As fixed deposit interest rates offered by banks in Singapore continue to drop, many people are starting to explore other options for better returns.

One popular alternative is investing in Real Estate Investment Trusts (REITs). Unlike fixed deposits, which currently offer relatively low interest rates, REITs could potentially provide higher returns through regular dividend payouts. With their ability to generate income from rent and property appreciation, REITs have become an attractive choice for those seeking a more rewarding investment option in the current low-interest-rate environment.

In Q3, Singapore REITs made a strong recovery, driven by the Federal Reserve’s decision to cut interest rates. As inflation eased and the labor market softened, the Fed shifted its focus toward promoting economic growth, creating a favorable environment for S-REIT investors. This policy shift led to increased interest and record inflows into S-REITs, with the iEdge S-REIT Leaders Index gaining over +16% in Q3.

This positive momentum also benefited Syfe’s REIT+ portfolios, which experienced significant inflows and a strong recovery during the quarter. As of September 24, 2024, Syfe REIT+ (100% REITs) delivered a +17.0% return for Q3, bringing its year-to-date performance to +3.5%. Thanks to ongoing portfolio optimization, REIT+ (100% REITs) consistently outperformed its benchmark, the iEdge S-REIT Leaders Index, achieving a cumulative excess return of +5.4% since its inception in April 2020.

Introducing Syfe REIT+

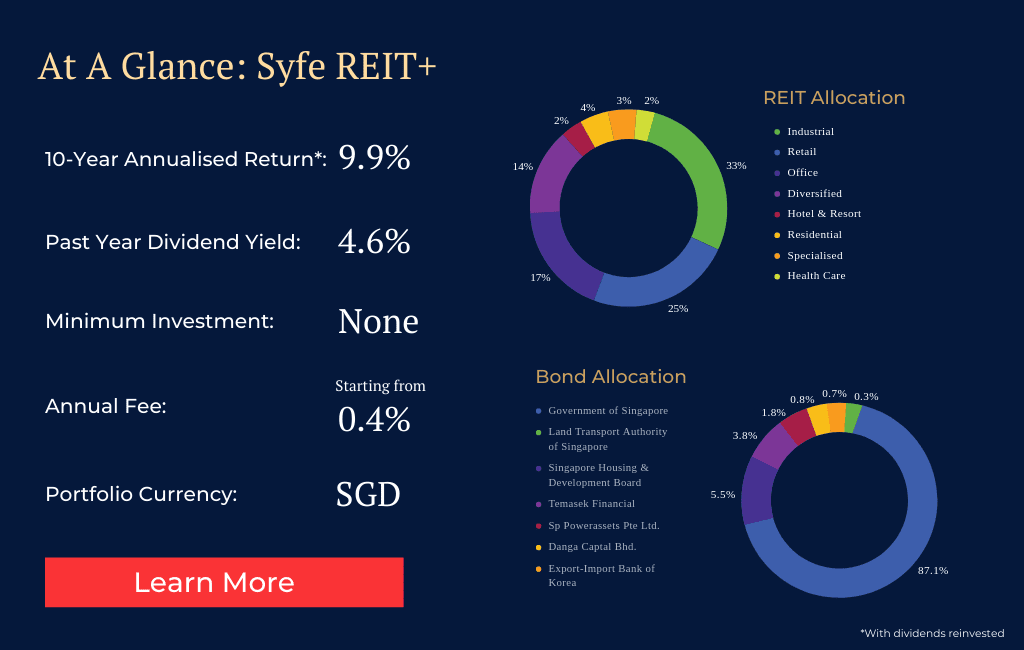

REIT+ is a robo-advisor product launched in partnership with the Singapore Exchange (SGX) that constructs an optimized portfolio of Singapore Real Estate Investment Trusts (REITs). Instead of directly replicating the iEdge S-REIT Leaders Index, REIT+ selects the top 20 REITs that meet specific criteria, such as being SGD-denominated, highly liquid, having strong market capitalization, and being managed by reputable teams. The exclusion of USD-denominated REITs, such as the Manulife US REIT (MUST SP), reduces currency risk and enhances portfolio performance.

The REIT+ investment team actively manages corporate actions, such as rights issues, to ensure the portfolio remains balanced and aligned with investors’ interests. Dividends from the REITs are automatically reinvested to maximize returns over time. Through periodic stock rebalancing, the portfolio adjusts individual REIT weightings based on market movements and corporate actions, ensuring the portfolio continues to track its optimization strategy.

As a robo-advisor, REIT+ automates portfolio management through algorithms, offering a low-cost, hands-off investment experience. Investors benefit from automated rebalancing and dividend reinvestment, providing an efficient way to gain diversified exposure to Singapore’s real estate market while maintaining liquidity and earning consistent income through dividends.

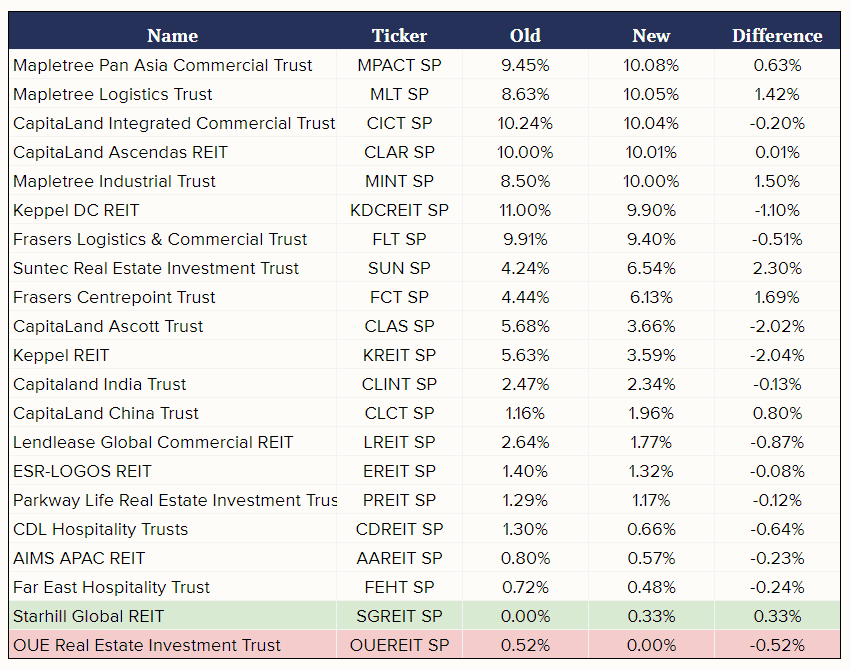

During the semi-annual rebalancing as of 24 September 2024 , OUE Real Estate Investment Trust (OUEREIT SP) was removed from the iEdge S-REIT Leaders Index due to its limited liquidity. As a result, OUE Real Estate Investment Trust was also excluded from the Syfe REIT+ portfolio. In its place, Starhill Global REIT (SGREIT SP) was added. The updated list of constituents and their respective allocations reflects these changes, following Syfe’s optimization process.

Syfe REIT+ Portfolio Composition

Syfe REIT+ includes 20 of Singapore’s most recognized REITs, such as Ascendas REIT, Mapletree Industrial Trust, CapitaLand Integrated Commercial Trust, Keppel DC REIT, and Frasers Centrepoint Trust.

How Syfe REIT+ Tracks the Index

While the iEdge S-REIT Leaders Index comprises 27 REITs, Syfe REIT+ is an optimized portfolio of 20 REITs, designed to balance market representation and trading liquidity, ensuring minimal tracking error and reduced trading costs.

Syfe uses a sophisticated optimization tool to construct its portfolio, achieving a tracking error of just 0.5% relative to the index. The portfolio is rebalanced twice a year to reflect changes in the index, ensuring that it remains aligned with market trends.

Corporate Actions and Dividend Reinvestment

One of the advantages of investing in Syfe REIT+ is that Syfe manages all corporate actions, such as rights issues, on your behalf. This means you don’t have to monitor and respond to individual corporate actions, saving you time and effort.

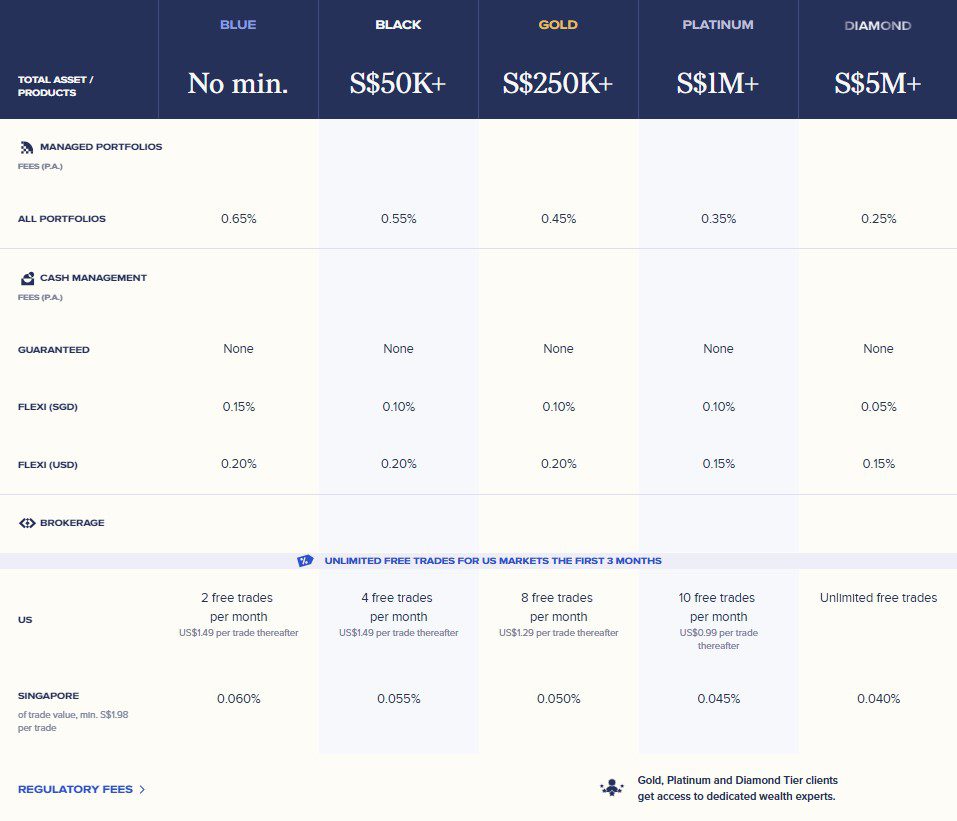

Dividends are automatically reinvested, potentially boosting your returns by an additional 0.5% annually. This can significantly offset Syfe’s tiered fees, ranging from 0.35% to 0.65% per year. For those in Syfe Black or higher tiers, there is also an option to receive dividends as quarterly payouts.

Risk Management with Syfe REIT+

Syfe REIT+ offers two investment options: a 100% REITs portfolio or a risk-managed portfolio that combines REITs with Singapore government bonds. The bond fund invests in AAA-rated government bonds, providing stability during market turbulence.

The risk-managed portfolio is ideal for investors who prefer lower volatility. During periods of increased market volatility, the portfolio’s proprietary algorithm reduces REIT exposure and increases bond allocation to protect against market downturns. However, to maintain a high dividend yield, the portfolio always retains a minimum 50% allocation to REITs.

Portfolio Performance

For investors with a higher risk tolerance and a long-term investment horizon, the 100% REITs portfolio offers higher potential returns, with an average annual return of 9.58% over the past decade.

On the other hand, the risk-managed option may suit those with a more conservative approach, offering lower volatility but slightly reduced long-term returns.

Why Invest in Syfe REIT+ Now?

Interest rates might be cut by 100-150 basis points by the end of 2024, which could boost S-REITs. Lower interest rates generally reduce borrowing costs and make REITs more appealing for income generation.

Currently, Singapore REITs are considered undervalued, with an average Price-to-NAV ratio of around 0.80. This undervaluation suggests there could be room for price growth as market conditions improve. Additionally, many S-REITs offer attractive distribution yields, which is important for income-focused investors.

Overall, the outlook for Singapore REITs in 2024 and 2025 is optimistic. Potential interest rate cuts, attractive yields, and growth in specific sectors all contribute to this positive view. However, investors should remain patient and keep an eye on changing market conditions.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.