Building wealth requires dedication and consistent effort. However, there are tips that can help expedite your journey. Before delving into the “how,” it’s essential to understand the “why” behind your goal.

Why is achieving your first $100,000 important?

- Boosts self-confidence: Accomplishing a goal you set for yourself, such as reaching your first $100,000, builds self-confidence. It provides a sense of control over your finances, breaking the cycle of living paycheck to paycheck.

- Eases the path to compound growth: Once you save your first $100,000, it becomes significantly easier to leverage the power of compounding. By allowing your money to grow over time, you can reduce the timeline to reach your first million dollars.

Regardless of your income level, the key lies in developing good saving habits. As Charlie Munger aptly stated, “The first $100,000 is a b*tch, but you gotta do it. I don’t care what you have to do—if it means walking everywhere and being frugal in your purchases, find a way to save $100,000. After that, you can ease off the gas a little bit.”

The initial $100,000 is challenging because it requires consistent adherence to various small, prudent financial decisions. Daily expenses need to be scrutinized and minimized. The amount you save and the speed at which you save are crucial factors.

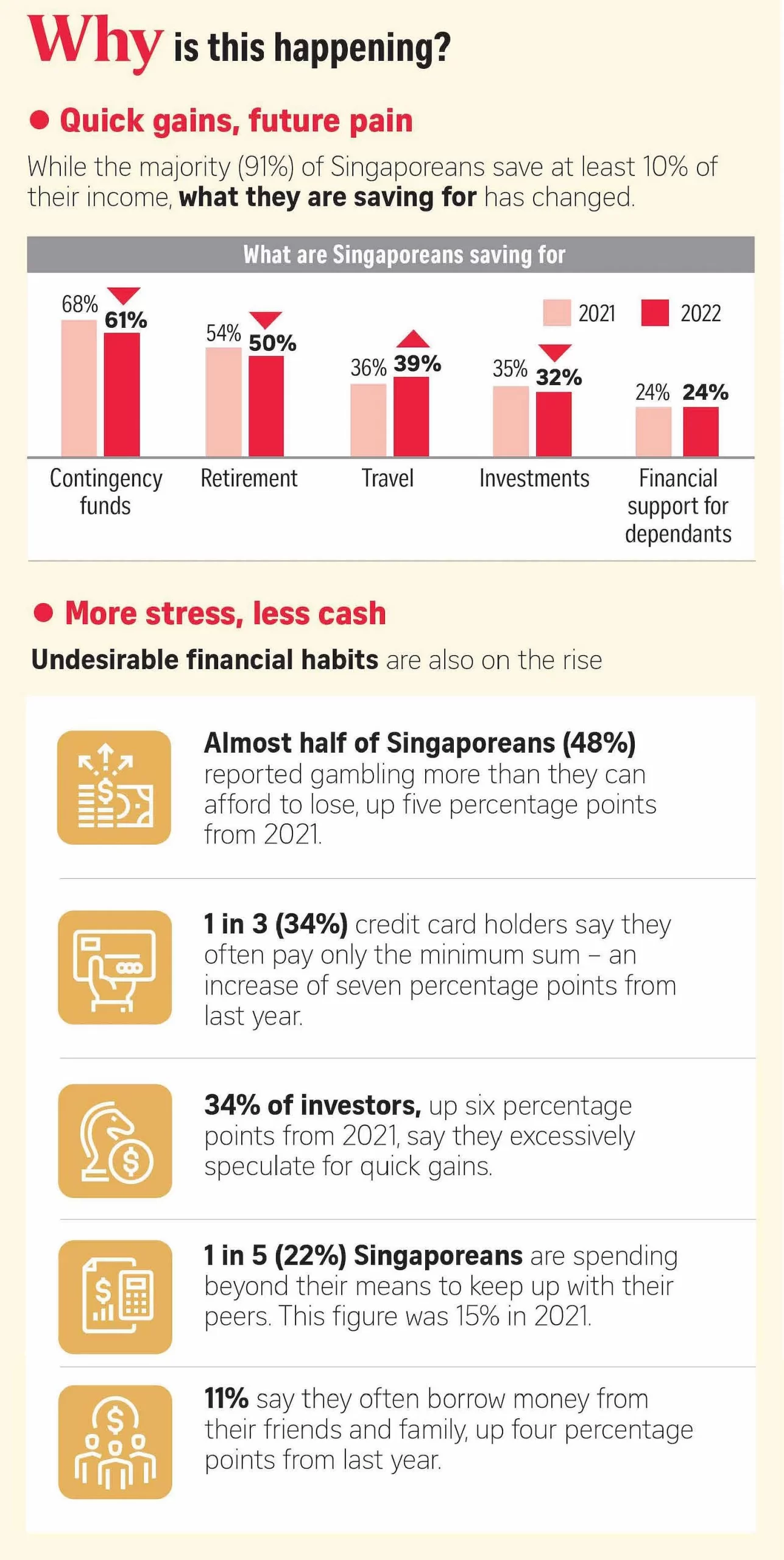

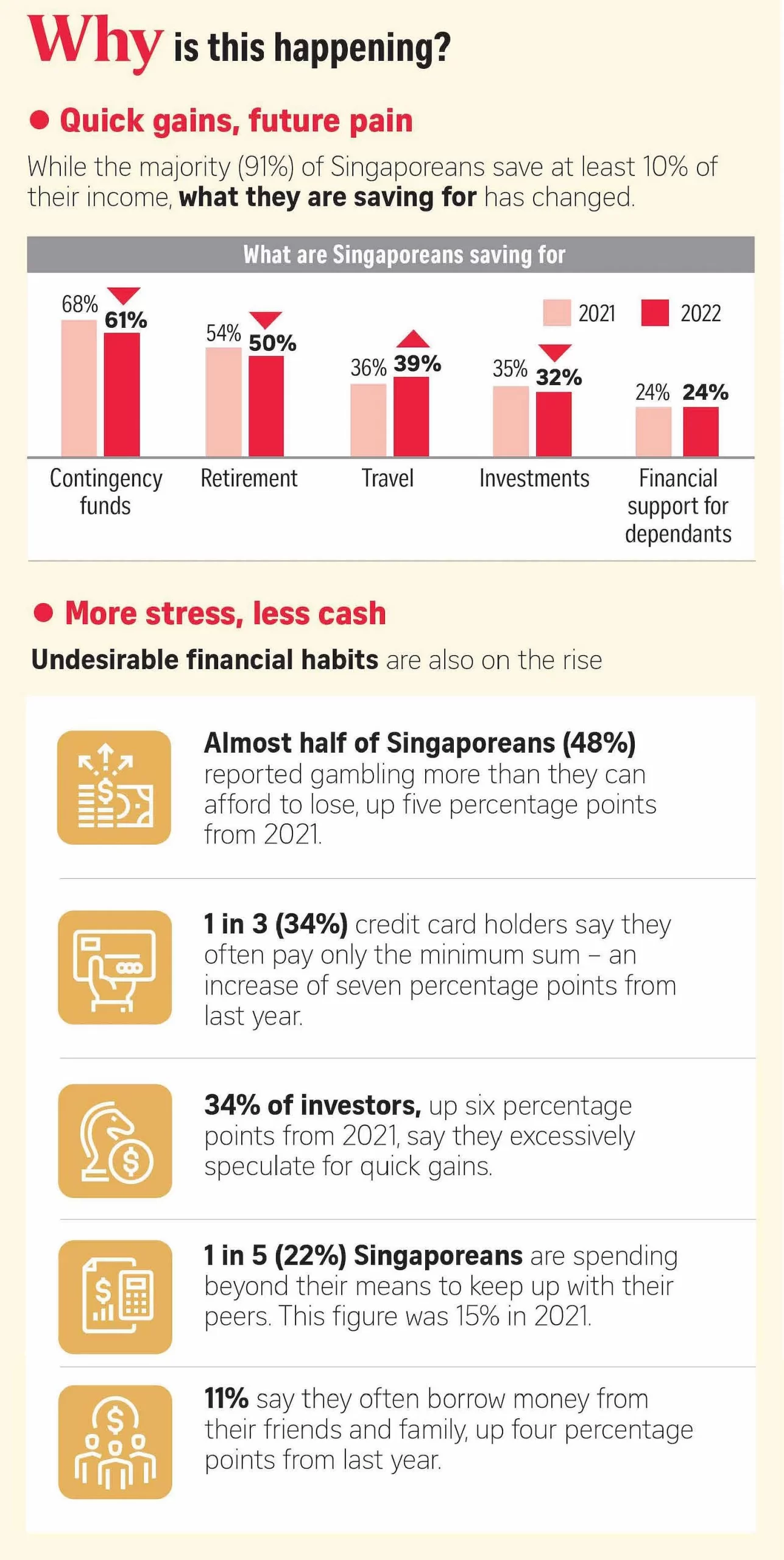

If the statistics are true, we don’t want to be in the position where close to half (47%) of Singaporeans don’t have enough emergency funds to last for 6 months in a crisis, while 45% say they do not have enough funds to meet family needs for the next year. Moreover, 2 in 5 Singaporeans face difficulty in paying their mortgages, up 9 percentage points from 2021.

But there’s hope! Having $100k can be life-changing, and with the right mindset and actions, you can achieve this goal.

According to Charlie Munger, Warren Buffett’s right-hand man with a net worth of over $2.3 billion, “The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do. If it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on a hundred thousand dollars.”

This means that in order to reach $100k as quickly as possible, we need to save and be frugal. It’s not about investing in gold or GameStop stock. Contrary to popular belief, the first $100k is not usually derived from investment returns, but from savings.

For example, if you save $15,000 a year for six years and attain a modest 4.5% return on your savings, you would have $105,000 after six years, but 85% of that would be from savings and only 15% from interest. Even if you save less, like $10k a year, but on average a 10% return, it would still take you seven years, and 67% of your total $104,000 would come from savings.

Getting your first $100k is all about saving, being smart with your money, and earning more money, all in tandem. Once you reach $100k, the next $100k is much easier and faster to make because of the compounding effect.

If you want to make $100k in a year, break down the number into a more digestible manner: $100k in a year is $273.97 a day. If you only count business days (260 in a typical year), that comes out to $384 a day. Your target should be to make between $380 to $400 every single working day, which translates to an hourly wage of $48 for a 40-hour week or $32 for a 60-hour week.

Is this possible? Statistically, no, but that shouldn’t stop you from trying because other people are doing it. To achieve this goal, you need to have the mindset of “Why can’t it be me?”

To make $380 a day, start by reading business and economy news to stay informed. The more irreplaceable you are, the more money you’ll make. So, find your niche, hone your skills, and become the best at what you do. Network with people in your industry and find opportunities to earn more.

Here’s how it works

Once you have established a savings fund, it’s time to invest your money! The earlier you start investing, the more time you have for your investments to grow through compounding. However, it is crucial to conduct thorough research and educate yourself on different investment opportunities before diving in.

For new investors, it is advisable to avoid being overly aggressive in your investment approach. Assume a reasonable 5% annual return on your investments and align your financial goals accordingly. This rate of return can be achieved through a balanced portfolio of diversified equities and bonds.

With a target of $100,000, you can create a personalized game plan based on your income. For example, if you have $2,000 in savings and dedicate $1,500 per month to investing, assuming a 5% return, you will reach the $100,000 mark in five years. The chart below demonstrates this impact. Without investing, your total would only amount to $92,000 instead of $104,576, a difference of $10,013!

Another perspective is that without investing, it would take an additional six months to surpass the $100,000 milestone. Investing and earning investment returns significantly reduce the time required to achieve your financial goals.

Tip: Practice prudence and discipline in your investment strategy. Investing often requires patience and the ability to remain unfazed by market fluctuations. Avoid getting overly excited when markets surge or selling out of panic when they crash. Investing is not about finding rapid price appreciation but rather a long-term approach focused on compounding.

Compounding becomes meaningful after reaching the first $100,000. As seen in the previous chapter’s chart, even with your money invested at a compounded rate of 5%, you would still need to save $92,000 to reach $100,000. The majority of your first $100,000 is the result of your own efforts. Investments below $100,000 may not yield significant returns.

Now, let’s assume you have saved your first $100,000 and continue investing with a 5% annual interest rate over a 20-year period. You will notice that when you start with a larger initial investment of $100,000, compounding becomes even more impactful. The value and contributions begin to diverge, and your wealth starts to snowball. Remember, you must work for money before the money starts working for you.

In conclusion, the importance of saving income cannot be overstated. Building wealth is a gradual process best approached with a long-term perspective. Once you have achieved your first $100,000, the path to $1,000,000 begins to unfold.

It won’t be easy, but with hard work, determination, and a strong savings plan, you can reach $100k and achieve financial freedom. Good luck!