Exploring a Rewarding Career Path

Articles on becoming a Financial Advisor in Singapore

Welcome to the world of financial advising in Singapore, where opportunities abound for those seeking a dynamic and fulfilling career. In this article, we’ll delve into the exciting journey of becoming a financial advisor in one of Asia’s financial hubs. From the necessary qualifications to the skills you’ll need and the potential rewards that await, let’s embark on a comprehensive exploration of this promising career path.

Basic Financial Planning Guide in Singapore

One of the cornerstone principles in your financial journey is to establish a robust safety net, and this begins with the creation of an ...

Top 5 Must-Have Insurance Policies for Your Financial Security

You’ve likely encountered the familiar refrain: purchasing insurance is an act of responsibility, and so on. However, despite the general awareness of the need ...

The Challenges Facing Financial Advisors Today

Technology is becoming a big part of the financial advisory business. Financial planners are adopting technology to improve the ways they serve their clients. ...

Prospecting as a Financial Advisor in Singapore

The career of a financial advisor is not as easy as it looks, it is quite a competitive environment. In Singapore alone, the financial ...

The Importance of Persistency and Production for Insurance Agents

Persistency and production are two crucial aspects for insurance agents as they significantly impact their success and long-term career prospects. Let’s explore why these ...

Achieving your Financial Goals

Nobody can fully predict the future, as anything can happen. However, let’s not allow that to discourage us from making wise decisions today. These ...

Choosing a Career as an Insurance Agent: Empowering Entrepreneurship, Financial Management and Sales Skills

Graduation marks a significant milestone in one’s life, often accompanied by a sense of excitement and the anticipation of embarking on a fulfilling career. ...

Christian jobs in Singapore

Singapore is a vibrant and diverse city-state that is home to many different religions, including Christianity. There are a variety of jobs in Christian ...

Review of POEMS Trading App

POEMS, or Phillip’s Online Electronic Mart System, is a prominent investment platform in Singapore. Established in the 1980s, it initially gained recognition as a ...

Dividing CPF-Related Assets in a Divorce: Understanding the Key Proceedings and Information

In a divorce, the court has the power to divide matrimonial assets between the divorcing parties in proportions that it thinks are just and ...

Decline in Insurance Agent Numbers in Singapore Since 2015

In response to a parliamentary question from Patrick Tay Teck Guan of Pioneer SMC, Deputy Prime Minister and Minister for Finance, Lawrence Wong, revealed ...

Climbing the Corporate Hierarchy

In the bustling world of work, rising through the ranks is often hailed as a grand accomplishment, a testament to one’s dedication and skill. ...

What Does it Mean to Achieve Financial Freedom

Achieving financial freedom is a goal that many aspire to, but what does it truly mean to attain this state of financial independence? At ...

The Concept of Compounding Interest in Financial Planning

The concept of compounding interest is a fundamental principle in finance that has the power to turn small investments into significant sums of money ...

Navigating Social Media Etiquette for Financial Advisors

In today’s interconnected world, social media is a powerful tool for financial advisors to connect, engage, and build their personal brand. However, like any ...

Persistency in Insurance: The Key to Long-Term Stability and Success

In the insurance industry, persistency is a crucial factor that plays a significant role in the long-term stability and success of insurance companies. It ...

Essential Insurance Coverage Every Singaporean Should Have

Insurance is a vital aspect of financial planning, but many individuals are unsure about the specific type and amount of coverage they require. It ...

Financial Strategies for Parents with Young Children

Raising children is undoubtedly a fulfilling journey, but it often comes with financial challenges, particularly in a world where the cost of living continues ...

The Challenges of Joblessness in Singapore

In recent times, Singapore has witnessed an influx of individuals in their mid-40s to 50s seeking alternative career paths, particularly as financial advisors. These ...

More Mature Candidates Shifting Careers to Part-Time Financial Advisory

We’ve noticed growing trend in Singapore. People aged 45 and older who already earn over 8000 SGD a month are increasingly becoming part-time financial ...

Are you too Young to be a Financial Advisor?

There has never been a better time to be a financial advisor. If you’re just starting your career, you have a clean slate with ...

Why I Quit being a Financial Advisor in Singapore

As of 2022, there were 26,388 insurance agents registered with the Monetary Authority of Singapore (MAS). This number has been declining in recent years, ...

Building Wealth with Charlie Munger’s First $100K Strategy

In the realm of wealth creation, the voice of Charlie Munger reverberates with unparalleled resonance. As an esteemed investor and the trusted partner of ...

Can Permanent Residents (PRs) Become Financial Advisors in Singapore?

The Singaporean insurance industry presents a dynamic and promising career path, open to both citizens and Permanent Residents (PRs). PRs are warmly welcomed to ...

On Using Insurance for Wealth Accumulation

When I embarked on my journey as a financial adviser at an insurance company many years ago, I was filled with optimism and enthusiasm, ...

Chinese New Year Greeting Messages in the Year of the Dragon for Financial Advisors

With the awesome Year of the Dragon kicking in, financial advisors in Singapore have this golden chance to really connect with their clients and ...

On Selling Insurance From Home Part-Time

SeIIing insurance from home part-time is great way to earn extra income and gain vaIuabIe experience in the insurance industry. Whether you’re a stay-at-home ...

为什么马来西亚人适合在新加坡成为成功的财务顾问

反思我在新加坡的十年,我意识到我本可以更好地管理我的财务。如果我早些寻求专业的财务建议,我可能会做出更明智的理财决策。

Building a Passive Income Portfolio for your Retirement

Many people in Singapore are realizing that retiring can be very expensive. This is because the cost of living goes up over time, and ...

What is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where an investor regularly invests a fixed amount of money into a particular security or portfolio, regardless of ...

The Retirement Gamble in Singapore

Retirement planning is a complex game of financial chess, and in the unique context of Singapore, it presents an even more intricate challenge. As ...

The Variety of Financial Products Financial Advisors Can Recommend in Singapore

In the dynamic and diverse financial landscape of Singapore, financial advisors have a broad array of financial products at their disposal to meet the ...

PRUFirst Promise: Comprehensive Maternity Insurance in Singapore

Before the baby is born, maternity insurance emerges as a key insurance option available. It aims to provide financial protection against risks such as ...

How to maintain a full-time job while still taking care of your family responsibilities

You have a great job, a nice house, and two beautiful kids. But it feels like you could do better. You’re tired of always ...

Stock Prices Take Another Dip: What’s the Significance?

So, you’ve probably noticed that stock prices are on the decline again. The S&P 500 is down by about 3.5% from its recent high, ...

On Getting a Career Coach in Singapore

In today’s competitive job market, it can be challenging to navigate the many career options available, especially in Singapore, where industries are rapidly changing ...

Unlocking the Power of Investment-Linked Insurance Policies (ILPs)

Investment-linked insurance Plans (ILPs) serve as powerful tools for wealth accumulation, yet their intricacies can be challenging to grasp, particularly due to their extensive ...

Insurance Commission Rebate Legalisation in Singapore

In 2002, the Monetary Authority of Singapore (MAS) made a pivotal decision to lift the ban on rebating commissions, signaling a significant shift in ...

Building a Solid Emergency Fund: How Much is Enough?

Life is full of uncertainties, and unexpected financial challenges can arise at any moment. To safeguard ourselves against such uncertainties, it is crucial to ...

Navigating Your Investment Portfolio Through Your 20s, 30s, and 40s

So, as we get older, our skin, body, and health aren’t the only things that change – our money situation evolves too. With the ...

Role of a Life Insurance Agent in Singapore

A life insurance agent plays a crucial role in Singapore’s insurance industry. They act as intermediaries between insurance companies and individuals or organizations that ...

Selling Insurance to High-Networth Individuals in Singapore

In Singapore, where financial prosperity often mirrors economic vitality, the High Net Worth (HNW) category is defined by a blend of income and asset-based ...

Insurance Scams in Singapore

Insurance scams in Singapore have been a concerning issue over the years, requiring vigilant awareness and preventive measures. These scams often target unsuspecting individuals, ...

John Bogle’s Guide to Investing

John Bogle, the influential founder of The Vanguard Group, revolutionized the investment world with his advocacy for low-cost index investing and dedication to individual ...

Young Professionals in Singapore Covering Health, Life, and Income Protection

For all you young guns charting your career course, securing your financial future is a must, and having the right insurance policies is your ...

Allianz to Acquire Majority Stake in Singapore’s Income Insurance

Allianz Europe B.V. announced on Wednesday, July 17, that it plans to acquire a majority stake in Singapore’s Income Insurance for approximately US$1.6 billion. ...

Taking a look at Online Brokers in Singapore: Moomoo, Interactive Brokers, Tiger Brokers, Webull, Syfes Trade

Keeping up with changes in brokerage services is vital for investors looking to improve their trading experience. Recent months have seen significant developments like ...

LIA Critical Illness Framework

The LIA Critical Illness (CI) Framework serves as a cornerstone for ensuring consistency and clarity in critical illness coverage across the insurance industry. By ...

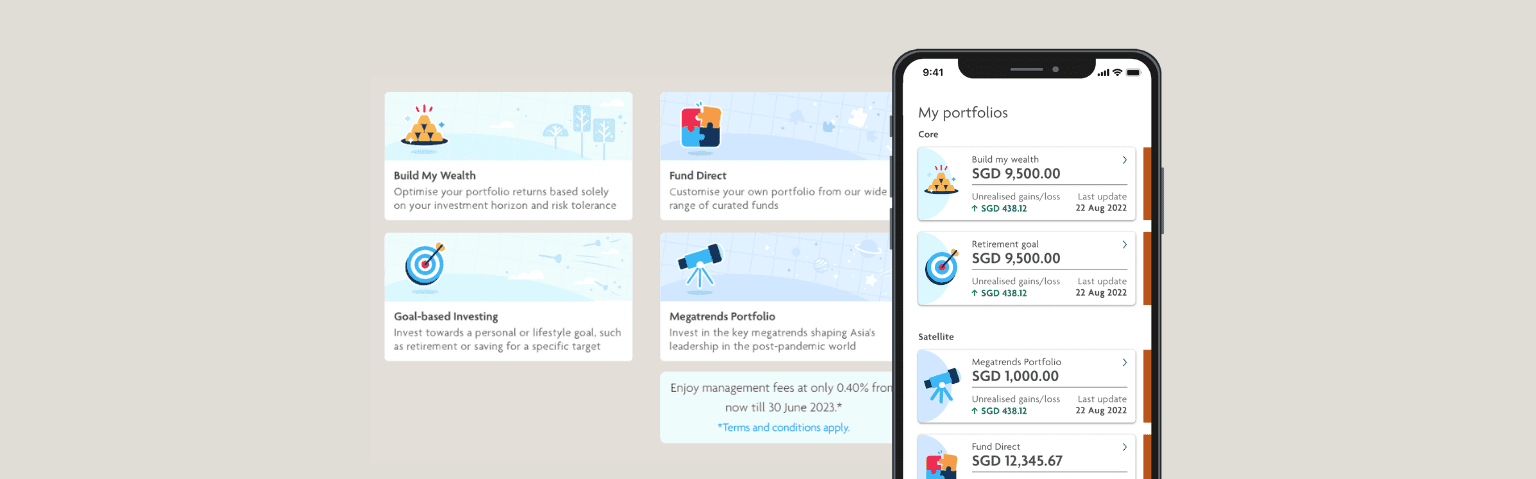

Best Robo-Advisors in Singapore – A Comparison Between Stashaway, Syfe and Endowus

Entering the world of investing can feeI overwhelming, especiaIIy if you’re just starting out or want something more automated. In a place Iike Singapore, ...

How to check if the decreased have life insurance in Singapore

I understand that dealing with the aftermath of a loved one’s passing can be overwhelming, and managing their life insurance policy may be the ...

I’ll Probably Die of Cancer Before Retirement – And That’s OK

Life is a journey, an unpredictable voyage filled with twists and turns, highs and lows. Along this path, we encounter moments of joy, sorrow, ...

Need Help Transitioning your Career as a Financial Advisor?

Transitioning to a career in financial advisory can indeed be a fulfilling journey, opening doors to positively influence individuals’ financial well-being and futures. However, ...

Sun Life Asia Financial Resilience Index

The Sun Life Asia Financial Resilience Index casts a spotlight on Singapore, among other key Asian markets, to gauge household financial resilience across various ...

The Importance of Savings

Saving money is a fundamental aspect of personal finance that holds immense importance in one’s financial journey. Whether it’s for short-term goals, long-term aspirations, ...

Exploring General Insurance to Enhance Life Insurance

In the dynamic landscape of insurance, the integration of various policies is becoming increasingly essential to provide comprehensive coverage and meet the evolving needs ...

A look at the World Today

A momentous event has recently unfolded in Russia, marked by a mutiny orchestrated by the head of the Wagoner Group. Their troops have marched ...

Joining the Best Financial Advisory for a Bright Career

Embarking on a career in financial advisory is a significant decision that demands careful consideration and thorough research. The choice between joining a traditional ...

Career Path of a Financial Advisor in Singapore

In the financial advisory industry, some are content with just staying at a producer level – to constantly hunt for new clients. These people ...

Accelerating your Career as a Financial Advisor

Embarking on a career as a financial advisor is akin to navigating an intricate landscape, filled with challenges and opportunities. Much like any expedition, ...

A Look at Synergy Financial Advisers

In today’s fast-paced business world, where digital changes are reshaping industries like never before, companies that embrace innovation and early adaptation often gain significant ...

A look at ARK Invest and ARK ETF

ARK Invest is an investment management firm founded by Cathie Wood in 2014. It has gained significant attention and popularity for its focus on ...

What it means to achieve MDRT as a Financial Advisor

The Million Dollar Round Table (MDRT) is an international group known for ceIebrating the best in the life insurance and financial advising fieIds. In ...

Duties of a Financial Advisor in Singapore

The role and responsibilities of a financial advisor within an insurance company in Singapore may exhibit some degree of variation, contingent upon the specific ...

6 Smart Ways to Clear Your Debts Fast

Debt can be an overwhelming burden, causing stress and anxiety. Often, in a desperate attempt to eliminate debts, we make unwise financial choices that ...

Protecting yourself as a Freelancer with Insurance

The Singaporean government is taking proactive steps to bolster support for gig workers, including taxi drivers and delivery personnel, through a series of policy ...

Staying Motivated in the Insurance Industry

Many insurance agents and agencies share a common challenge, struggling to find ways to keep motivated. An insurance agent that is motivated will willingly ...

Probably the Best Part-Time Job in Singapore

Working from home has become increasingly popular, driven by factors such as the ongoing pandemic, a desire for better work-life balance, and the need ...

Oh I HATE my Job

As I sit here in my cubicle, I can’t help but think about how much I hate my job. It’s not just the work ...

How much do we need to Retire in Singapore

In this article, we are going to discuss how much money is needed for retirement. Many people are concerned about their retirement savings and ...

Building up your Emergency Fund

If you faced an emergency and needed to cover an unexpected bill, would you be prepared? Shockingly, nearly half of Singaporeans find themselves unprepared, ...

The Long-term Perspective of Cash vs. Investment

Hello there, I’m Myron, your friendly neighborhood financial planner, and today we’re going to dive into a common dilemma: should you stash your money ...

The Importance of Legacy Planning

Retirement planning is a popular concept in Singapore when we talk about financial planning and focuses on ensuring that you have enough financial resources ...

Being a Property Agent in Singapore

Opting for a career as a property agent is a tempting choice for many, as it offers both flexibility and the potential for substantial ...

What is an Independent Financial Advisor (IFA)

In Singapore, there are approximately 20,000 financial advisors, from traditional tied agency, hybrid agencies and independent financial advisory with some focusing on promoting investment-linked ...

My Journey of Starting Over at 40

As I stood on the threshold of my 40th birthday, I found myself engulfed in a whirlwind of emotions. There was a sense of ...

Finding Harmony Between Hunting and Farming in Insurance Sales

In the dynamic world of insurance, success often hinges on mastering the nuanced roles of “hunter” and “farmer” in sales and client management strategies. ...

On Deceptive Investment Opportunities and the Illusion of High Returns

In today’s interconnected world, the digital landscape has become a breeding ground for a myriad of investment opportunities, often presented through the lens of ...

On Selling Your Endowment Plan

Endowment plans are a type of insurance policy designed to help people save money over the long term. They are commonly referred to as ...

Celebrate Singapore’s 58th National Day with Moomoo

Join InsuranceJobs and Moomoo in commemorating Singapore’s 58th National Day with exciting offers that you won’t want to miss. Take advantage of these limited-time ...

Exploring Financial Advisory Careers in Singapore

The financiaI advisory sector in Singapore has transformed into a vibrant and Iucrative fieId, attracting individuaIs aspiring to build fuIfiIling careers in finance. Amidst ...

Filing Income Tax as Financial Advisors in Singapore

Six insurance agents in Singapore have been found guilty of tax evasion. The court determined that they had submitted false business expenses to collectively ...

Handling Objections in Selling Life Insurance

Embarking on a career in life insurance sales can be both rewarding and challenging. One of the most common hurdles faced by agents is ...

Essential Insurance Plans for Families

In the bustling and vibrant nation of Singapore, family is undeniably at the core of our lives. The well-being of our loved ones takes ...

Exploring Salaries in Singapore: What You Need to Know

Alright, buckle up as we venture into the fascinating world of money and salaries in Singapore. No time for lengthy introductions – let’s get ...

The Potential of Sales as a Lucrative Career

While it’s important to note that not everyone in sales achieves high-income levels, if you’re aiming to quickly build your wealth and lack strong ...

The Importance of Critical Illness Insurance in Singapore

A new report reveals that one in four Singaporeans lack critical illness (CI) coverage, despite efforts to narrow the protection gap. Price sensitivity and ...

Are Singapore’s Financial Advisors More Sales-driven than Advisory?

In Singapore’s dynamic financial landscape, individuals seek guidance from professionals to navigate the complexities of financial planning and wealth management. However, a pervasive concern ...

Simple Math for Retirement Planning

Retirement, my friend, is no cakewalk. It’s that phase where finding a job becomes more arduous, and you worry about your hard-earned savings taking ...

Dressing for Success as a Financial Advisor

In the dynamic world of finance, the saying “dress for success” holds a deeper significance for financial advisors. Beyond being just a superficial guideline, ...

Insurance jobs in Singapore

Singapore’s insurance and financial sector is a significant contributor to the country’s economy, employing a large number of professionals and providing various financial services ...

What to consider before taking on a policy loan on your policy

Whenu are in need of quick cash, taking a loan on your life insurance policy can be a good option. It can give you ...

What are the Qualities Needed to be a Good Insurance Agent?

The financial planning industry has boomed in recent years, making it one of the most profitable careers in the world. Insurance is a fascinating ...

Financial Advisors Act in Singapore and Regulations for Financial advisors

Singapore has a well-developed financial sector, and with the increasing complexity of the financial market, there is a growing need for financial advisors. However, ...

Warren Buffett’s Advice: 12 Expenses to Cut for Wealth Accumulation

Ever find yourself scratching your head, wondering where all that hard-earned cash of yours is disappearing to? Well, that’s a telltale sign that your ...

What Insurance do I Need in Singapore?

Insurance is a fundamental aspect of financial planning that provides individuals, families, and businesses with a safety net in the face of unexpected events. ...

Why Malaysians Can Succeed as Financial Advisors in Singapore

Reflecting on my decade in Singapore, I realize I could’ve managed my finances better. If I’d sought proper financial guidance earlier, I might have ...

Strategic Financial Planning in Your 40s

Reaching your 40s is a significant milestone that often brings a heightened awareness of financial responsibilities, ranging from supporting your children to caring for ...

Why Achieving Your Initial $100K Can Be Challenging, but Your First Million Is Attainable!

Building wealth is undoubtedly a gradual journey, especially when you’re just starting out. Many successful individuals, like Charlie Munger, have attested to this fact. ...

Freelancing as a Financial Advisor in Singapore

In Singapore, the regulatory environment governing financial advisors is stringent to uphold standards of competence and professionalism. Individuals aspiring to offer financial advice must ...

What is NLP and why is it important for Financial Advisors

Neuro-Linguistic Programming (NLP) is a methodology that focuses on understanding and modeling human behavior, communication, and thought patterns. It explores the relationship between neurological ...

Retirement jobs in Singapore

The Retirement Dilemma So you have finally retired, this is something you have been waiting for literally your whole life. But, you are quickly ...

Ensuring Your Family’s Financial Security

In today’s rapidly changing economic landscape, securing your family’s financial plan has never been more critical. With unpredictable market fluctuations, rising living costs, and ...

You Could Have a Job, a Career; or You Can Have a Calling

In life, we are presented with choices—choices that shape not only our careers but also our very sense of purpose and fulfillment. Among these ...

Transitioning from Traditional Agencies to Financial Advisories

In the current landscape of stricter regulations aiming to empower investors with vital information for making informed decisions, the role of licensed Financial Advisors ...

Paying Down Your Mortgage or Investing?

So, you’re pondering one of the classic financial dilemmas: Should you focus on paying off your mortgage as soon as possible or channel your ...

Is it possible for an Introvert to pursue a Career as a Financial Advisor?

In a study conducted by the esteemed Financial Industry Regulatory Authority (FINRA), they uncovered the top five personality traits commonly observed in exceptional financial ...

Are Investment-Linked Policies (ILPs) Bad?

Investment-linked policies (ILPs), also known as unit-linked policies, have a history that traces back several decades. The concept originated as a response to the ...

Buying Term Insurance VS Life Insurance

Term insurance and life insurance are both types of life insurance, but they differ in a few key ways. Term insurance is a type ...

Exploring MLM Companies in Singapore

Let’s chat about the MLM (Multi-Level Marketing) scene in Singapore. It’s a hot topic that gets peopIe taIking. RecentIy, Riway’s fancy new headquarters in ...

Estate Planning in Singapore

Estate planning in Singapore is regulated by the Wills Act (Chapter 323) and the Mental Capacity Act (Chapter 57). These laws set out the ...

Mastering Your Niche as a Financial Advisor

In the fast-paced world of financial advisory services in Singapore, standing out is crucial. In a marketplace saturated with competition, the key to success ...

How to Begin Budgeting for Investing

Getting started with budgeting for investing can feel daunting, particularly if you’re new to the investment landscape. Simultaneously managing budgets for essential expenses and ...

Time to Secure High Yields Bond

Singapore’s central bank, the Monetary Authority of Singapore (MAS), has announced that it will pause its monetary tightening measures. This has caused two-year Singapore ...

Being a Property Agent VS Insurance Agent in Singapore

Choosing between a career as a real estate agent or an insurance agent is a big decision that invoIves understanding both professions’ simiIarities and ...

Still the World’s Priciest Cities to Live in

Singapore and Zurich leaped ahead of New York to snatch the title of the world’s priciest cities to live in this year, according to ...

On Early Stage Critical Illness Insurance in Singapore

Early Critical Illness (ECI) insurance plays a significant role in providing financial security in the face of health-related challenges in Singapore. It is a ...

About the Wealth Management Accelerator Programme (WMAP)

The Wealth Management Accelerator Programme (WMAP) is an innovative initiative designed to create a strong pipeline of talented professionals in the Wealth Management sector. ...

A Comparative Overview of being an Insurance Agent, Independent Financial Advisor, and Personal Banker

In the intricate world of financial advisory within Singapore, it’s easy to feel overwhelmed by the abundance of technical terminology and a multitude of ...

The Realities of Being an Insurance Agent in Singapore

Insurance agents have long had a bad reputation for a multitude of reasons that range from excessively aggressive sales tactics to distasteful wealth flexing. ...

Why Diploma Holders Excel as Insurance Agents

In 2023, diploma graduates in Singapore are seeing promising opportunities, according to data from the Ministry of Manpower (MOM), which indicates a median gross ...

Traits and Qualities of a Good Financial Advisor

The financial planning industry has grown in leaps and bounds and is one of the most lucrative careers in the world today. A financial ...

Causes, Consequences, and Solutions to Credit Card Debts in Singapore

Credit card usage has become increasingly prevalent in Singapore, offering convenience and financial flexibility to individuals. However, with the ease of credit card spending ...

Wealth building plan for young adults

Are you interested in learning about wealth building? Well, let me tell you, it’s definitely worth your time to become knowledgeable in this area. ...

Are Singaporeans Saving and Investing Enough?

Singapore is known for its high savings rate. In 2022, the personal savings rate in Singapore was 37.5%, which is one of the highest ...

Unveiling the Singlife Financial Freedom Index 2023

Singlife’s inaugural Financial Freedom Index for 2023 offers a profound glimpse into Singapore’s financial landscape, revealing that the average consumer scored 60 out of ...

Essence of Value Investing – Seeking Undervalued Opportunities

Value investing is an investment strategy that has been practiced and preached by some of the most successful investors of our time. It is ...

Do you need Standalone Critical Illness Insurance?

Critical illness insurance is a form of coverage available in Singapore that can be obtained as whole life insurance, standalone term insurance, or as ...

Confessions of a Financial Advisor

Becoming a financial advisor is like stepping onto a rollercoaster ride – thrilling highs, gut-wrenching lows, and twists you never saw coming. Here’s my ...

Prudential Unveils Prudential Financial Advisers, Enhancing Distribution Network

Prudential Singapore, a leading life insurer, has unveiled the launch of Prudential Financial Advisers (PFA), its dedicated financial advisory arm. This expansion broadens Prudential’s ...

10 Financial Decisions That You Might Regret in Future

The future remains elusive, with its twists and turns impossible to predict. Yet, this should never deter us from making prudent choices today that ...

Approaches to Asset Allocation for Retirement Planning

As individuals approach retirement, one of the critical aspects to consider is how to effectively allocate their assets. The process of asset allocation involves ...

Traded life policies and traded endowment policies for Sale

Traded life policies (TLPs) and traded endowment policies (TEPs) are investment products that involve purchasing life insurance policies or endowment policies from the original ...

The Illusion of Passive Income

Passive income has become a buzzword in the entrepreneurial world, promising financial freedom and a life of leisure. Many individuals are drawn to the ...

Sun Life Expands Presence in Asia with New Singapore Branch

Sun Life Financial Inc., a global leader in life insurance and asset management, has officially inaugurated its Singapore branch, marking a strategic move to ...

Advice for New Insurance Agents

Embarking on a career as an insurance agent is akin to venturing into a dense, untamed jungle. The path ahead is fraught with twists, ...

Investing as a Young Adult

Today, let’s delve into the topic of investing as a young adult and explore three key aspects that you should consider. By understanding these ...

Exploring Profitable Side Incomes to Earn $1000 in Singapore

One of the major perks of being a financial advisor is the level of control you have over your time. Unlike many traditional careers, ...

Addressing Critical Illness and Mortality Protection Gaps in Singapore

In recent years, Singapore has witnessed remarkable economic growth and development, transforming into a global financial hub. However, amid this prosperity, there exists a ...

Navigating Investment Options for Young Graduates

Feeling overwhelmed by the multitude of investment options? Don’t fret as you step into adulthood. We’ve got you covered with practical alternatives that are ...

Serving High Networth Individuals as a Financial Planner

As of 2022, the landscape of Singapore boasted an estimated count of 298,650 High Net Worth Individuals (HNWIs), collectively amassing a substantial net worth ...

A Comprehensive Guide to Financial Planning in Singapore

Feeling unsure about managing your finances? Don’t worry – we’ve got you covered. Getting a grip on personal finance might seem tricky. But with ...

So I Did Not Get Promoted Again

In the corporate world, promotions are seen as a validation of your hard work and a step forward in your career. They signify recognition ...

Are Singaporeans Living Paycheck to Paycheck

In Singapore, where economic prosperity often takes center stage, there lurks a silent but pervasive issue that affects a significant portion of the population: ...

The Risks of Buying IPO Stocks at Launch

Investing in Initial Public Offering (IPO) stocks can be an enticing prospect for many investors. The allure of getting in on the ground floor ...

Being an Independent Financial Advisor in Singapore

Singapore’s financial terrain is a dynamic realm, marked by diversity, complexity, and rapid transformations. In such an intricate environment, making informed financial decisions is ...

All about Surrendering and Selling your Insurance policy for Cash

Besides buying insurance policies, you are able to sell or surrender your insurance policies as well. There are certain situations that you might encounter ...

A Career as a Retirement Planner in Singapore

One of the most important components of personal financial planning is planning for retirement. Due to an aging population, it is predicted that there ...

Part-Time / Work from Home Jobs in Singapore

In the bustling metropolis of Singapore, where academic excellence and the cost of living run high, many residents, including students and young professionals, are ...

Embracing the Role of an Expat Financial Advisor in Singapore

The expat population in Singapore has been steadily increasing over the years, making the country a vibrant and diverse cosmopolitan hub. Singapore has attracted ...

Roadmap to Succeed as a Financial Advisor

Embarking on a career as a financial advisor is a journey filled with challenges and opportunities. To navigate this path successfully, aspiring professionals must ...

Understanding the Free Look Period in Insurance

In the realm of insurance, the free look period holds immense significance for policyholders. This provision, typically included in life insurance policies and certain ...

Achieving Passive Income Through Options Trading

The concept of options trading stems from the financial derivative known as an “option contract,” offering the right to buy or sell specific assets ...

Evaluating Your Suitability for a Career as a Financial Advisor

Are you considering a career as a financial advisor but unsure if it’s the right fit for you? Dive into the industry and discover ...

What if Interest Rate Keeps Going Up?

Nikolai Kondratieff, a prominent Russian economist of the early 20th century, is best known for his research on long-term economic cycles, now famously referred ...

The Indispensability of Personal Accident Plans

A personal accident plan, or PA plan, is a specialized form of insurance designed to provide financial support in the unfortunate event of an ...

The Benefits of a Dedicated Home Office for Financial Advisors

The financial advisory sector in Singapore has undergone significant transformations in recent years, with financial advisors assuming pivotal roles in guiding individuals and enterprises ...

Being an Islamic Financial Advisor in Singapore

In recent years, there has been a noticeable increase in the demand for professionals specializing in Islamic finance. This trend is exemplified by the ...

Side Hustle as a Financial Advisor

Many financial advisory firms are wary of taking on part-time candidates. They stress commitment, regulatory compliance, and client service. Financial advising requires deep dedication ...

10 Tips to Buying Term Insurance in Singapore

Term insurance is a vital part of planning your finances. It gives crucial protection to you and your family, if something unexpected happens. Life ...

On Choosing a Digital Marketing Agency for Your Insurance Agency

Firstly, branding is an essential aspect of any business, including insurance agencies. A strong brand can help differentiate your agency from competitors, build trust ...

Navigating the CMFAS Insurance Papers

Becoming an insurance agent in Singapore entails meeting specific criteria outlined by the Monetary Authority of Singapore (MAS). To qualify as an Appointed Representative, ...

Harnessing the Power of Retirement and Annuity Plans, SRS, CPF Life, Unit Trusts, Stocks, and ETFs

As we approach the golden years of retirement, ensuring a reliable stream of income becomes a paramount financial goal. In today’s landscape of extended ...

Understanding T-Bill in Singapore

In Singapore, T-bills refer to Treasury bills, which are short-term debt securities issued by the Singapore government. They are sold at a discount to ...

Employee Benefit Insurance in Singapore

Employee benefits insurance is an essential part of the compensation package provided by employers in Singapore. It is a type of insurance that offers ...

Exploring Distinctive Traits in Male and Female Insurance Agents in Singapore

The realm of insurance in Singapore is marked by a diverse cadre of agents, each contributing unique strengths to this dynamic industry. While it ...

The Importance of Early Retirement Planning in Singapore

Singapore, a shining beacon of economic prosperity and high living standards, faces an age-old challenge – the rising cost of living. From housing to ...

Beginners Guide to Investing in ETFs

Imagine you want to invest in the stock market, but you’re not quite ready to dive headfirst into individual stocks. Maybe you’re looking for ...

How to Become an Insurance Agent in Singapore

The number of insurance agents in Singapore has been increasing steadily over the years. According to the Monetary Authority of Singapore (MAS), there were ...

Needs Based Financial Advisor – Navigating Personal Finance with Precision

Financial advisors come in various forms and specialties, each serving a unique purpose in helping individuals manage their wealth. Among them, needs-based financial advisors ...

5 Key Considerations Before Purchasing an Endowment Plan

Life is inherently unpredictable, and at any given moment, unforeseen circumstances can drastically alter our lives. Ensuring the financial security of oneself and loved ...

The Role and Importance of Fee-Based Financial Advisors in Singapore

In the ever-evolving realm of Singapore’s financial services, a remarkable transformation has taken place, championing a breed of financial advisors who operate on a ...

8 Questions to Consider Before Embarking on Career as an Insurance Agent

Every day, I have the pleasure of engaging with individuals who are considering a company or career change. For those contemplating a venture into ...

Benefits of Working as a Financial Advisor for New Mothers

Working mothers are taking on more responsibilities than ever before, juggling work, home, and children while striving to maintain a healthy lifestyle. While this ...

The Rise of Family Offices in Singapore

A family office serves as a discreet and exclusive institution dedicated to the meticulous management of both the financial and personal affairs of affluent ...

Deciphering Singaporean Investment Trends

Self-sufficiency represents a significant aspiration for countless individuals, offering the freedom from dependence on others or the need to work well into old age. ...

Investing in a Corporate Video for Your Financial Advisory

In the ever-evolving landscape of financial services, establishing a robust online presence is no longer optional; it’s a strategic imperative. In this digital age, ...

The Fear & Greed Index: Understanding Investor Sentiment in Financial Markets

Financial markets are driven not only by economic fundamentals but also by human emotions and behavior. The CNN Business Fear & Greed Index is ...

Common Investment Strategies for Beginners in Singapore

For beginners looking to start investing in Singapore, there are several common investment strategies to consider that align with different risk tolerances, financial goals, ...

Financial Planning for New Parents in Singapore

Embracing the arrival of a newborn brings a wave of excitement and hope for the future, especially for parents in Singapore. Amidst this joyous ...

Tips for Inexperienced Insurance Salespeople to Achieve Astounding Success

Welcome to the world of insurance sales! If you’re new to the industry but possess an extraordinary drive for success, you’ve come to the ...

Islamic Financial Planning in Singapore: Aligning Faith and Finance

The financial situation of Malays in Singapore has been a topic of extensive research and discussion. Studies have revealed that compared to other ethnic ...

Best Insurance Companies in Singapore

In Singapore, the insurance scene is buzzing with activity, featuring a myriad of companies offering an extensive range of insurance solutions customized to meet ...

Empowering Financial Literacy: Insights from the Finder Singapore Report

In today’s dynamic financial environment, staying informed about the ever-evolving investment landscape is essential for anyone championing financial literacy in Singapore. As a dedicated ...

The 4% Rule

Let’s discuss two different methods for planning retirement income: the four percent rule and the dynamic spending rule. The four percent rule states that ...

The Importance of Business Insurance in Singapore

Business insurance is not just a regulatory requirement, but also a way of protecting your employees, suppliers, and customers from potential threats. Properly insuring ...

All about Investing in Gold

Investing in gold can be an attractive option for individuals looking to diversify their investment portfolios and protect their wealth. Gold has a long-standing ...

Investing in REITs vs. Property Ownership in Singapore

Investing in real estate can take various forms, each offering unique opportunities and challenges. In Singapore, two prominent avenues for real estate investment are ...

Maximizing your Annual Insurance Evaluation with 5 Strategic Approaches

So, you know how life can be like a rollercoaster, right? Full of ups and downs, twists and turns. Well, making sure your insurance ...

The Bengen Rule: A Guiding Light for Retirement Planning

In an era where retirement planning is paramount, the Bengen Rule, also known as the 4% Rule, emerges as a guiding star in the ...

Why Investments Won’t Make You Rich (Probably)

In a society inundated with promises of extraordinary investment returns and enticing get-rich-quick schemes, it is crucial to pause and critically evaluate the true ...

Recognising the Right Time to Change Careers

Choosing a career is one of the most impactful decisions we make in our lives. It dictates our daily routines, influences our personal growth, ...

On a Career Change into Financial Planning

If you’re considering a career change into financial planning, there are several pros and cons to keep in mind. Here are some key factors ...

On Getting Retrenched

The significant rise in retrenchments in Singapore in 2023 underscores the volatile nature of the job market, especially in industries sensitive to global economic ...

Sumitomo Life Acquires Full Ownership of Singlife

Singlife, a home-grown Singaporean insurer, will now operate as a wholly owned subsidiary of Japanese life insurance company Sumitomo Life Insurance. Sumitomo Life has ...

Singapore’s Top Insurers Experience 3.7% YoY Asset Decrease

Singapore’s top 50 insurers experienced a 3.7% decline in assets in 2022, marking a notable departure from the 5.1% year-on-year growth observed in the ...

Pursue a Career as a Financial Advisor Without Sales Expertise

Becoming a financial advisor in Singapore typically involves a combination of sales skills, financial knowledge, and regulatory compliance. While sales skills are undoubtedly important ...

Understanding the Six Income Stream Buckets

In today’s world, there are various ways to earn money. The concept of the 6 buckets of income stream is an interesting one that ...

Will I lose all my Money in the Stock Market?

Investing in the stock market involves inherent risks, and there is always the potential for financial losses. However, it is crucial to recognize that ...

Insurance Careers in Singapore

The insurance industry in Singapore is a dynamic and rapidly evolving sector that plays a critical role in the country’s economy. It provides a ...

Navigating the Stock Market with Tykr

Venturing into the stock market is akin to navigating a bustling casino, where the majority find themselves on the wrong side of the hustle. ...

The Role of Financial Advisors in Singapore Amidst an Impending Recession

Singapore, renowned for its unwavering economic stability and thriving financial sector, has long been a sanctuary for financial services. However, as ominous signs of ...

Choosing between being a Property Agent or Insurance Agent in Singapore

Let’s taIk money. If you’re Iooking into becoming a property agent in Singapore, you’re probabIy wondering how much you can make. On average, property ...

Working as a Part-Time Insurance Agent in Singapore

Part-time insurance jobs are also great for students. They can get a feel for the industry before they graduate. Even if you don’t have ...

Myers-Briggs personality traits most suitable to join the insurance industry

The Myers-Briggs Type Indicator (MBTI) is a popular personality assessment that categorizes individuals into 16 different personality types based on four dimensions: extraversion/introversion, sensing/intuition, ...

Planning for Retirement in Singapore

Planning for retirement is a critical aspect of financial planning, and it requires careful consideration and a well-thought-out strategy. Retirement planning can be daunting, ...

How Are Financial Advisors Compensated?

Financial advisors play a crucial role in helping individuals and businesses make informed financial decisions. In Singapore, a dynamic and rapidly growing financial hub, ...

About the CPF Basic Retirement Sum, Full Retirement Sum and Enhanced Retirement Sum

The Central Provident Fund (CPF) is a mandatory social security savings scheme in Singapore. It is a defined contribution plan, where both employees and ...

Top 21 High-Demand Jobs in Singapore for 2024 and Beyond

In the wake of the post-COVID era, the employment landscape is undergoing significant transformations, ushering in a wave of novel opportunities and technological advancements. ...

The Most Common Insurance Policies Purchased in Singapore

On average, Singaporean households allocate approximately 5.5% of their monthly expenditures to healthcare. With the continually increasing healthcare expenses in Singapore, obtaining insurance coverage ...

Unveiling OCBC’s Great Eastern Bid

OCBC’s recent announcement to acquire the remaining 11.56% stake in Great Eastern for S$1.4 billion has stirred debates regarding the timing and motives underlying ...

Why do you need a career coach and mentor as a financial planner?

A career coach or mentor can help you leverage your strengths, understand your weaknesses and learn to stand out from the crowd. This blog ...

Fresh Grads Flocking to Financial Advisory in Singapore

The financial advisory scene in Singapore is booming, with over 5,000 advisors flying solo and another 15,000 on the payroll of insurance giants. Why ...

Investing in Robo-Advisors vs. ETFs: What Are the Main Differences?

In recent years, investing has become more accessible and efficient with the rise of technology-driven solutions. Robo-advisors and exchange-traded funds (ETFs) are two popular ...

AIA Launches The AIA Ultimate Critical Cover

The AIA Ultimate Critical Cover (AIA UCC) stands as a robust response to the pressing need for enhanced critical illness (CI) protection in Singapore. ...

Why Singapore High-Income Earners are Broke

In Singapore, a phenomenon that often perplexes observers is the prevalence of high-income earners who struggle with financial insecurity or even end up in ...

Retirement Planning for Women

In the vibrant tapestry of Singapore, gender disparities in retirement preparedness paint a revealing picture. It’s a narrative where women often face unique challenges ...

Benchmarking Your Annual Salary: Insights into Income Comparison for 2023

In Singapore, obtaining a precise understanding of your financial position compared to your peers is made effortless by utilizing this resource. Unlike typical income ...

How Much Does an Insurance Agent Make in Singapore?

Being an insurance agent in Singapore might look pretty straightforward, right? It feels like there are insurance agents everywhere you turn. It’s no wonder ...

Mastering the Art of Health Insurance Planning for Singaporeans

Planning for your health insurance in Singapore is a crucial endeavor that demands a thoughtful and strategic approach, especially when confronted with the unpredictable ...

Investing in REITs in Singapore

Investing in Real Estate Investment Trusts (REITs) offers investors a compelling opportunity to gain exposure to the real estate market while enjoying passive income ...

Why Singaporeans Choose to Sell Their Endowment Insurance Policies

In today’s modern, fast-paced world, where almost everything appears to have a price tag, it’s not surprising that even your endowment insurance policy has ...

The Role of Student Financial Advisors: Challenging Stereotypes and Embracing Growth

During the Association of Financial Advisers (Singapore) Annual Conference 2023, Minister for Education Chan Chun Sing expressed a warm welcome to financial advisers who ...

Licenses needed to be a Financial Advisor in Singapore

To become a financial advisor in Singapore, individuals are required to obtain certain licenses and pass relevant exams. The licensing and regulatory framework is ...

Mastering Your Finances with Kakeibo: A Simple Approach to Budgeting

Have you ever felt like your money just slips through your fingers without you even realizing it? Well, that’s where Kakeibo comes in – ...

Choosing a Career in Insurance Sales

There are a lot of things to consider when choosing a career, and a career in insurance sales is a great option for many ...

Achieving MDRT Membership in One Year: A Roadmap to Success

The Million Dollar Round Table (MDRT) is an internationally recognized achievement in the insurance and financial services industry. Attaining MDRT membership is a prestigious ...

Safeguarding Deposits: Singapore’s Deposit Insurance Scheme (FDIC Insurance)

Singapore is known for its robust banking system, ensuring the stability and soundness of financial institutions within its jurisdiction. The Monetary Authority of Singapore ...

Exploring the Top Insurance Companies to Join in Singapore

When considering the top insurance companies in Singapore for their positive work environments and employee satisfaction, a comprehensive understanding of each company’s offerings is ...

HSBC Acquires AXA Singapore under HSBC Life

HSBC has announced the successful completion of the legal merger between AXA Singapore and HSBC Insurance (Singapore) through a transfer arrangement. This marks the ...

Protecting Your Loved Ones and Financial Security with Term Insurance

Insurance is an essential component of financial planning, providing individuals and families with a safety net against life’s uncertainties. Among the various insurance options, ...

Why I Love my Job as a Insurance Agent

Hello. I’m an insurance agent. The job of an insurance agent is much more than just selling insurance. It’s a great way to learn ...

What work experiences are most appropriate for transitioning into a financial advisor role?

Becoming a financial advisor is a challenging and rewarding career that requires a diverse skill set and work experience. To be successful in this ...

Before you take on a personal loan in Singapore

People may consider taking a personal loan for a variety of reasons, such as paying off high-interest credit card debt, covering unexpected expenses, or ...

Elevating Brand Recognition, Fostering Core Brand Principles, and Driving Sales Growth as a Financial Advisor

In financial advisory services, where competition is fierce and trust is paramount, the ability to stand out and establish a strong brand presence is ...

Making your first $100k in Singapore

Building wealth requires dedication and consistent effort. However, there are tips that can help expedite your journey. Before delving into the “how,” it’s essential ...

Opportunities and Risks in Making Money Online in Singapore

The advent of the internet has brought forth a myriad of opportunities for individuals seeking to make money online. From freelancing to e-commerce, the ...

Building Success Brick by Brick: The Compounding Lifestyle

In the hustle and bustle of modern life, individuals often find themselves entangled in the pursuit of immediate gratification and quick fixes. However, there ...

Social Media Marketing for Your Insurance Agency

Social media has become an integral part of our daily lives, and businesses are increasingly utilizing it as a marketing tool. The insurance industry ...

Comprehensive Listing of Independent Financial Advisory Firms in Singapore

An Independent Financial Advisor (IFA) is like your financial confidant, offering impartial guidance to individuals or organizations without being tied to any specific bank ...

Constructing Your Dividend-Paying Portfolio

In an era defined by economic uncertainty and evolving financial landscapes, individuals are faced with the imperative of making strategic decisions regarding their financial ...

How Childcare Teachers Excel as Insurance Agents

Childcare teachers possess a unique blend of skills and qualities that seamlessly translate into the realm of insurance agencies. Their exceptional communication skills, honed ...

About the FIRE Movement in Singapore

The FIRE (Financial Independence, Retire Early) movement is not just a lifestyle choice or a financial strategy – it’s a game-changer that can transform ...

Preparing an Emergency Fund

Life is full of surprises, both pleasant and challenging. While we all hope for the best, it’s essential to prepare for the unexpected. That’s ...

How much can a food delivery rider realistically earn in Singapore?

One of the most significant perks of being a food delivery rider is the flexibility in working hours. Most food delivery companies allow riders ...

If you are looking for a licensed moneylender in Singapore, first familiarise yourself with the Moneylenders Act

Before turning to moneylenders for financing, it is important to explore all possible options to avoid high-interest loans. One such option is to consider ...

Can I Purchase Insurance for an Unborn Baby?

Before the baby is born, one of the few types of insurance available is maternity insurance. This coverage is specifically designed to provide financial ...

Understanding Universal Life Insurance in Singapore

Universal life insurance policies in Singapore offer a unique combination of insurance protection and investment returns. These bundled products provide policyholders with the opportunity ...

A Guide to Investing in the Fundsmith Equity Fund in Singapore

Fundsmith Equity Fund is a renowned investment fund that has gained significant attention in the financial industry. Managed by Fundsmith LLP, an asset management ...

Pros and Cons of Buying Term Insurance

The Life Insurance Association (LIA) Singapore regularly releases industry performance reports, providing valuable insights into the state of the insurance market. However, these reports ...

Alternative Opportunities for Experienced Financial Advisors

Are you an experienced financial advisor feeling disillusioned by the relentless pursuit of sales targets? Are you seeking a career path that allows you ...

An Overview of CPF in Singapore

CPF (Central Provident Fund) is a compulsory savings and pension scheme designed for employed Singaporeans and permanent residents. If you are unfamiliar with the ...

A Guide to Financial Planning for Singaporeans from Graduation to Retirement

Hey there! Are you a young Singaporean who’s just graduated and starting to think about your financial future? It’s never too early to start ...

How Important is Retirement Planning

Planning for your retirement is essential, no matter where you live, and Singapore is no exception. With the rising cost of living, it is ...

The Most Overlooked Insurance: Disability Income Insurance

Two out of every three workers in Singapore express concerns about potential job loss due to illness or disabilities, and alarmingly, over half (53%) ...

How the Rule of 72 Can Help You Double Your Investments

If you’ve ever wanted to convince someone else or yourself about the power of compounding – and why you should begin investing today – ...

UOBAM Invest Robo-Advisor Review

UOBAM Invest is a hidden gem that not many people know about, and it is managed by the wholly owned subsidiary of UOB called ...

Top 10 Reasons to be a Financial Planner in Singapore

A financial planner isn’t just for investment bankers and those with millions to invest. We all need a financial planner to make sure we ...

What I Wish I Knew before Starting in Insurance as an Insurance Agent

We’re all familiar with the story of the young guy who decided to go into insurance after working in the corporate world. He wanted ...

What it means when you need to buy Insurance

Insurance is an essential part of our lives. We buy insurance to protect us against any potential financial loss due to an unfortunate incident. ...

Guide To A Career Change To The Financial Planning Industry

The Covid-19 pandemic has led many workers to question their quality of life in their current employment, wondering if there are any options out ...

Crafting an Expense Management Framework

Regardless of your current life stage, mastering expense management is pivotal for financial well-being. As you navigate through different phases of life, such as ...

Workmen Compensation Insurance in Singapore

Work Injury Compensation (WIC) insurance is a crucial requirement for employers in Singapore to protect their employees in the event of work-related injuries. The ...

Looking out for Deceptive “Pump and Dump” Schemes

Listen up, seekers of financial gain. Today, we delve into a prevalent swindle within the realm of investments – the notorious “pump and dump” ...

Becoming a Trusted Financial Advisor: Building Client Trust and Professionalism

Being a trusted financial advisor is not only about providing sound financial advice but also about building strong relationships based on trust and professionalism. ...

Exploring Different Approaches to Investing: Active, Passive, and Beyond

Mobile stock trading apps like moomoo and Webull have experienced significant popularity in Singapore, especially among young and tech-savvy investors. The combination of user-friendly ...

Goal Setting as a Financial Advisor to Pave the Path to Success

Picture this: a financial advisor embarks on a thrilling journey, armed not just with financial savvy, but also with the magic wand of goal ...

Difference between Will and Trust

When planning for the future, many people consider creating a will or trust to ensure their assets are distributed according to their wishes. Although ...

Changes to the Integrated Shield Plan from April 2023

Starting from April 1st, 2023, the Cancer Drug List will be implemented for Integrated Shield Plans (IP) in Singapore. This will affect private insurers’ ...

A Day in the Life of an Insurance Agent

Ah, the glamorous life of a financial advisor! Are you ready to hear all about it? Here’s a glimpse into a day in my ...

Retirement planning in Singapore (2023)

The Singapore Budget 2023 has introduced enhanced measures to help middle and lower-income Singaporeans with cost-of-living concerns. How the Singapore Budget 2023 will Affect ...

Financial Planning after a Divorce

DIVORCE is more than just an emotional upheaval – it can be a financial disaster if not handled properly. As a seasoned financial planner, ...

How to motivate your insurance agents

If you’re looking to boost your agency’s performance and motivate your agents, you’ve come to the right place. Here are 9 ways to get ...

Investing is Easy. Life is Hard.

In the big puzzle of life, investing can seem like an easier piece to fit in. Aswath Damodaran, who knows a lot about money ...

How to Begin Investing With Just $1000 in Singaopore

Have you ever pondered where to invest your first $1000? Perhaps you harbor ambitions of financial prosperity and are eager to take the initial ...

All about CPF Life

The Central Provident Fund (CPF) is a comprehensive social security savings plan that has been a cornerstone of Singapore’s social policy since its introduction ...

The Responsibilities of an Insurance Financial Adviser to Their Customers

Insurance is an essential component of financial planning and security. As an insurance financial adviser, your role is not only to sell insurance policies ...

Why Financial Advisors will never be Replaced by AI

Advancements in technology and IoT have revolutionized our society, making systems simpler and more efficient. Although this is a welcome development in most industries, ...

I am Afraid of Retirement

As retirement draws nearer, it feels like a looming storm cloud casting a shadow over my thoughts and emotions, mixing excitement with apprehension in ...

Establishing a Client-Centric Culture in Your Financial Advisory Firm

In the world of financial services, the concept of a client-centric culture is more crucial than ever. Financial advisories are entrusted with the responsibility ...

Guide to Freelancer Insurance in Singapore

The gig economy has transformed the workforce, and freelancers and gig workers must prioritize their protection. This comprehensive guide provides essential information about freelancer ...

On Leadership

I understand that people represent an organization’s most appreciable asset. No resource is more valuable than people. Wise leaders practice the Law of Addition. ...

On Inflation and the Financial Markets

Inflation is a term we hear frequently in the news and media, but what does it mean for our finances and investments? Essentially, inflation ...

There’s so much finance content online! Do I really need a financial advisor?

It’s safe to say that most people from the younger generation feel intimated by any financial talk that comes up. With tons of cryptic-sounding ...

The Importance of Digital Marketing for Insurance Agents

In this day and age, buying almost anything starts with an online search. With over 50% of the global population being 30 or younger ...

Beginner’s Guide to understanding the Stock Market

A recent Endowus study offers valuable insights into the investment behaviors and financial concerns of Singaporeans in 2023. One significant discovery is that a ...

Legacy Planning for your business

As a successful business person, you have likely put in a great deal of effort to build a profitable business. You may be planning ...

Know the difference between being an Insurance Agent, an Independent Financial Adviser, or a Personal Banker?

What is the difference between being an Insurance Agent, an Independent Financial Adviser, or a Personal Banker? The financial advisory industry in Singapore is ...

A Mid-Career Switch Into The Financial Advisory Industry

It happens all the time, you’ve been working in the same industry for over a decade and now you want out. Perhaps when you ...

How Does an Insurance Policy Loan Work

An insurance policy loan is a loan that is borrowed against the cash value of a permanent life insurance policy. This type of loan ...

Is Insurance a Good Career in Singapore?

Embarking on a career as an insurance agent in Singapore is like opening the door to a dynamic world of financial security, client relationships, ...

The Driving Forces Behind the Booming Growth of Singapore’s Insurance Industry

Singapore’s general insurance sector is poised for a substantial upswing, with forecasts projecting a 6.9% growth in 2023 and 5.6% in 2024. This surge ...

The Best Insurance Policies for Children

In Singapore, there are various insurance policies designed to provide financial protection and benefits for children while also ensuring insurability later in life. These ...

MoneyOwl Robo-Advisor Review

MoneyOwl announced on August 31, 2023, regarding the decision to wind down its financial advisory operations. As part of this decision, MoneyOwl will transfer ...

The Difference Between Index Funds, ETFs and Mutual Funds

Investing in the stock market can be intimidating for many people. However, there are various ways to invest your money in the market, and ...

Choosing the Right Financial Advisory to Join

Entering the financial industry for the first time can be an overwhelming or even scary experience. There are many conditions to take into account ...

Internship Salaries in Singapore

Internships are super important for students moving from school to the work world. They give you real-world experience and let you see what it’s ...

Navigating the Sales Cycle Effectively: The Roadmap for Insurance Agents

In the dynamic world of insurance sales, understanding the customer journey is paramount for insurance agents to navigate the sales cycle effectively. By viewing ...

Singlife Introduces Dementia Cover for Comprehensive Mental Health Support

Singlife has introduced Singlife Dementia Cover, the first insurance policy specifically designed to provide annual financial support to individuals diagnosed with dementia and other ...

Fintech, Financial Services & Insurance Companies Among Statista’s 2024 Growing Companies

Statista, a renowned global research firm known for its comprehensive data and insights, has collaborated with The Straits Times to compile a meticulously curated ...