Planning for retirement is a critical aspect of financial planning, and it requires careful consideration and a well-thought-out strategy. Retirement planning can be daunting, but knowing how much you need to save is an important starting point.

While there is no one-size-fits-all answer to how much you should save for retirement, several factors, including your lifestyle, your earnings, and your vision for your retirement, play a crucial role.

Therefore, it is essential to plan your retirement savings strategy based on your unique needs. And today, we will be discussing the topic of retirement savings and providing some insights on how to plan and prepare for it.

As we all know, retirement planning is an important part of our financial journey, and it is something that we need to start thinking about early on. The question of how much we need to save for retirement and by what age is a common one that often arises among young adults and those nearing retirement age.

Modern and Traditional Approaches to Retirement Planning

The world of retirement planning has evolved significantly, and what worked for your grandparents might not be the best approach for you. Let’s delve into the key differences between modern and traditional retirement planning:

Traditional Approach to Retirement Planning

Fixed Asset Allocation

A prevalent approach entailed a 60/40 portfolio split between stocks and bonds, with adjustments tailored to age and risk tolerance.

Limited Investment Options

Traditional avenues predominantly encompassed stocks, bonds, and mutual funds, with alternative investments receiving comparatively less attention.

Retirement at a Fixed Age

The conventional notion of retirement, symbolized by the “gold watch” at 65, was viewed as the ultimate objective, with minimal consideration for phased transitions or adaptable lifestyles.

Modern Approach to Retirement Planning

Embrace diverse income streams

This includes individual retirement accounts (CPF), side hustles, rental properties, and other potential sources of income.

Personalized and dynamic asset allocation

Risk tolerance and individual needs influence investment decisions, with more attention to factors like career stage, health, and lifestyle goals.

Diversified investment options

Modern investors explore alternative investments like commodities, real estate investment trusts (REITs), and even digital assets like cryptocurrencies. Flexible retirement timelines: Early retirement, phased transitions, and multiple “mini- retirements” are becoming increasingly common, catering to diverse aspirations.

Key Differences

Traditional plans prioritize employer-sponsored options, while modern approaches encourage individual initiative and income diversification. Investment: Traditional methods rely on standard asset allocation, while modern approaches are more personalized and dynamic. Retirement: Traditional planning aims for a fixed retirement age, while modern planning embraces flexible timelines and lifestyles.

Choosing the Right Approach

Ultimately, the best approach depends on your individual circumstances and goals. Consider these factors: The earlier you start planning, the more flexibility you have. Income and expenses: Understand your earning potential and desired retirement lifestyle. Risk tolerance: Evaluate your comfort level with market fluctuations. Health and longevity: Consider life expectancy and potential healthcare costs. Values and aspirations: Define what a fulfilling retirement looks like for you.

Saving Early for Retirement

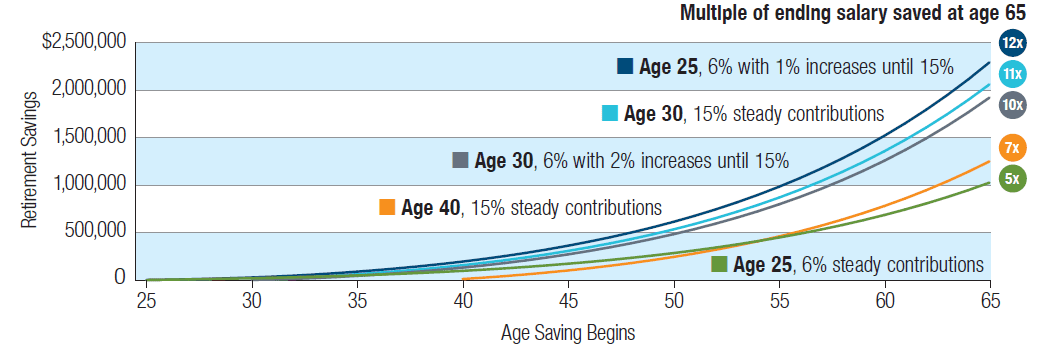

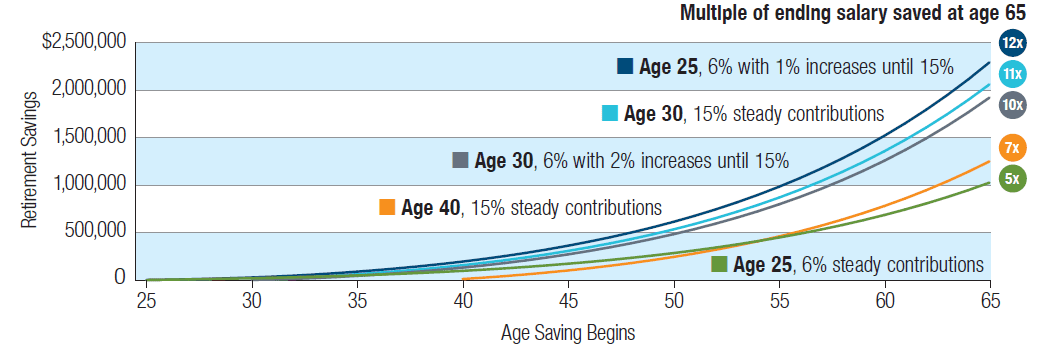

Starting to save for retirement early is key to achieving your financial goals. The sooner you begin saving, the better off you’ll be in the long run. For example, if you start saving for retirement at age 25 and gradually increase your savings rate by 1% annually until you reach 15%, with a 7% annual rate of return, you can end up with 12 times your salary saved by the age of 65. However, it is important to note that these figures are based on several assumptions, including a starting salary of $40,000, annual increases of 5% until age 45 and 3% until age 65, and all savings being assumed tax-deferred. These assumptions may not reflect actual market conditions or your specific circumstances.

Assessing how much you’ve saved by certain ages can provide a quick way to check your progress and determine whether you are on track to achieve your retirement savings goals and we recommend using savings benchmarks to determine how much you should have saved at various stages of your life. These benchmarks assume that you will be dependent primarily on personal savings and CPF benefits in retirement. Therefore, if you are expecting other income sources, such as a pension, your benchmark would be lower.

It is also important to consider other factors such as income and marital status when determining your personal savings benchmarks.

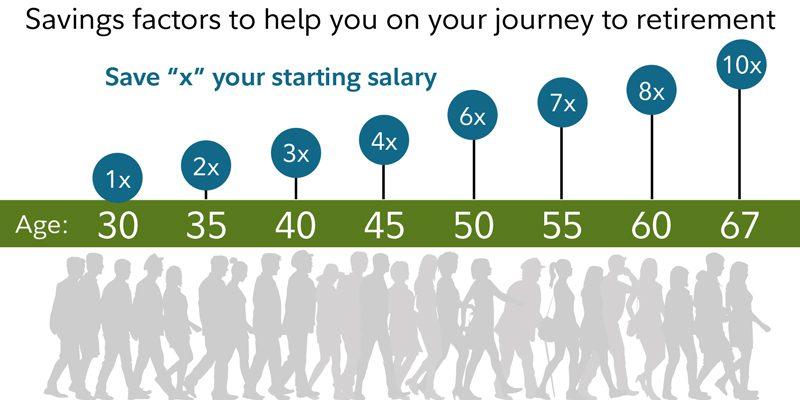

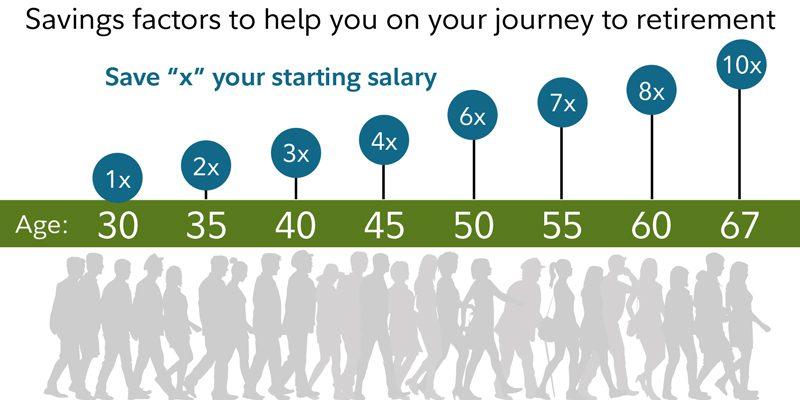

Before we delve into the specifics, it is important to note that there are several sources of information available online, including presentations and articles by financial experts. One such source is Fidelity Investments, which provides a chart on its website that suggests a savings factor based on starting salary.

While this chart may be useful to some, I find it somewhat arbitrary and not entirely relevant to retirement planning. For instance, it assumes that one’s starting salary is indicative of their retirement needs, which is not necessarily the case. As we progress in life, our expenses change and our expectations of lifestyle also evolve. Thus, starting salary is not necessarily an accurate indicator of retirement needs.

Image from https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

Another issue I have with the Fidelity chart is the savings factors themselves. The characteristics seem to be placed arbitrarily, with a 50% growth from age 35 to 40, followed by only a 33% growth from 40 to 45, and then a 50% growth from 45 to 50. This is not reflective of the exponential growth pattern that we would expect to see in savings. Therefore, while the Fidelity chart may be useful to some, it is not the most accurate or reliable source of information for retirement planning.

Moving on, I came across another source of information that I found more useful: the T.Rowe Price insights. Unlike the Fidelity chart, the T.Rowe price chart factors in current salary rather than starting salary, which makes more sense as it reflects our changing expenses and lifestyle needs. According to the T.Rowe price chart, one should aim to have 11 times your ending salary saved by the time one retires.

While these figures are helpful, it is important to note that everyone’s retirement needs will be different. Some people may require more savings due to health concerns or other unforeseen circumstances, while others may need less. Therefore, it is important to consult with a financial advisor to determine one’s retirement needs and develop a customized retirement plan that works best for their individual situation.

Retirement planning is an important part of our financial journey, and it is important to start planning early. While there are several sources of information available online, it is important to consider the relevance and accuracy of each source before making any decisions. By consulting with a financial advisor and developing a customized retirement plan, individuals can ensure that they are adequately prepared for their retirement years.

While there is no one-size-fits-all answer to how much you should save for retirement, starting early, saving at least 15% of your income, and regularly reassessing your savings benchmarks can help you achieve your retirement savings goals. It’s wise to consult a financial advisor who can help you navigate the changing landscape of retirement planning and create a personalized roadmap that aligns with your unique needs and aspirations.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.