UOBAM Invest is a hidden gem that not many people know about, and it is managed by the wholly owned subsidiary of UOB called UOB Asset Management. UOBAM Invest has been around for over 35 years, manages $32 billion worth of assets, and is one of the most awarded fund managers in Asia.

Furthermore, UOBAM Invest lets you start investing with as little as one dollar and charges a management fee between 0.6% to 0.8% per annum, depending on your investment amounts. UOBAM Invest is more accessible than other bank robot devices, such as DBS DG Portfolio and OCBC Global Invest, which require a minimum investment of at least $1,000 and $100 US dollars, respectively.

While UOBAM Invest’s management fee of 0.8% is slightly more expensive than DBS DG Portfolio’s 0.75% fee for investments of $25,000 and below, it is the cheapest management fee for investments over $25,000. Non-bank global advisors have a lower fee, but UOBAM Invest offers the investment expertise of an asset manager, the security and stability of a bank, and a personalized portfolio based on investment objectives, risk tolerance, and investment horizon. Another perk is that UOBAM Invest’s portfolio allocation adjusts based on personal preferences, and the Glide-Path solution adjusts the portfolio based on the investment horizon. Overall, we believe that UOBAM Invest is a unique and impressive option for investing.

About UOBAM Invest Digital Adviser

UOBAM Invest Digital Adviser is a robo-advisory service provided by UOB Asset Management. Here are some points to consider in a review of UOBAM Invest Digital Adviser:

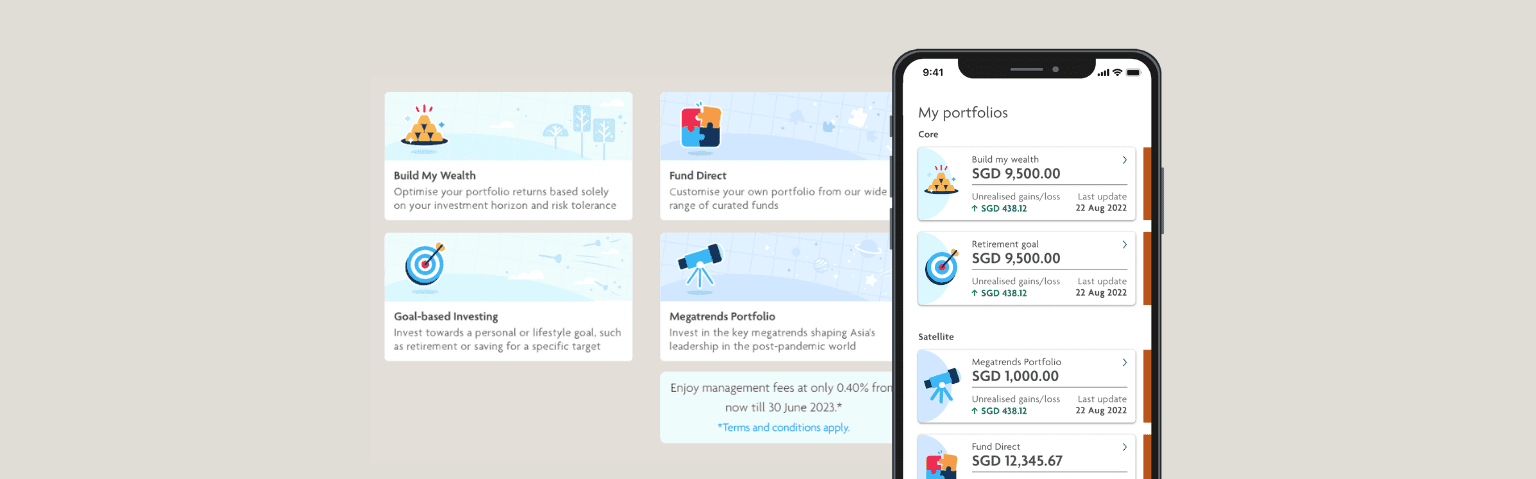

- User Experience: The UOBAM Invest Digital Adviser is designed to provide users with a simple and intuitive user experience. Users can easily sign up, answer a questionnaire to assess their risk profile and investment objectives, and get recommended investment portfolios that are tailored to their needs.

- Investment Methodology: UOBAM Invest Digital Adviser uses a data-driven investment methodology to construct portfolios. The portfolios are designed to be diversified across asset classes and geographies, and are regularly rebalanced to maintain optimal risk-adjusted returns.

- Investment Products: UOBAM Invest Digital Adviser offers a range of investment products, including ETFs and mutual funds, which are used to construct the recommended portfolios. The investment products are selected based on their quality, liquidity, and cost-effectiveness.’

- Fees: The fees charged by UOBAM Invest Digital Adviser are generally competitive within the robo-advisory industry, with an annual management fee ranging from 0.65% to 1.5% (Enjoy absolute zero fees* + no lock-up with the United SGD Money Market Fund) depending on the portfolio size.

- Performance: The performance of UOBAM Invest Digital Adviser portfolios has been generally positive since its launch, with returns that are in line with or slightly above market benchmarks. However, past performance is not a guarantee of future results.

Overall, UOBAM Invest Digital Adviser is a user-friendly robo-advisory service that provides users with a data-driven investment methodology and a range of investment products. Its competitive fees and positive performance make it an attractive option for investors who are looking for a simple and low-cost way to invest. As with any investment, it is important to do your own research and consult with a financial advisor before making any decisions.

Current Promotions

- Enjoy absolute zero fees* + no lock-up with the United SGD Money Market Fund

- From 1 January 2023, the first 3,000 users to sign up for UOBAM Invest will receive S$10 credit when the account is approved.

- Use our promotion link and receive S$25 credit when you open an account and invest a minimum of S$500 with UOBAM Invest.

Visit https://uobaminvest.page.link/e67o

Available Funds

The Fund Direct feature offered by UOBAM Invest app enables intermediate investors to directly purchase and sell selected unit trusts of their choice without any investment advice.

United SGD Money Market Fund

Aimed at providing a return that is comparable to that of Singapore dollar short-term deposits, the United SGD Money Market Fund invests in liquid and high-quality short-term debt securities and money market instruments.

United SGD Fund

Step up your investments with our flagship fixed-income fund that aims to deliver stable and regular returns.

United APAC Real Estate Income Fund

Build stable income with Singapore’s first Asia Pacific REIT fund. A portfolio of selected Asia Pacific real estate assets that aims to deliver stable returns and income.

United China A-Shares Innovation Fund

Aims to achieve long-term capital appreciation by investing primarily into China-listed companies that are likely to benefit from technology, innovation and other growth trends.

United Global Healthcare Fund

Achieve long term capital growth by investing in securities issued by companies principally involved in the development, production or distribution of products, equipment and/or services related to healthcare in any part of the world.

United Sustainable Asia Top-50 Fund

Achieve long-term capital appreciation by investing in 50 in total, of the top corporations incorporated in, or whose principal operations are in, Asia including Japan. These companies are selected following the Fund’s investment focus on Environment, Social and Governance (ESG) factors using UOBAM’s proprietary ESG selection process.

United Japan Small And Mid Cap Fund

Aims to achieve long term capital growth through investing in securities of small and medium capitalisation corporations listed, domiciled, or having substantial operations, in Japan.

United Global Growth Fund

The Fund invests mainly in shares in global developed and emerging markets, identified for having good prospects for growth.

United Smart Sustainable Singapore Bond Fund

Invest in a sustainable future in the first Singapore-focused ESG fund that tracks and measures the ESG impact of its investments, while providing stable income and capital appreciation.

United Gold and General Fund

Achieve returns on investment mainly in securities of corporations whose business is in the mining or extraction of gold, silver, or precious metals, bulk commodities, base metals of all kinds, and other commodities.

Behind UOBAM Invest Digital Adviser

UOB Asset Management is the asset management arm of United Overseas Bank, one of the largest banks in Southeast Asia. Here are some points to consider in a review of UOB Asset Management:

- Investment Products: UOB Asset Management offers a range of investment products, including mutual funds, exchange-traded funds (ETFs), and institutional mandates. These products cover different asset classes such as equities, fixed income, and alternative investments.

- Investment Philosophy: UOB Asset Management’s investment philosophy emphasizes on active management and a long-term investment approach. They believe in conducting rigorous research and analysis to identify quality companies with strong fundamentals and growth potential.

- Performance: The performance of UOB Asset Management’s investment products has been mixed, with some products outperforming their benchmarks while others have underperformed. It is important to note that past performance is not a guarantee of future results.

- Fees: The fees charged by UOB Asset Management are generally competitive within the industry, with expense ratios ranging from 0.4% to 1.5% for their mutual funds.

- Reputation: UOB Asset Management has a good reputation in the industry, with a strong presence in Southeast Asia. They have won several awards for their investment products and services.

Overall, UOB Asset Management is a reputable asset management company with a range of investment products and a focus on active management and long-term investing. As with any investment, it is important to do your own research and consult with a financial advisor before making any decisions.

Pros and Cons of using Robo-Advisory Services in your investment portfolio

Here are some potential pros and cons of using a robo-advisory service for your investment:

Pros:

- Low Cost: Robo-advisory services generally have lower fees than traditional investment advisors, making them a cost-effective option for those who are looking to invest with lower amounts.

- Convenience: Robo-advisors are accessible 24/7 through digital platforms, allowing investors to manage their portfolios at their own pace and on their own time.

- Customization: Robo-advisory services offer automated, data-driven algorithms that provide investment portfolios customized to an individual’s risk tolerance and investment goals.

- Transparency: Robo-advisors use technology to automate the investment process, which provides greater transparency than traditional investment advisors. This means investors can see their investment portfolio and the fees charged to them at all times.

- Diversification: Robo-advisors can offer a diversified portfolio to investors by investing in a broad range of asset classes and securities.

Cons:

- Limited Human Interaction: Robo-advisors lack human interaction, which can be disadvantageous for investors who prefer to discuss their investments and financial planning with a human advisor.

- Lack of Flexibility: Robo-advisors have predefined portfolios that do not cater to individual preferences or needs. This can be a limitation for investors who want more flexibility in their investment strategies.

- Lack of Personalization: Although robo-advisors offer customization, the algorithmic investment strategy used by these services may not always take into account individual circumstances or external factors that could impact investment decisions.

- Risk: Although robo-advisors are designed to minimize risk by using diversification, there is still the potential for losses in volatile markets.

- Technology Reliance: Robo-advisors rely on technology, which can be a disadvantage if there are any technical issues or malfunctions in the system.

Overall, the pros and cons of using a robo-advisory service for your investment will depend on your individual preferences, investment goals, and risk tolerance. It is important to consider the advantages and disadvantages of robo-advisory services before deciding if it is the right option for you. Follow this link to access a detailed review of other popular robo-advisors in Singapore, which covers platforms like Stashaway, Endowus, and Syfe.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.