The biggest appeal of U.S. stocks lies in their upside potential. During good years, U.S. stocks can deliver returns far higher than what we typically see from Singapore stocks.

For example, in 2023, the S&P 500 gained 21.9%, while Singapore’s Straits Times Index (STI) saw a more modest 4.7% increase. And it’s not just one year—over the past 10 to 20 years, U.S. stocks have consistently outperformed most other markets.

When I compared the S&P 500 with other major indices like Singapore’s STI, Hong Kong’s Hang Seng Index, MSCI Japan, and MSCI Europe, U.S. stocks clearly came out on top. The U.S. stock market is the deepest and most liquid in the world, so it’s no surprise that investors seek exposure to it.

But there’s a significant downside to U.S. stocks—the risk of large declines. In 2020, for instance, the S&P 500 dropped 33.9%, and in 2022, it fell by 25.4%. That’s two sharp drawdowns in less than three years, highlighting the volatility U.S. stocks can bring.

In short, U.S. stocks offer substantial upside, but you need a strong tolerance for risk. That got me thinking: what if there were a way to capture the U.S. market’s growth while limiting potential losses?

Syfe has introduced a solution with Singapore’s first Downside Protected S&P 500 Portfolio. This portfolio is structured to curb potential losses while allowing for gains, using ETFs with options strategies for varied levels of protection. Investors can start with an estimated max loss as low as 3.3% and enjoy gains of up to 12.4% (as of September 4). Designed to help investors manage volatility, this innovative portfolio makes the U.S. stock market more accessible, especially for those newer to investing. Through this approach, Syfe offers a way to participate in the S&P 500’s growth while maintaining a safety net for potential downturns.

Key Features of Syfe’s Downside Protected S&P 500 Portfolio

The Syfe Downside Protected Portfolio has two primary features that define its risk and return dynamics: the Estimated Max Loss and the Current Upside Cap. The Estimated Max Loss is the maximum potential loss an investor could expect in the event of a market drop. This makes the portfolio particularly appealing to cautious investors, as it aims to cap losses to a specified limit, such as 3%, even if the broader S&P 500 experiences a significant downturn. The Current Upside Cap, on the other hand, is the upper limit on potential returns. To keep downside protection affordable, the portfolio caps gains at a certain level—typically around 12%. This cap is reviewed periodically, with the potential for upward adjustments so that investors can continue to benefit from market growth over time.

Performance in Different Market Scenarios

The portfolio’s performance will vary depending on market conditions. In a down market, where the S&P 500 might drop by 20%, the Protected Portfolio would likely limit losses to the estimated max loss, providing a safeguard for most of the investment. In a moderately positive market, if the S&P 500 rises by 10%, the portfolio might achieve a gain of around 5%, though slightly below the index growth. In a booming market, where the S&P 500 jumps by 20%, the portfolio would reach its upside cap, securing a maximum gain of 12%.

Who Should Consider Syfe’s Downside Protected S&P 500 Portfolio

This portfolio is ideally suited for risk-averse investors, who prioritize minimizing potential losses while still aiming for some growth. It’s also a beneficial option for those currently holding cash, waiting for an opportune time to enter the market; the Protected Portfolio offers them a way to invest with confidence, thanks to its built-in loss limitations. Additionally, U.S. equity investors who want more stability during uncertain market periods may find this portfolio a safer, more secure alternative to traditional equities.

Comparing Syfe’s Downside Protected Portfolio with Other Investments

Compared to stocks or bonds, the Protected Portfolio generally experiences less volatility, which reduces the risk of sharp price swings. For instance, during the COVID-19 market downturn in March 2020, while the S&P 500 dropped almost 34%, the Protected Portfolio would have only fallen around 3.8%. In 2022, amid rising interest rates that impacted market performance, the portfolio’s loss would have been limited to about 2.7%, a stark contrast to the S&P 500’s decline of nearly 25%.

How Does the Portfolio Achieve Downside Protection?

The portfolio achieves downside protection through its ETFs, which utilize three main options strategies. First, to mirror S&P 500 growth, the ETFs buy a call option that tracks the index, allowing for growth when the market rises. To guard against losses, a “put” option serves as insurance, limiting losses when the S&P 500 falls. Finally, to offset the cost of this protection, the ETF sells a call option, which caps the portfolio’s gains and creates the Current Upside Cap.

Managing the Portfolio for Growth and Stability

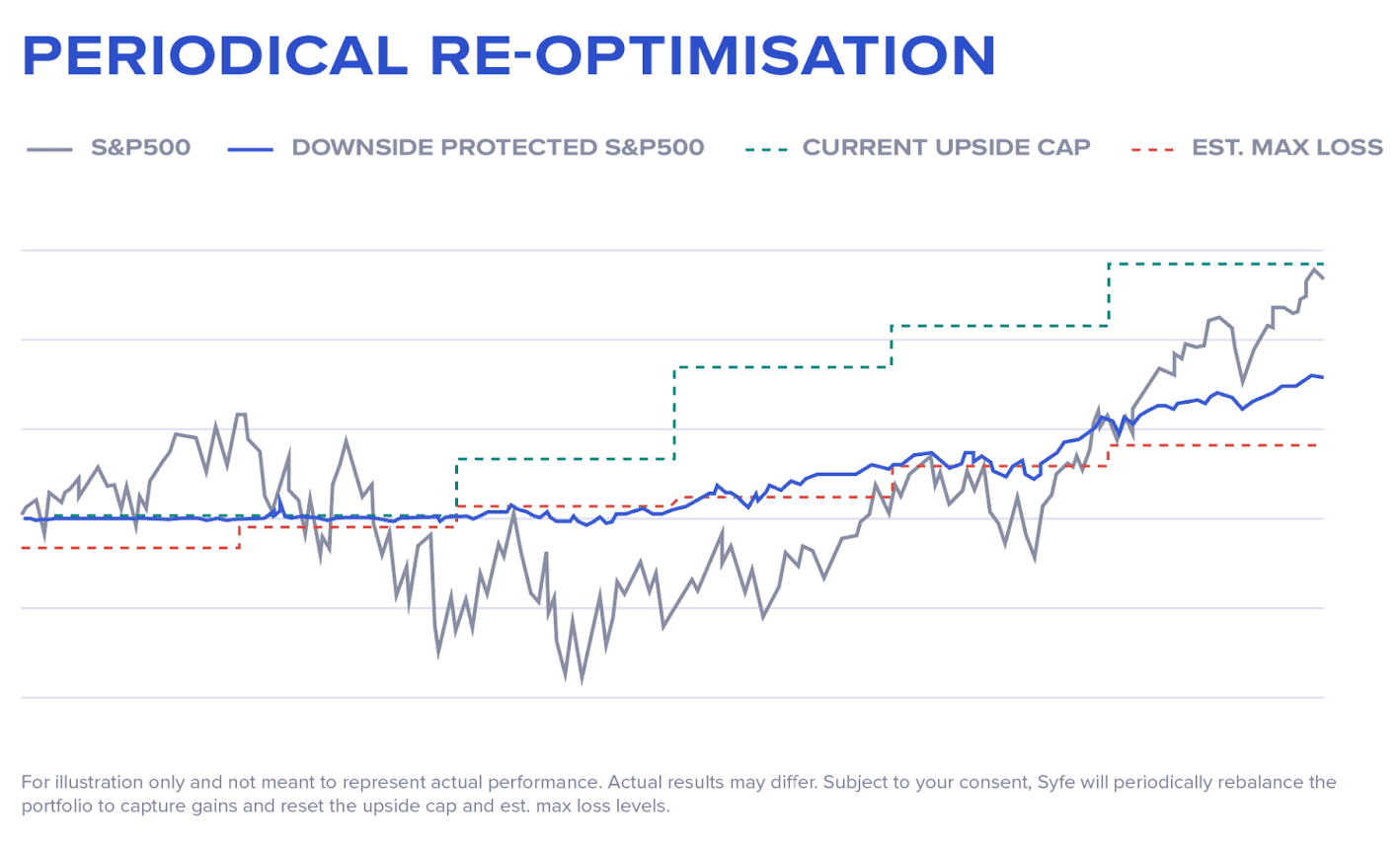

Syfe’s team actively manages the portfolio, periodically reviewing and adjusting it according to market conditions. If either the max loss level or upside cap becomes less favorable, Syfe may replace existing ETFs with new ones to optimize the portfolio’s balance between risk and return. This re-optimization ensures the portfolio remains adaptable to shifts in the market, making it an “evergreen” investment choice.

Risks to Consider

Despite its structured protections, the Protected Portfolio still involves some risks. Market risk means that while losses are capped, the portfolio’s value can still fall if the S&P 500 declines. Currency risk may impact returns if the investor’s base currency differs from USD, as exchange rate fluctuations will affect the portfolio’s value. Since the portfolio is actively managed, there is also management risk, where Syfe’s decisions may not always meet expectations. The upside cap can also limit returns, especially during rapid market rallies. Finally, the portfolio’s use of options introduces additional risks, particularly during unusual market conditions, when it may not perform exactly as expected.

In Summary

Syfe’s Downside Protected Portfolio is a conservative investment tool for those looking to balance some upside potential with significant downside protection. It’s particularly useful for risk-averse investors, those waiting to enter the market, or anyone already invested in U.S. equities seeking a more stable alternative. With its combination of protection and growth, the Protected Portfolio aims to help investors navigate uncertain markets while securing steady returns.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.