In the Hong Kong market, however, Longbridge isn’t the cheapest. They charge 0.03% plus HKD 15 per trade, with a minimum of HKD 20. Webull and Moomoo SG are cheaper since they don’t have the additional HKD 15 platform fee. For U.S. options, Longbridge is also more expensive, with a minimum fee of USD 2.98, compared to lower rates offered by IBKR, Tiger Brokers, and Webull.

When it comes to forex spreads, specifically SGD to USD conversion, Longbridge offers a fairly competitive rate. While Interactive Brokers consistently provides the best forex rates, Longbridge and POEMS follow closely, with only a small 0.18% loss compared to Interactive Brokers.

Comprehensive Trading Tools

Longbridge stands out for its array of advanced tools designed to support traders in making informed decisions. These tools include real-time market data, industry chain analysis, and data visualization features, which help users gain deeper insights into the markets. Such comprehensive tools are especially useful for experienced traders, though they are presented in a user-friendly way that even beginners can grasp.

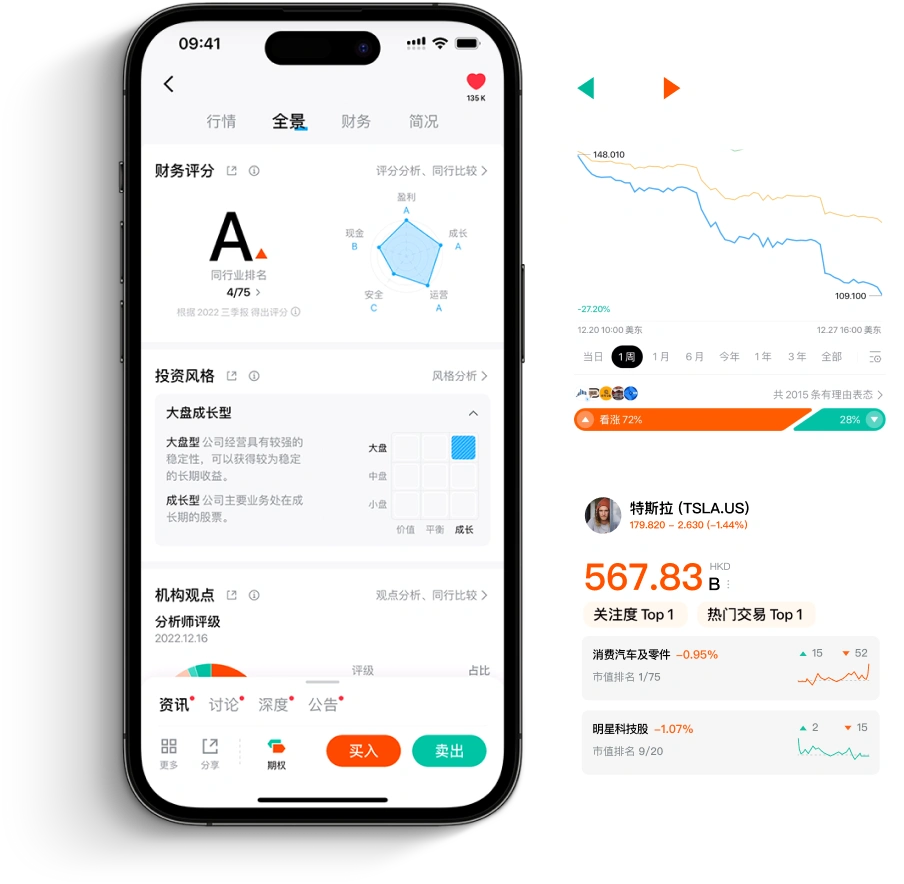

Longbridge is available on desktop, mobile, and web platforms, all of which include a dark mode feature—a nice touch for those who prefer it. While all the platforms have useful features, lets focus on the mobile app, which is packed with functionality.

On the app, the first thing you’ll see is the Watchlist page, offering a quick overview of how your selected stocks are performing. The stock page provides basic info, such as price charts, capital flow data, and stock-related news. For those who want to dig deeper, the overview page includes a financial rating, stock valuation, and analyst opinions. There’s even a “deep analysis” tool that visually maps out factors affecting the company. The Financials tab shows the company’s latest earnings and key financial metrics, while the Summary tab offers a snapshot of the company’s background, industry ranking, and revenue sources.

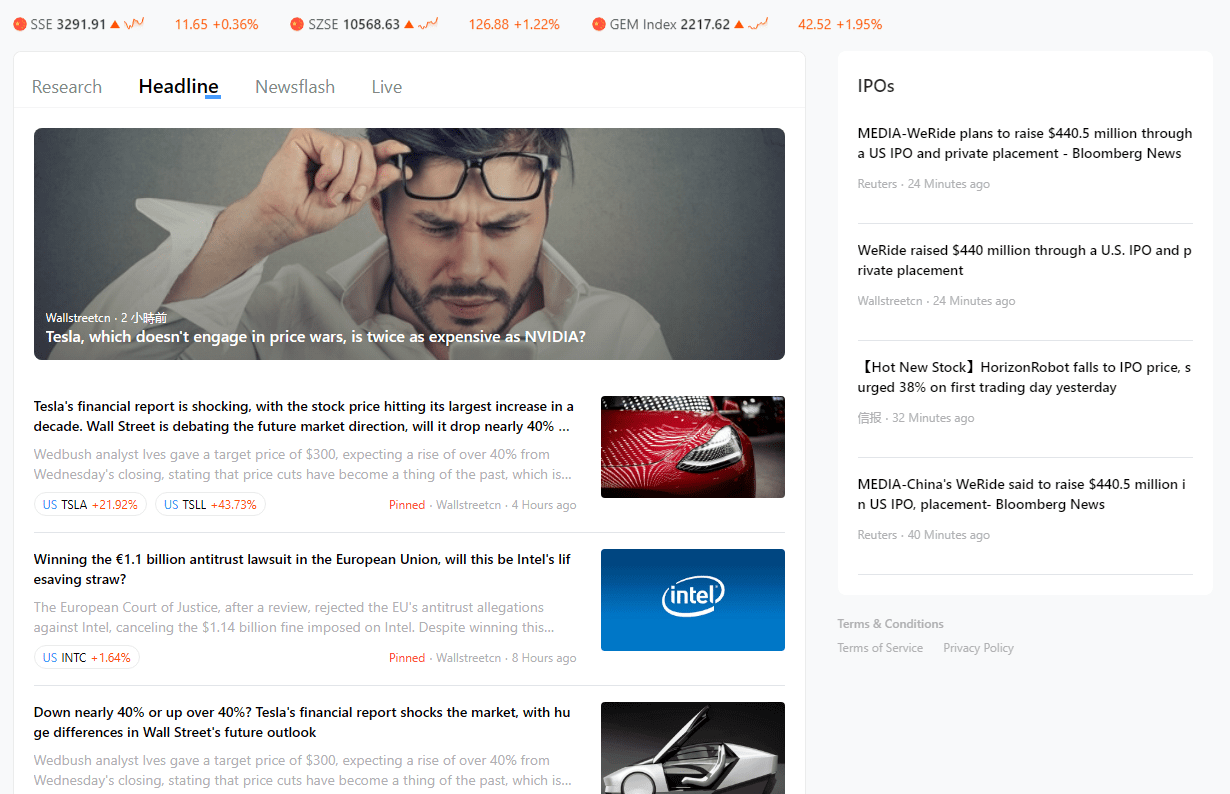

The app also gives you a broad view of market performance on the Markets page, including a “fear and greed” index showing current market sentiment. You’ll also find widgets tracking gainers and losers, the most mentioned stocks of the day, and how different industries are performing. Additional resources include news headlines, research articles, live earnings calls, and educational tools to enhance your investing knowledge.

An interesting feature is “PortAI,” Longbridge’s AI chatbot. Similar to ChatGPT, but focused on financial data, PortAI can access real-time data and assist with tasks like summarizing earnings reports or explaining stock options in simple terms. While it can’t provide direct stock recommendations, it’s a useful tool for research and will likely improve over time.

One limitation of Longbridge is that it doesn’t offer fractional shares for the U.S. market, but it’s one of the few brokers that does allow fractional shares for the Hong Kong market. This is especially helpful for investors who want to buy high-priced stocks like Alibaba but don’t want to purchase a full lot of 100 shares. Longbridge also currently only offers basic options strategies, such as long and short positions, meaning more advanced strategies like covered calls or spreads are not available yet.

PortAI

PortAI is a specialized financial intelligence assistant developed by LongPort, tailored to support users with finance-focused tasks directly within the app. Leveraging OpenAI’s GPT API, it combines LongPort’s financial data and community insights to provide real-time financial information. Users can interact with PortAI in multiple ways: through real-time chat for quick responses, by tagging @PortAI in community posts, or by using the “Summarize” feature to condense long articles over 300 words. Additionally, users can access daily position summaries in the News Center with just one click.

PortAI serves as a powerful financial search engine, enabling users to quickly locate relevant information on specific financial topics. It can also track the development of major financial events and provide analyses to help users understand and attribute causes to market events. However, PortAI has some limitations. It does not offer stock screening capabilities based on fundamental or technical analysis, cannot make investment decisions on behalf of users, and does not forecast stock market movements, though it can provide insights on trends. Its scope is strictly financial, so non-financial topics such as politics or weather are beyond its capabilities.

Unlike ChatGPT, PortAI is designed specifically for finance, integrating LongPort’s financial information and community insights to provide more relevant responses for investment and financial inquiries. To use PortAI effectively, questions should be finance-focused, specific, and clearly phrased to receive the most accurate responses.

Social Trading and Community Support

The social live trading feature in Longbridge introduces a community-oriented approach to this platform by allowing users to share their trading ideas and strategies with one another interactive learning environment. This generates an atmosphere of collaboration whereby traders, whether new or professional, get to share ideas and enhance their investment strategies by learning from their peers.

Longbridge offers in-built digital support and 24/5 customer support to make sure assistance is always available. It also allows customers to access the support in local languages, hence improving the user experience. There is a learning centre and demo account available that would help users build confidence in their trade.

Secure and Regulated

Longbridge is keen on security and regulatory matters and, thus, holds a license from the Monetary Authority of Singapore. For this reason, there is total assurance of a safe trading environment since the platform observes stringent financial regulations. It also incorporates top-notch encryption technology in safeguarding user information, making all transactions and personal particulars related to it perfectly secure. The minimum age for opening an account is 18 years. Any user at this age can use MyInfo for an online application.

Cross-Platform Support

The other exciting edge of Longbridge lies in its cross-platform usability. iOS, Android, or a desktop device-all work seamlessly. That flexibility means that traders can have access to their account, get on to monitor the market moments, and execute a trade from wherever.

Overall Look at Longbridge

It is perhaps not among the cheapest in every market, but Longbridge certainly has impressive features to boast with: partial shares in Hong Kong, the most comprehensive breakdown of company earnings, and the best AI chatbot.

Overall, Longbridge welds together all the great benefits of inexpensive trading, comprehensive tools, community support, security, and flexibility – a perfect hub for traders of any level of experience. Whether you are a beginner who just wants to learn about the global markets or an expert trader looking for more sophisticated tools, Longbridge will cater to your needs with its robust and safe trading environment.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.