In the fast-paced world of financial advisory services in Singapore, standing out is crucial. In a marketplace saturated with competition, the key to success lies in carving out a niche that caters to specific client needs or objectives. In this guide, we delve into the best financial advisor niches and how to find the one that suits you in the vibrant Singaporean landscape.

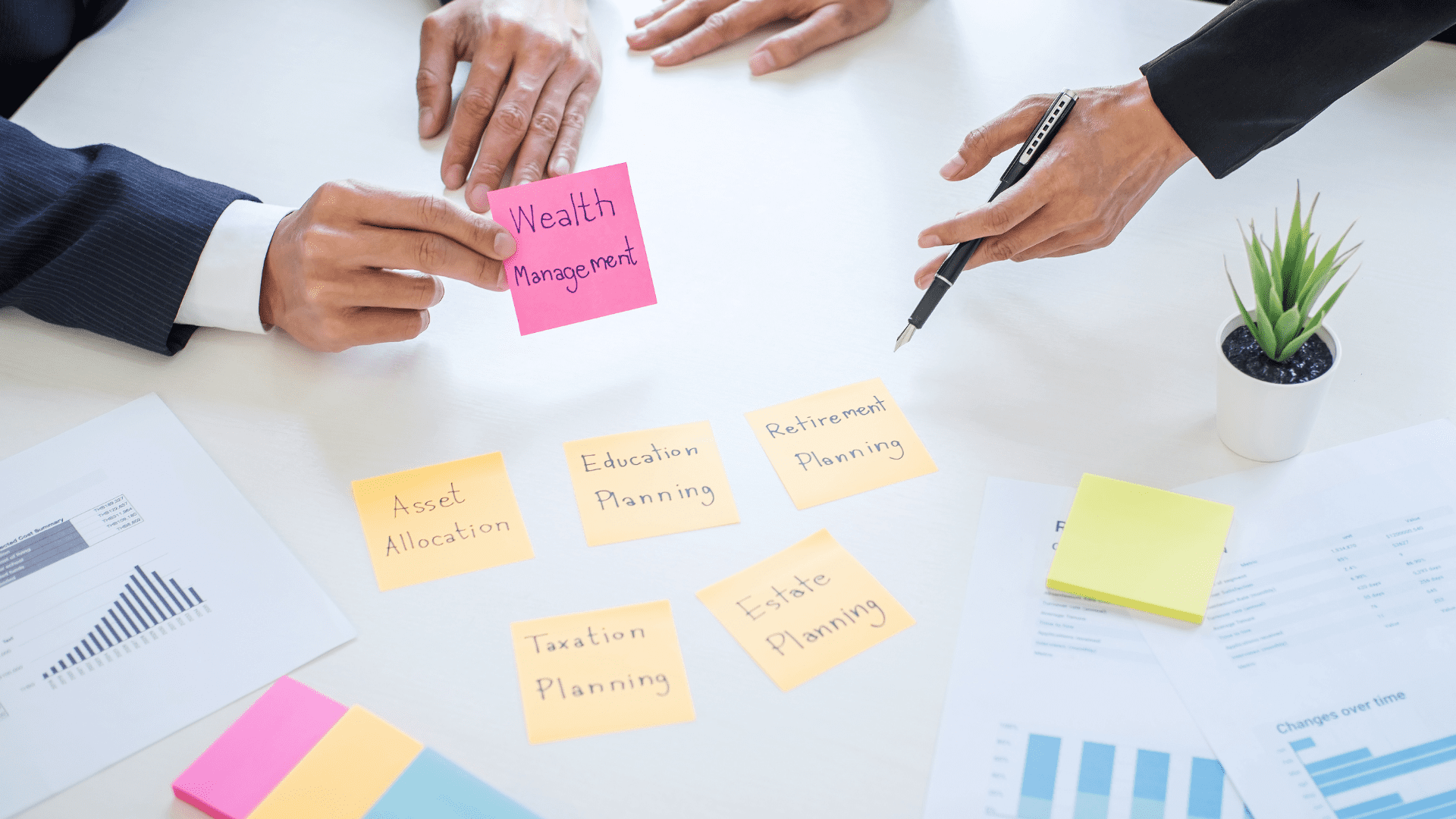

What Are Financial Advisor Niches?

In the realm of financial advising, a niche can take various forms, ranging from focusing on a particular demographic, such as young professionals in healthcare or retirees, to specializing in specific financial services, like investment in ETFs or retirement planning. The essence of a niche lies in tailoring your expertise to address unique financial needs, making your services more attractive and relevant.

The Top Financial Advisor Niches in Singapore

Retirement Plans and Stages

In the dynamic landscape of financial advisory services in Singapore, there are diverse niches that advisors can specialize in to cater to specific client needs. One prominent niche involves focusing on Retirement Plans and Stages, where advisors excel in navigating complex financial instruments such as pension plans, CPFIS, and other retirement savings options. This specialization becomes crucial for individuals nearing retirement age, providing them with personalized strategies for a secure and fulfilling post-work life.

Financial Products

Another avenue is Financial Products, where advisors delve into the intricacies of investment vehicles like mutual funds or Exchange-Traded Funds (ETFs). By offering comprehensive knowledge and perspective, these specialists guide clients through the selection and management of investment options, significantly impacting the growth potential of individual portfolios.

Financial Planning for Women

Addressing the distinctive financial challenges faced by women, Financial Planning for Women is a niche that spans various aspects, from estate planning to long-term care and family education planning. Advisors in this field offer targeted solutions that empower women to navigate their financial journeys with confidence.

Age-Based Clients

Age-based clients, such as Millennials and Gen Z, present another significant niche. Advisors catering to these tech-savvy generations not only understand their digital preferences but also assist in creating financial plans that resonate with their unique goals and lifestyles. By tailoring strategies to specific age groups, advisors in this niche bridge the gap between generational preferences and effective financial planning in the modern landscape.

Small Business Financial Planning

Small business financial advisors specialize in assisting business owners with the management of both their personal and business finances. Their services encompass a wide range of areas, including retirement planning tailored specifically for business owners, succession planning to ensure smooth transitions of ownership, conducting business valuations to determine the worth of the enterprise, and optimizing tax strategies uniquely suited to small businesses. By providing comprehensive financial guidance in these areas, small business financial advisors help entrepreneurs navigate the complexities of managing both their personal wealth and the financial health of their businesses, ultimately fostering long-term financial stability and success.

Other Potential Niches in the Singaporean Landscape

One lucrative avenue involves catering to high-net-worth individuals, where advisors can provide personalized and sophisticated strategies designed to manage substantial wealth. These clients often have complex financial portfolios, requiring specialized expertise to optimize their investments, taxation, and estate planning.

Another niche opportunity lies in serving expatriates residing in Singapore. Expatriates face distinct financial challenges, such as navigating cross-border taxation and understanding local investment options. Advisors specializing in this niche can offer tailored solutions to address the unique financial needs and goals of expatriates, creating a niche within a niche in the cosmopolitan financial landscape of Singapore.

Benefits of Finding Your Financial Niche

Targeted Marketing

In the competitive realm of financial advisory services in Singapore, targeted marketing is a powerful strategy that can significantly elevate an advisor’s success. Understanding your ideal client is the cornerstone of this approach, as it allows you to tailor marketing efforts with precision. By defining your target audience based on demographics, financial goals, and preferences, you can craft campaigns that speak directly to the needs and aspirations of your ideal clientele.

Enhanced Service Delivery

This focused marketing strategy not only streamlines your efforts but also makes them more effective. Rather than employing a one-size-fits-all approach, you can create content and messaging that resonates specifically with the individuals you aim to serve. Whether through digital channels, traditional advertising, or networking events, the ability to tailor your message to a well-defined audience enhances the likelihood of capturing their attention and engagement.

Professional Development and Reputation

By honing in on your ideal client through targeted marketing, financial advisors in Singapore can establish a more meaningful connection with their audience. This not only fosters brand loyalty but also positions the advisor as a trusted and knowledgeable resource in the eyes of the clients they most want to attract. Ultimately, targeted marketing becomes a strategic tool in building a client base that aligns closely with the advisor’s expertise and business objectives.

How to Find and Pursue Your Niche as a Financial Advisor

Assess Personal Interests and Expertise

Embarking on the journey to find and establish a niche as a financial advisor in Singapore begins with a critical self-assessment. Take the time to reflect on your personal interests and areas of expertise. Assessing your strengths and passions will help guide you towards niches that align with your skills, making your advisory services not only specialized but also fulfilling.

Identify Gaps in the Market

In tandem with self-reflection, it’s essential to identify gaps in the market. Explore the financial landscape to uncover underserved markets or unmet needs. This keen observation will enable you to pinpoint potential niche opportunities that align with both market demand and your unique capabilities. Identifying these gaps positions you strategically to offer services that are not only in demand but also cater to specific client needs.

Evaluate Potential Client Bases

As you delve into potential niches, it’s crucial to evaluate the profitability and growth potential of the client base. Assessing the financial landscape and understanding the prospective clients’ needs and aspirations will allow you to make informed decisions. Balancing the potential for financial success with your personal interests and expertise is key in selecting a niche that not only meets your business goals but also resonates with your passion for providing tailored financial advice.

Once you’ve chosen your niche, create a Unique Value Proposition (UVP), a clear statement describing why your specialized advisory business offers unique services and distinguishes you from the competition.

Communicating Your Unique Value Proposition in Singapore

You can communicate your UVP through various channels, including marketing materials, websites, consultations, and ongoing client communication. For instance, if serving professional athletes, your UVP could be: “With an intricate understanding of the financial dynamics in the sporting world, we provide tailored strategies designed to manage your wealth beyond your playing days.”

Bottom Line: Master Your Niche, Master Your Success

In the dynamic financial advisory landscape of Singapore, finding your niche is the key to differentiation. By creating a unique value proposition, specializing your services, and seeking professional development, you can elevate your advisory business to new heights. Remember, in Singapore’s bustling financial scene, standing out is not just an option – it’s a necessity.

Running an advisory business in Singapore comes with its challenges, including finding and retaining quality clients. If you find yourself spending too much time scouting for new prospects, consider leveraging online lead-generation tools to save you valuable time. Additionally, harness the power of social media to market your business effectively. Experiment with various content types, such as blog posts, polls, quizzes, and video content, to discover what resonates with your ideal clients in the Singaporean market.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.