MoneyOwl announced on August 31, 2023, regarding the decision to wind down its financial advisory operations. As part of this decision, MoneyOwl will transfer its investment insurance and insurance services to iFAST Financial Pte Ltd (“iFAST”) and cease all commercial activities by December 31, 2023. This strategic move follows a joint review with its shareholder, NTUC Enterprise, which determined that the business was not commercially viable.

MoneyOwl is pleased to inform you that Temasek Trust has expressed interest in acquiring MoneyOwl (“proposed acquisition”). Under Temasek Trust, MoneyOwl’s capabilities, intellectual properties, and technology platforms will be repurposed to support the financial well-being of community groups such as essential workers, gig workers, and youths.

Under Temasek Trust’s ownership, MoneyOwl will shift its focus away from direct retail sales of commercial insurance and investments. Instead, it will concentrate on developing targeted financial planning solutions in collaboration with like-minded partners and delivering programs through companies and unions.

MoneyOwl is an NTUC social enterprise that is licensed by the Monetary Authority of Singapore as a fund management company that offers a robo-advisory platform to its clients. The platform is designed to provide personalized investment advice and portfolio management using algorithms and technology. In this essay, we will discuss the key features of MoneyOwl’s robo-advisory platform and how it works.

MoneyOwl’s robo-advisory platform is designed to help investors build diversified investment portfolios that align with their goals, risk tolerance, and time horizon. The platform uses a proprietary algorithm to create customized portfolios that are optimized for each client’s individual needs. The algorithm takes into account a wide range of factors, including the client’s investment goals, risk appetite, and current financial situation. It also considers the current market conditions and economic outlook to ensure that the portfolio is optimized for the current market environment. MoneyOwl strives to make investing accessible to novice investors by keeping their barriers to entry low. The Dimensional portfolio requires a minimum one-time lump sum investment amount of just $100, while the minimum monthly investment amount is only $50 for those who prefer regular investments. If you’re considering investing in MoneyOwl’s WiseIncome portfolios, the minimum one-time lump sum investment is $1,000, or you can opt for a monthly investment of $100.

MoneyOwl deviates from the traditional robo-advisor model in that it offers the option to receive guidance from a human advisor while investing on its platform. Although like robo advisors, MoneyOwl provides an automated investment platform where users can set their portfolio based on their risk profile, and the platform manages their investment automatically. The unique value-added service of MoneyOwl is the availability of a human advisor to provide investment advice and clarify any uncertainties without charging a commission fee. One key difference between MoneyOwl and other prominent robo advisors is that MoneyOwl invests in funds offered by Dimensional Fund Advisors, rather than ETFs.

One of the key benefits of MoneyOwl’s robo-advisory platform is its low cost. The platform uses exchange-traded funds (ETFs) to build portfolios, which are low-cost investment products that offer exposure to a wide range of asset classes. By using ETFs, MoneyOwl is able to keep costs low while still providing clients with access to diversified investment portfolios.

Another important feature of MoneyOwl’s robo-advisory platform is its simplicity and ease of use. Clients can sign up for the platform online and answer a few simple questions to create their investment profile. The platform then uses this information to create a customized investment portfolio that is aligned with the client’s goals and risk tolerance. Once the portfolio is created, clients can monitor their investments and make changes as needed using the platform’s user-friendly interface.

MoneyOwl’s robo-advisory platform also offers a high level of transparency and control to clients. Clients can view their investment portfolio and performance data in real-time using the platform’s dashboard. They can also adjust their investment allocations and risk level as needed, giving them control over their investment strategy. Additionally, the platform provides detailed information about the ETFs that are included in the portfolio, including their performance history and underlying holdings.

Another key benefit of MoneyOwl’s robo-advisory platform is the level of support and advice that clients receive. With a combination of technology and human support provides clients with the best of both worlds, allowing them to benefit from the efficiency of automated investment management while still having access to personalized advice and support.

MoneyOwl Promotions

- Free $20 worth of WiseSaver units when you open a WiseSaver account

- Receive up to $60 Grab vouchers when you sign up using this link

MoneyOwl Features

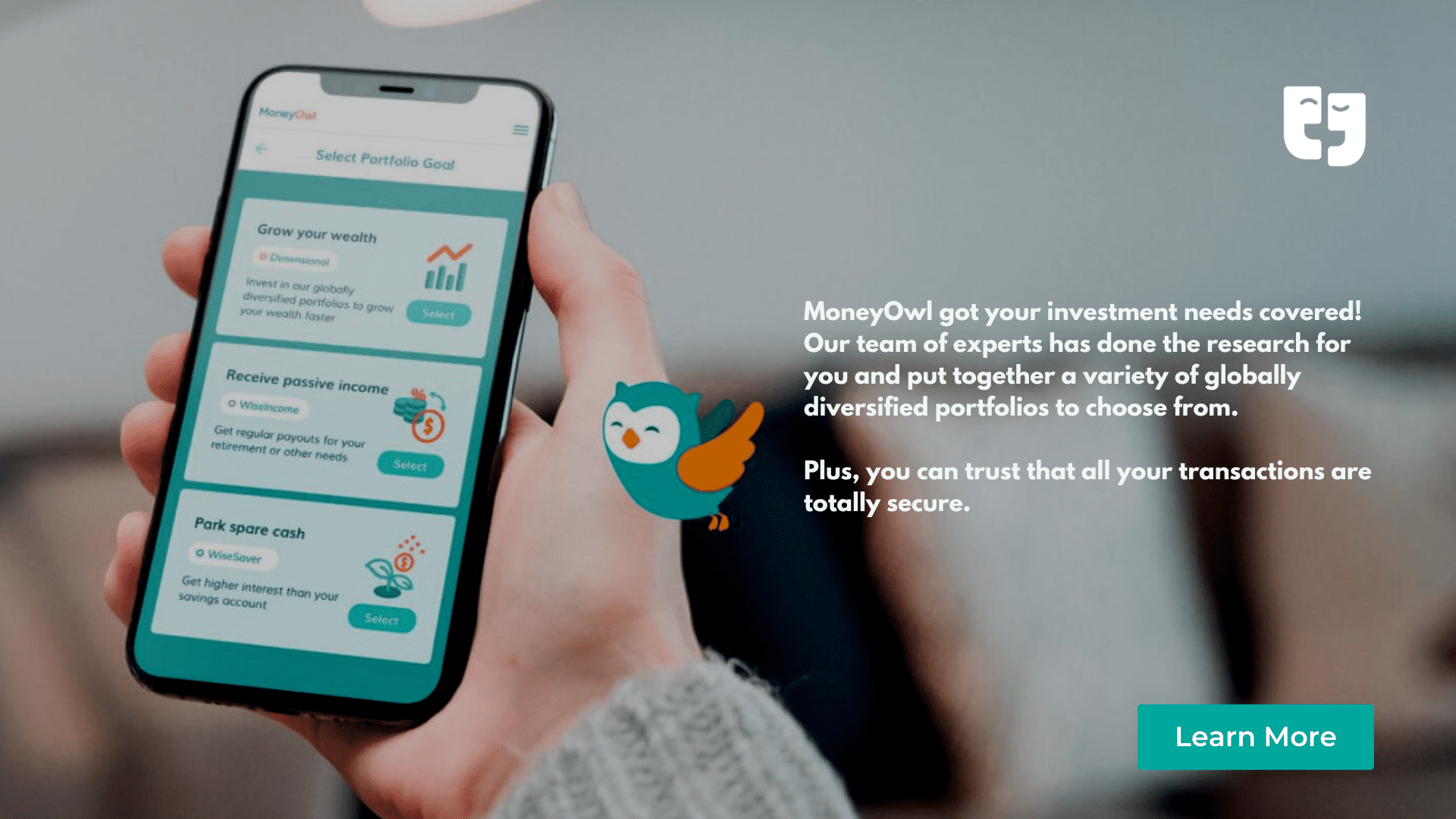

MoneyOwl offers three different account options: Dimensional, WiseSaver, and WiseIncome with your Cash, CPF, and SRS Account. Here’s how they differ:

- MoneyOwl Dimensional: This account is an investment account that uses a passive investment strategy. It invests in globally diversified low-cost index funds from Dimensional Fund Advisors (DFA). It is suitable for individuals who are looking for long-term investment growth and are willing to accept higher levels of risk.

- MoneyOwl WiseSaver: This account is a savings account that offers a high-interest rate of up to 1.8% p.a. It is suitable for individuals who are looking to save money in a low-risk account with no restrictions.

- MoneyOwl WiseIncome: This account is an investment account that focuses on generating regular income through a diversified portfolio of fixed-income securities. It is suitable for individuals who are looking for a steady stream of income and are willing to accept moderate levels of risk.

In summary, MoneyOwl’s robo-advisory platform is a low-cost, user-friendly, and transparent investment solution that is designed to help clients achieve their financial goals. With its customized portfolios, diversified investment options, and high level of support, the platform is an attractive option for investors who are looking for a hassle-free and cost-effective way to manage their investments.

MoneyOwl Wisesaver Account Review

MoneyOwl’s WiseSaver account is designed to help individuals save money by offering a higher interest rate than traditional savings accounts.

The WiseSaver account is a cash management account that provides access to several features, such as a high-interest rate, no lock-in period, no initial deposit, no minimum balance, and no withdrawal fees, review of MoneyOwl’s WiseSaver and WiseIncome Dimensional Fund?ideal for individuals who want to save money and earn a higher interest rate without any restrictions. It is a low-risk savings option that is easy to use and offers peace of mind. However, it’s important to note that the interest rates offered by MoneyOwl may change from time to time based on market conditions. (5-day moving average at 3.89% p.a as of 14 April 2023).

About the MoneyOwl Platform

UI/UX-wise, the MoneyOwl platform is relatively user-friendly. However, certain tasks such as creating a new portfolio require more clicks and time than necessary, which can make experimenting with the system somewhat tedious. For instance, starting from the home page, it takes 22 clicks on MoneyOwl to create a sample flagship portfolio and see the recommended asset allocation, compared to 12 clicks on Endowus and a mere 5 clicks on StashAway.

Signing up for MoneyOwl is a breeze for Singapore Citizens and PRs, thanks to Singpass. Your account is fully functional within minutes, and there’s no paperwork required. However, MoneyOwl’s primary focus appears to be on financial planning. After signing up, you must complete a lengthy assessment covering your family, finances, aspirations, and risk appetite before you can invest in any ready-made portfolios. This can be frustrating if you’re not interested in financial planning, particularly since you must answer some of these questions every time you create a new portfolio. If you do wish to obtain a comprehensive financial planning report at the end of the assessment, it costs S$99.

Funding your account is a straightforward process via PayNow (SGD only) or Bank Transfer. PayNow transfers are particularly convenient, thanks to the QR code provided. MoneyOwl typically acknowledges the receipt of funds the following day, although it may take 3-4 days to complete the investment.

To invest in any of the portfolios, simply click on the portfolio tab, and the system will guide you through the investment process. For the Dimensional product, this entails answering risk assessment questions and a few additional questions before viewing the recommended portfolio. If you wish to invest in another portfolio, you’ll need to start the process all over again, answering all the questions. Unfortunately, we couldn’t find a way to quickly modify the risk profile and the recommended portfolio.

About MoneyOwl

MoneyOwl is a financial advisory company based in Singapore that was launched in 2018. The company is a joint venture between NTUC Enterprise, the holding company of the National Trades Union Congress, and Providend, a fee-only financial advisory firm. MoneyOwl provides a range of financial planning services, including investment advice, insurance recommendations, and will writing. The company aims to make financial planning accessible and affordable for all Singaporeans, with a focus on providing transparent, ethical, and personalized advice.

One of the key features of MoneyOwl is its fee-only model. Unlike many financial advisory firms, MoneyOwl charges a flat fee for its services rather than earning commissions from financial products. This means that the company has no incentive to recommend certain products over others, and clients can be assured that the advice they receive is impartial and in their best interest. By removing conflicts of interest, MoneyOwl is able to provide transparent and ethical financial advice to its clients.

Another important aspect of MoneyOwl’s approach is its focus on financial planning rather than just investing. While investing is an important part of building wealth, it is only one piece of the puzzle. MoneyOwl recognizes that financial planning involves a holistic approach that takes into account an individual’s unique circumstances, goals, and risk tolerance. The company’s financial advisors work with clients to create a comprehensive financial plan that includes investing, insurance, retirement planning, and estate planning. By taking a long-term view and considering all aspects of a client’s financial situation, MoneyOwl helps clients achieve their financial goals and minimize their financial risks.

In addition to its financial planning and robo-advisory services, MoneyOwl also offers insurance recommendations and will writing services. The company’s insurance recommendations are based on a client’s needs and risk profile, rather than on commissions or sales targets. MoneyOwl’s will writing service is also designed to be accessible and affordable, with fixed fees and an online platform that makes it easy for clients to create a will.

Overall, MoneyOwl’s approach to financial planning is unique in the Singaporean market. By focusing on transparency, ethical advice, and comprehensive financial planning, the company is able to provide a valuable service to its clients. With its fee-only model and robo-advisory platform, MoneyOwl is also able to make financial planning more accessible and affordable for all Singaporeans. As the company continues to grow, it has the potential to become a leading player in the Singaporean financial advisory market. Follow this link to access a detailed review of other popular robo-advisors in Singapore, which covers platforms like Stashaway, Endowus, and Syfe.

Disclaimer

Every effort has been made to ensure the accuracy of the information provided, but no liability will be accepted for any loss or inconvenience caused by errors or omissions. The information and opinions presented are offered in good faith and based on sources considered reliable; however, no guarantees are made regarding their accuracy, completeness, or correctness. The author and publisher bear no responsibility for any losses or expenses arising from investment decisions made by the reader.